Quarterly dairy market update - Q1 2022

Tuesday, 17 May 2022

The first quarter of 2022 has been dominated by inflation through the dairy supply chain, and the subsequent impact on milk production. While strong market returns have allowed milk buyers to increase milk prices and alleviate some on-farm cash flow pressures, they have not yet triggered an uplift in milk production. The war in Ukraine has made the inflationary pressures worse, and added significant volatility and uncertainty to markets, fuelling further cost increases along the agri-food chain.

Milk production

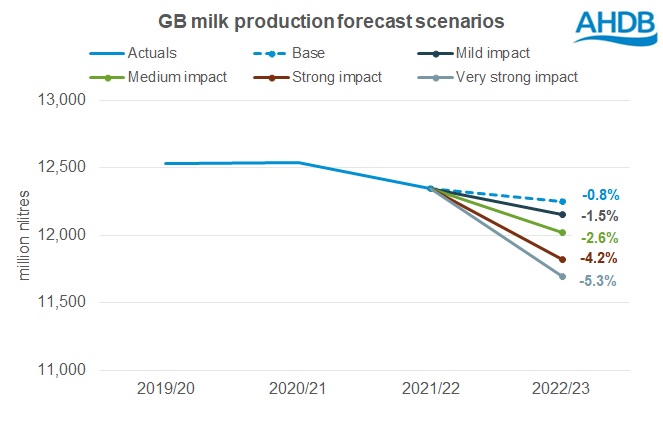

Following our annual Milk Forecasting Forum in March, GB milk production was forecast to decline by 0.8% in the coming season (Apr22-Mar23) as farmers face an extraordinary amount of pressure on cash flows. However, given the uncertainties surrounding access and affordability of key inputs, as well as the potential for milk prices to keep up with costs, there are a variety of possible outcomes, ranging from reductions of 0.8% to 5.3%.

Production in April was down 3% year on year at 1,084 m litres based on AHDB daily delivery data. This was a slight improvement on March deliveries, which were down 3.3%. production, but 0.8% lower than forecasted volumes.

High input costs continue to be the main deterrent to milk production, with all three key cost categories for dairy maintaining their upward trend through the first quarter of 2022. Higher milk prices have helped to offset some of the cash flow pressure for farmers, but whether this is enough to trigger higher production overall remains unclear.

Product availability

The challenges of the past year, particularly the rate of input cost inflation and the resurgence of demand post-lockdowns, led to tightness in dairy product availability. In the UK, the limited availability of milk saw cheese and butter production prioritised over fresh products, although reduced trade meant product availability tightened in 2021. A similar situation occurred in the EU, where strong domestic and export demand has outstripped production. According to the Milk Marketing Observatory, estimated stock levels are at historically low levels for butter, cheese and SMP.

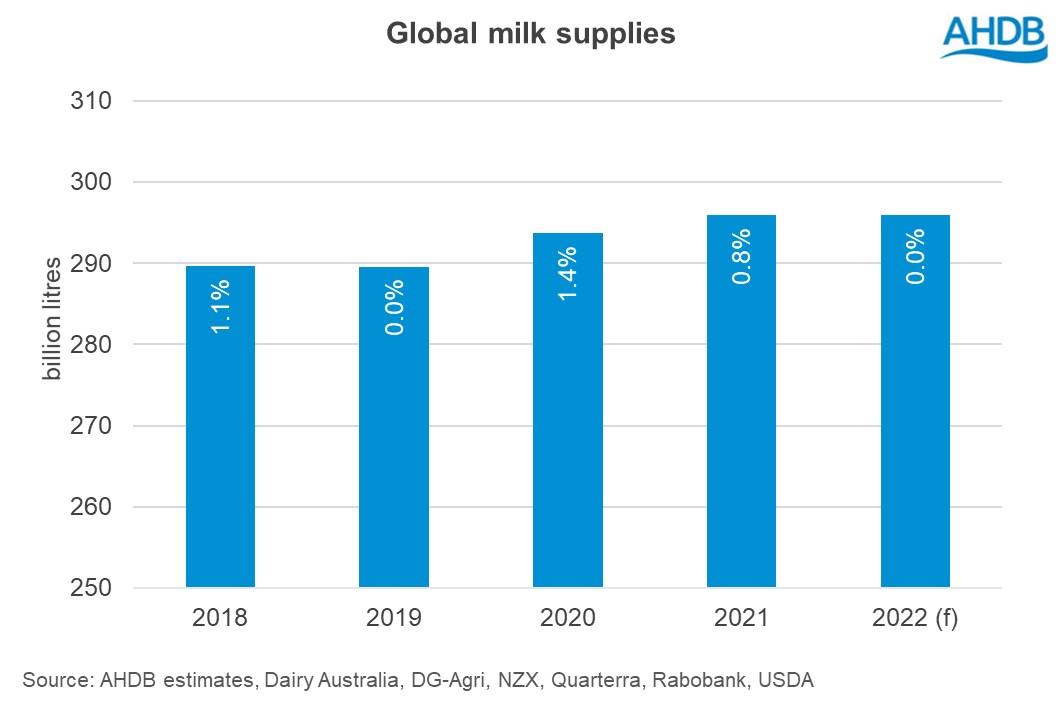

With no growth expected in milk production across the key exporting regions for 2022, dairy product prices have increased considerably over the past six months. There has been some softening in recent weeks, as indicated by the latest GDT auction results. This was linked to the recent lockdowns in China as they grapple with further Covid outbreaks, but there is also some concern that the high price levels may be starting to impact demand from more price-sensitive buyers. However, balanced against tight milk supplies, downward pressure on dairy product pricing should be limited.

Farmgate prices

The rising market returns realised in the second half of 2021 started to flow through to farmgate prices at the beginning of 2022, with some significant upturns. In the first three months alone, GB milk price increases averaged 3.7ppl. Since then, there have been further announcements of price increases for April, May and June.

While higher market returns will be part of the reason for the rising farmgate prices, it’s likely that milk price changes are being fast-tracked by milk buyers to ensure sufficient cashflow on farms to stem any further reductions in milk production.

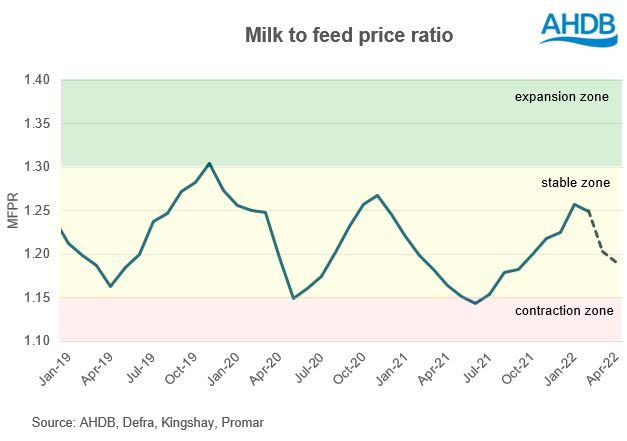

The next question then is are the price increases enough? Typically, we see milk production drop when the milk-to-feed-price ratio declines, particularly when it falls below a trigger point of around 1.15. While this indicator of profitability isn’t as accurate during a time of widespread input cost inflation, the fact that it is trending down suggests milk price increases are not keeping pace with higher average feed costs.

With the added pressures of higher fertiliser and fuel costs, uncertainty over feed costs in the second half of the season, labour shortages and reduced farm payments, milk prices will need to maintain upward momentum into the second half of the year to maintain production capacity. This of course necessitates the ability of manufacturers to recover appropriate returns from the market.

What remains to be seen is how much milk will be needed as the level of demand adjusts to the realities of higher prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.