Prime cattle markets drop back once again

Wednesday, 30 September 2020

By Felicity Rusk

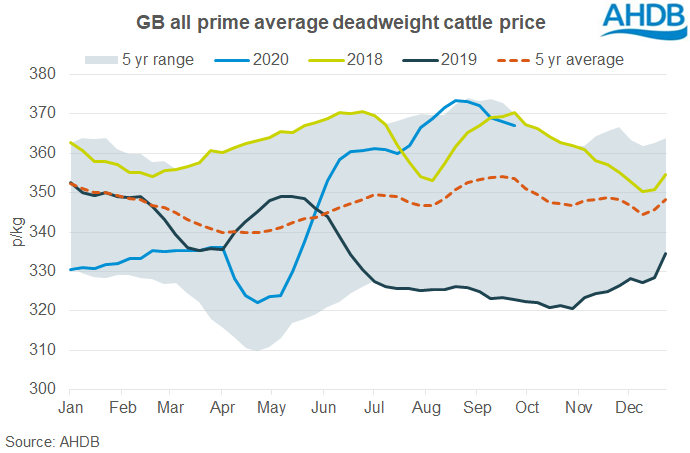

Prime cattle markets have continued to move down in the most recent week. In the week ending 26 September, the GB all prime average stood at 367.0p/kg, 1.0p less than in the previous week. This puts prices 13.5p above the same week in the previous year, and just over 44p above the five-year average.

Price drops were recorded in all key prime markets, although the largest drop was recorded in steers meeting the R4L specification.

- Steers (overall): 367.8p/kg, ↓ -1.0p

- Steers (R4L): 380.5p/kg, ↓ -2.8p

- Heifers (overall): 367.8p/kg, ↓ -1.1p

- Young bulls (overall): 355.3p/kg, ↓ -0.6p

Estimated slaughter increased by 1.6% on the week, the equivalent of 530 head to total 33,750 head. Interestingly heifer throughputs increased by almost 10% on the week . However, both throughputs of steers and young bulls dropped back on the week.

Cow markets meanwhile remained comparatively more steady. Overall cow prices remained steady on the week, at 244.7p/kg. Meanwhile, prices for cows meeting the O4L specification increased by 1.1p on the week to reach 263.8p/kg. Throughputs dropped back by 200 head on the week to total 11,700 head.

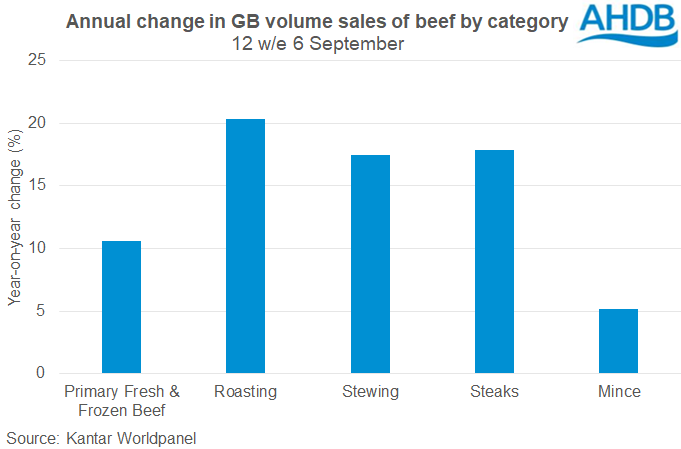

The latest data from Kantar continues to show strong retail growth for the beef market, with growth tracking in-line with the average food and drink uplift. In the 12 weeks ending 6 September, volume sales of primary beef were up 10.6% compared to the same period in the previous year. This is marginally above the growth for the total food and drink (excl alcohol) category as a whole, at 10.3%. The roasting, stewing and steak categories continued to record particularly strong growth, however the growth was more muted in mince sales.

While volumes remain well above last year, the volume growth has dropped back from the previous period. In the 12 weeks ending 9 August, volume sales of primary beef were up 15.5% on the year. This is not surprising as more of the foodservice and hospitality sector comes back online, sales at retail will inevitably decline.

However, tighter local restrictions have the potential to disrupt regional demand, affecting carcase balance. Furthermore, there are some localised cases of consumers returning to ‘panic buying’ behaviour. As such, it will be interesting to see how demand develops in the coming weeks, and what impact that will have on overall beef demand.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.