Polls predict tighter global maize and soyabean stocks: Grain market daily

Tuesday, 9 February 2021

Market commentary

- Global grain and oilseed futures prices rose yesterday as traders re-positioned ahead of tonight’s USDA report. May-21 Chicago maize futures gained $5.71/t, to $221.26/t and the same contract on Chicago soyabeans rose by $7.44/t, to $509.22/t.

- Cold weather in the US could pose a risk to winter wheat crops because there’s limited snow cover in some areas. This, along with the continuing fallout from Russia’s export tax announcement, pushed up wheat futures yesterday. Chicago wheat futures (May-21) gained $5.05/t, closing at $242.30/t yesterday.

- UK wheat futures rose less than global prices because sterling has strengthened again against the US dollar. May-21 futures gained £0.60/t to £203.10/t, while Nov-21 futures rose by £1.60/t to £167.10/t.

- In France, winter wheat was planted on 4.86Mha according to its government. This is 128Kha more than December’s estimate and 15% more than last year. The winter barley area was also trimmed but is still 3% larger than 2020, at 1.21Mha. However, the winter rapeseed area was reduced by 122Kha, to 1.00Mha, and is now 26% smaller than the 2016-2020 average.

Polls predict tighter global maize and soyabean stocks

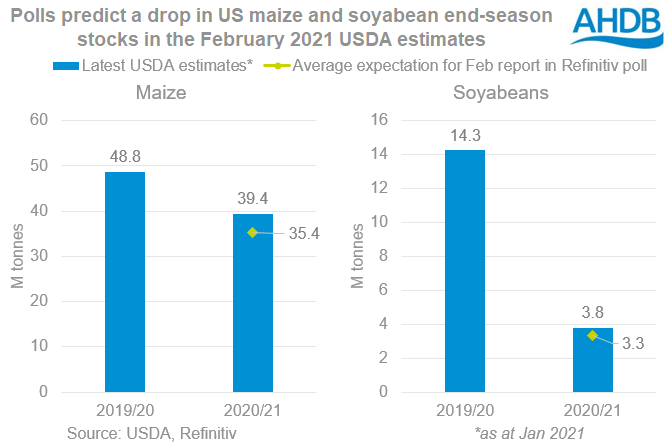

Industry analysts expect the USDA to reduce its forecasts for US and so global stocks at the end of this season, tonight. This is according to a poll of industry analysts by Refinitiv. The USDA will release its monthly estimates of world supply and demand tonight at 5pm UK time.

The cuts to US stocks are expected to mean similar cuts to global stocks. This would show tighter global supply and demand situations for both maize and soyabeans.

Demand from China is arguably the main reason that US and global stocks of maize are expected to shrink this season. Last month, the USDA forecast Chinese imports at 17.5Mt vs 7.6Mt last season.

But since the last official report, US officials in China have increased their forecast of maize imports to 22.0Mt. Also, the US has already sold 17.7Mt for export to China for this season. As a result, there is speculation that the USDA may increase its Chinese maize import forecast tonight.

Only small cuts to US (-0.1Mt) and global wheat stocks (-0.3Mt) are expected.

Small reductions are also expected to the Brazillian and Argentinian crop estimates for the maize and soyabeans. For example, the market expects a Brazilian maize crop around 108.4Mt, 0.6Mt below the USDA’s January report.

Many crops in South American had a difficult start due to dry weather through the latter part of 2020. Welcome rain arrived in January as early crops were at critical stages for yield formation. The rain has improved soil moisture levels in many areas. However, it’s not clear if it was enough or in time to prevent losses.

US officials in Brazil recently estimated the country’s maize production at 105.0Mt, 4.0Mt below the USDA’s January report. As a result, the South American crops will be a source of uncertainty for some time yet.

The potential impact?

Prices can rise or fall sharply when the USDA’s estimates are different from the market’s expectations. For example, Chicago maize futures (May-21) gained $9.84/t on the day the January 2021 report was released after the USDA unexpectedly cut US maize production and stocks. UK feed wheat futures (May-21) rose £4.75/t that day.

Tonight, if the USDA cuts US or global stocks by less than the market expects, prices may fall. This could result from minimal or small changes to the Chinese import forecasts or, or unchanged South American production figures.

Conversely, if the cuts to US and global stocks are larger than expected, prices may rise. This could result from larger imports or a bigger than expected cut to South American production figures.

However, if the difference between the USDA’s estimate and market expectation is small, the change in prices may be limited.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.