Market report - 08 February 2021

Monday, 8 February 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

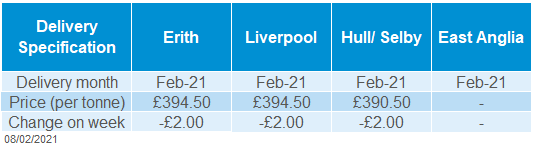

With oilseed markets making minimal movements week on week, currency changes were the cause for delivered rapeseed values to decline. UK rapeseed (Feb, Erith) was quoted at £394.50/t, down £2.00/t from the week before. Sterling briefly hit £1=€1.1400 on Thursday for the first time since May 2020.

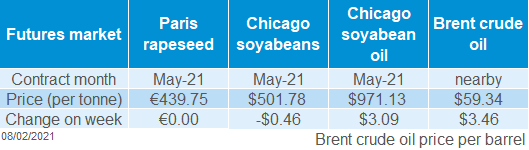

Paris rapeseed futures (May-21) ended last week flat at €439.75/t Friday-Friday.

Statistics Canada figures show canola stocks as at 31 Dec 2020 down 24% year on year at 12.1Mt. Some canola managed money funds have rolled long positions into May expecting a tighter level of supply towards the end of the season.

Wheat

Wheat is now taking a breather across the globe. There are a few worries about new crop supplies and old crop markets have had little new news to continue to feed the bull run.

Global grain markets

Maize

Strong demand continues to hold prices at multi-year highs. But should we see this demand start to wane, or plentiful supplies come onto the market, this could change market sentiment.

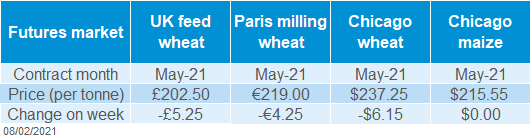

Global grain futures

Barley

Barley prices remain firm, its inclusion in the ration due to its relative price now means demand is very strong and it is holding its own while wheat prices back off.

UK focus

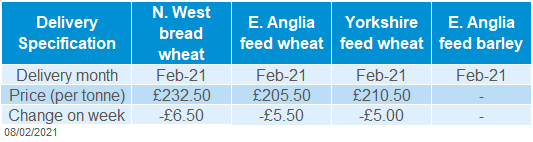

Delivered cereals

In the week ending 28 January, US maize export sales reached record levels, with 7.43Mt sold. Of this, 5.86Mt was purchased by China. This shows persistent very strong demand from China, which should continue to lend support to global cereal prices.

Last week, Russia announced they are introducing a formula-based tax on wheat exports from 2 June. This means the tax will automatically increase as prices rise. It is calculated at 70% of the difference between the base price of wheat per tonne and $200/t.

Brazil have said they are expecting record crops in 2021, despite planting and harvest delays due to weather problems. They potentially are expecting a 103Mt maize crop, but of course there is a long way between now and harvest 2021, so a lot of time for production difficulties to set in. The US are also expecting a rebound to maize production levels in 2021, with current estimations at 8.5% higher than 2020. This is mainly due to increased area as well as a return to more average yield levels.

The world’s 3rd largest maize exporter, Argentina, have announced a further 1Mt cut to their maize production, now pegging it at 46Mt. This is 1.5Mt below the January USDA estimate so it will be interesting to see what cuts the USDA make in the February estimate tomorrow.

Ukraine’s grain exports are now 20.5% behind last year so far this season. In 2020, Ukraine exported 57Mt of grain, the government has said this figure could fall to 45.4Mt due to poor harvests. Ukraine’s soft milling wheat export price has fallen by $10-$11/t over the last week due to a big push in Russian wheat exports ahead of the upcoming Russian export tax.

Oilseeds

Domestic wheat prices backed off this week. Friday-Friday old crop (May-21) futures were down £5.25/t to close at £202.50/t. New crop (Nov-21) however only lost £1.70/t over the same time period, closing on Friday at £165.50/t. At 11am this morning, May-21 was up £0.50/t and Nov-21 was up £0.75/t from Friday’s close.

Delivered feed wheat in East Anglia for May 21 movement lost £5.00/t on the week, now quoted at £209.00/t. The loses for East Anglian milling wheat for the same movement period were greater, losing £8.00/t, with prices currently at £228.50/t delivered.

On Thursday, the pound traded at £1 = €1.14 against the euro, these are levels not seen since last May. Support has come from the Bank of England saying there was no chance there would be another cut to interest rates in the short term. As well a good vaccination progress giving hope of a strong economic recovery. A stronger pound puts downwards pressure on domestic prices because it means our exports become more expensive and imports are cheaper.

Rapeseed

A strengthened sterling pushed UK delivered rapeseed prices lower. Global supply of rapeseed could narrow at the end of the season following aggressive Canadian canola exports.

Global oilseed markets

Soyabeans

Markets await the release of USDA reports tomorrow with changes to South America production figures expected. Rainfall has slowed harvest progress in Brazil with pace behind last year. A delay to new-crop exports is expected.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Rapeseed and Soyabean markets traded sideways last week in the run up to a flurry of USDA data releases tomorrow. These reports include the monthly global supply and demand estimates (WASDE) and the monthly world oilseeds markets report. Changes are expected to global supply and demand following persistent rainfall across parts of Brazil since the last report. In the January WASDE report, Brazilian soyabean production was estimated at 133Mt. A Reuters pre-report poll indicates an average figure of 132.46Mt for the upcoming report tomorrow. This perhaps suggests the rainfall has helped production estimates stand on following the dryness concerns earlier in the season.

The Brazilian soyabean harvest is slowed by the rainfall. Harvest pace was at 1.9% complete as at the beginning of February, versus 8.9% last year. As a result of this, it is expected soyabean exports will really pick up in March rather than later on in February. These delays could increase Chinese purchases of US soyabeans over the next few weeks.

Argentine farmers finished planting their soyabean crops last week, though crop conditions are looking poor. Only 18% of the crop was rated good-excellent, against a rating of 66% as at Feb 3 last year.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.