New season barley prices relatively supported: Analyst's Insight

Thursday, 18 March 2021

Market commentary

- Global wheat futures fell yesterday after SovEcon increased its forecast for the Russian 2021 wheat crop by 3.1Mt. The crop is now pegged at 79.3Mt, compared to 85.9Mt in 2020. The upgrade follows a mild winter and good recent rainfall.

- For UK feed wheat futures, the impact on old crop prices was offset by a rise in Chicago maize prices. May-21 UK wheat futures were unchanged at £200.00/t, while Nov-21 price fell by £0.80/t to close at £167.30/t.

- May-21 Chicago maize futures were supported by the purchase of US maize by China mentioned in yesterday’s Grain Market Daily.

- There was also pressure on oilseed prices after rainfall in Argentina, which could stabilise soyabean yields. New crop (Nov-21) Paris rapeseed futures lost €6.00/t yesterday to close to €438.50/t.

New season barley prices relatively supported

Early insights into barley supplies next season point to support for barley prices relative to other grains.

Smaller global crop in 2021/22?

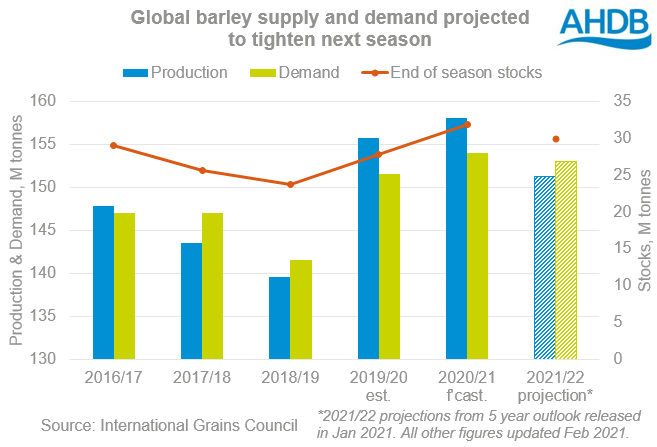

Global barley production was forecast to fall in 2021/22 by the International Grains Council (IGC) in January. The IGC made this projection as part of its five year outlook to 2025/26 so few details are available. In January, the IGC projected the 2021 crop at 151.3Mt, 1.7Mt below a static demand – more on this below.

Both Stratégie Grains and RMI suggest a similar global situation in 2021/22 to the IGC. The IGC usually makes its first detailed assessment of the new season in late-April.

In the major barley exporting countries, barley supplies look likely to be similar to 2020/21. But, at this early stage, average or ‘trend’ yields are used to make the projections. A good growing season and higher yields would increase supplies and reduce support for barley prices.

- EU-27 – The total barley crop is forecast at 54.5Mt by Coceral, 1.2Mt below 2020. Small declines in both the area and yields are expected. So far, crops are in a fair condition across the EU. But in top exporter France, winter barley is in its best condition since 2017. Also, the French spring barley area could be bigger than forecast. FranceAgriMer report that some rapeseed crops are being removed after pest and cold weather damage; spring barley is a likely replacement.

- Ukraine – Production is expected to rise 1% next season by UkrAgroConsult. This would likely mean more is available for export. Farmers planted a bigger winter barley area. But, the spring barley area may continue its long-term decline due to the attractiveness of other spring crops.

- Canada – The Canadian barley area is expected to rise 4% in 2021 by Agriculture and Agri-food Canada (AAFC). This follows attractive prices in the 2020/21 season. The results of Statistics Canada’s survey of farmers’ planting intentions are out on 27 April. But, AAFC expects tighter supplies in 2021/22, unless yields are above average, because of lower opening stocks.

- Australia – No forecasts are available yet. But, after such higher yields and bumper crops in 2020/21, lower yields and so a smaller crop seems likely.

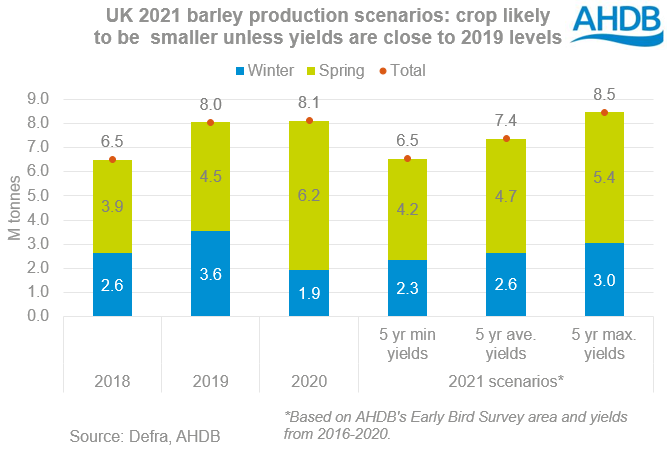

- UK – Based on the 2020 crop of 8.1Mt, the UK is the world’s joint fifth-largest barley producer with Turkey (USDA). Our area is expected to contract 18% for 2021, as a rise in winter barley is more than offset by a fall in spring barley. Using average yields this could put the 2021 crop around 7.4Mt, or a 9% fall from 2020.

China important to demand outlook

Initial projections suggest barley demand next season will stay high next season. This season, the biggest rises in demand are forecast for China (+2.3Mt) and Europe, including the UK (+1.5Mt).

To meet higher domestic demand, the USDA forecast Chinese barley imports at 8.3Mt in 2020/21. This is 1.6Mt more than 2019/20 and the second highest on record. Chinese imports of all grains could stay high next season as its pig herd continues to recover.

This morning, China reportedly launched a campaign to lower the content of maize and soyameal in animal feed (Refinitv). Demand for grains such as sorghum and barley is likely to rise if this is confirmed. Higher Chinese demand for barley would further support barley prices relative to other grains.

Usage of barley for animal feed in Europe and the UK is likely to drop next season, as wheat production rebounds. But, there is potential for malting demand to pick up, as pandemic restrictions are eased.

Price impact

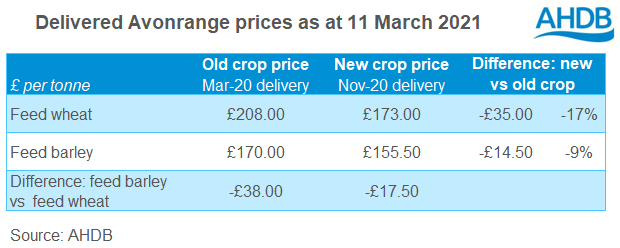

Forward barley prices are not as readily available as spot prices or those for other grains. The available prices show new crop barley supported relative to other crops. This reflects the potential for tighter global barley supplies next season.

For example, in the UK last week, feed barley for November delivery priced just £14.50/t below spot delivery. For feed wheat, the gap between old and new crop prices was much wider. New crop barley is also at a much smaller discount to feed wheat (£17.50/t) than it has been this season.

But, the overall direction of UK barley prices will be determined by the global supply of and demand for wheat and maize.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.