Natural gas prices dropped back: Grain market daily

Friday, 28 October 2022

Market commentary

- UK feed wheat futures (May-23) gained £1.00/t yesterday, to close at £279.00/t. New-crop futures (Nov-23) closed at £261.75/t, down £0.25/t over the day.

- Global wheat contract movements were mixed yesterday, with Paris milling wheat (May-23) rising by less than 1%, but Chicago wheat (May-23) down by less than 1%.

- Rains falling into drought hit Argentina, and poorer than expected US maize export numbers in the week ending 20 October, add pressure to the global grain picture. Though global markets continue to follow news on the Ukrainian export corridor closely.

- Yesterday, the EU Commission reportedly lowered their forecast for usable EU maize production for 2022/23 to 54.9Mt, down from 55.5Mt last month. If realised, this will be the lowest for 15 years. This is reportedly reflecting lower area or yield in Spain, France, and Poland. Conditions have been dry in the EU, could we see further reduction to this number?

- Paris rapeseed futures (May-23) gained €1.75/t yesterday, to close at €641.00/t. With some support seen across nearby brent crude oil futures yesterday too.

Natural gas prices dropped back

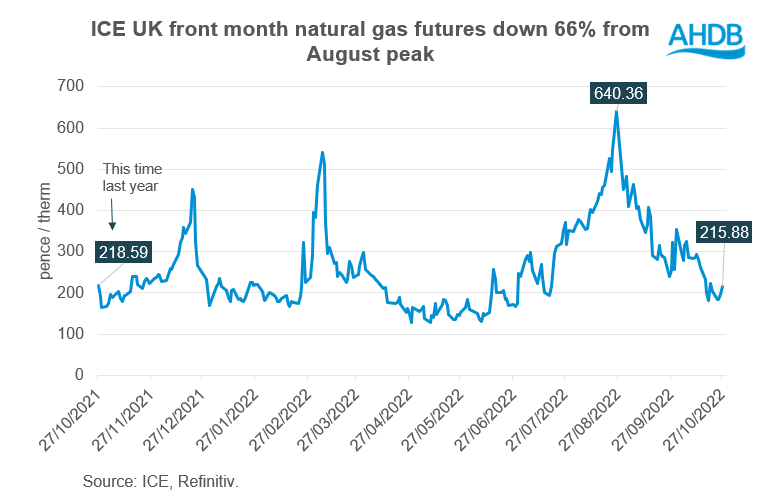

UK natural gas prices have been falling over the past 2 months, back to levels in line with last year. Yesterday, nearby ICE UK natural gas futures closed at 215.88p/therm. This compares closely to this time last year, where nearby futures closed at 218.59p/therm (27 October 2021).

Nearby prices have come down c.66% from peaks seen in August. On 26 August, we saw prices reach 640.36p/therm. This support was due to the tightening of Russian gas supplies via the Nord stream, plus strong EU demand, in the backdrop of the war between Russia and Ukraine.

Though today, prices are trending slightly higher, currently at 227.00p/therm (12:30).

Why have prices been falling in recent months?

Firstly, Europe has experienced milder weather than usual which has dampened demand for winter gas supplies.

On top of this, the EU have met their target for refilling gas storage to 80% by 01 November. Facilities are currently at 93% of capacity, up from 77% at the same point last year, according to Gas Infrastructure Europe (Refinitiv).

Finally, supply has been strong from wind power, LNG (liquefied natural gas) and from the Norwegian pipeline too. LNG deals with United Arab Emirates and natural gas supplies from Norway, Belgium, and the Netherlands have helped to fulfil EU supply gaps left from reduced Russian supplies.

Could we see prices continue to fall? This could be dependent on weather remaining mild to dampen demand. Currently temperatures are warmer-than-normal over Europe for the time of year. However, early indications estimate high pressure from November going into December for western Europe which could bring less wind and colder spells, but this is a watchpoint (European Centre for Medium-Range Weather Forecasts).

Further to that, global competition for especially LNG will be important to consider for future supply of energy.

What does this mean for fertiliser?

Natural gas makes up around 60-80% of fertiliser production costs in Europe. Rising natural gas cost has led to some fertiliser manufacturers pausing or reducing production. This includes CF Industries halting domestic ammonia production at its Billingham site at the end of August. As such, the UK is more dependent on imported nitrogen fertiliser.

As reported this week, Norwegian company Yara’s ammonia production is now reportedly back to running at 65% of capacity in Europe. This is back up from just 35% of capacity in August, due to high natural gas prices.

This shows some optimism for increased supply of nitrogen fertiliser on the global market. But challenges remain, with gas prices volatile, as the war continues between Russia and Ukraine.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.