EU maize yield estimate cut further and winter plantings progress: Grain market daily

Tuesday, 25 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £262.00/t yesterday, down £5.50/t from Friday’s close. The May-23 contract lost £2.50/t over the same period, closing at £282.00/t. New-crop futures (Nov-23) closed at £264.05/t yesterday, down £3.00/t. Pressure on the wider grains picture includes optimism on the renewal of the Ukrainian export deal, with ships continuing to leave Ukraine, plus harvest pressure across US maize.

- Chicago maize futures (Dec-22) closed at $268.31/t yesterday, losing $1.08/t across the session. The USDA said yesterday that as at 23 October, the US maize harvest was 61% complete, ahead of the five-year average of 52%.

- Chicago soyabean futures (Nov-22) lost $8.64/t yesterday, closing the session at $504.07/t. Even with increased demand from major importer China, harvest progress pressured the market. China’s soyabean imports in September rose 12% on the year to 7.72Mt, according to customs data released yesterday. This is after a months-long trend of low arrivals being reported.

- Paris rapeseed (Nov-22) gained €14.00/t over yesterday’s session, to close at €644.75/t. The last trading day for this contract is close (31 Oct). The May-23 contract gained €6.00/t yesterday, to close at €644.00/t.

EU maize yield estimate cut further and winter plantings progress

Yields

Yesterday’s release of the EU’s monthly crop monitoring report saw the outlook for certain summer crops (maize, sunflowers and soyabeans) worsen further. Drought conditions are ongoing across north-western Italy, and rain deficits continue in southern Spain and eastern Romania and Bulgaria. Rains did arrive in September in some EU regions, but often too late for summer crops.

Maize yields for harvest 2022 were down again, following a steep cut last month. The yield forecast is now pegged at 6.34t/ha, down 1% from last month’s estimate, and down 19% on the five-year average. Most countries reported lower or similar to average yields, apart from Portugal (forecasted by Strategié Grains to account for c.1% of the EU 2022 crop) which noted a higher-than-average yield. Notably, maize yields are forecasted low in Hungary, Romania, and Bulgaria (collectively making up c.32% of the EU 2022 crop). These countries had some welcome rain across September, but this was perhaps too late in areas as forecasted yields remain low due to the drought over the summer.

It’s thought that grain maize production was also curbed slightly by some farmers (particularly in Romania and Bulgaria) choosing to cut the crop as fodder maize for use on farm rather than for grain. This, combined with another cut to maize yields, further tightens the global maize supply outlook and ensures that the floor of support in global maize prices remains, in at least the short term.

The sunflower yield forecast was also cut in yesterday’s report. The yield estimate is now pegged at 1.97t/ha, down 4% from the previous month and down 16% on the five-year average. Again, most countries are forecasted lower than average yields. This year, with such a tight rapeseed outlook due to the limited exports from the Black Sea region, demand for vegetable oil is strong, and a tighter sunflower outlook could have a greater impact on rapeseed prices.

EU soyabean yields were also revised down from the previous month’s estimation. Average soyabean yield is now pegged at 2.37t/ha, down 1% from last month’s report, and down 18% on the five-year average.

Planting conditions

Yesterday’s report also looked at planting conditions for EU winter crops. The report suggests that generally conditions have been good for planting and emergence of winter cereals, but that some main rapeseed producers have faced challenges.

The hot and dry weather in the summer, followed by the colder and rainy conditions seen in September, have meant that parts of the EU were delayed in sowing their winter rapeseed crop. For example, in Germany, planting was delayed until the end of August, and was finalised at the beginning of September after beneficial rains. Some areas in Poland experienced torrential rains, resulting in uneven emergence, and in some cases, crops have needed re-planting. However, other areas such as France, Ireland, the Baltic countries, and Northern Italy, had adequate soil moisture and favourable planting conditions.

Winter cereal plantings are said to be progressing well across Europe without too many challenges. Cereal sowings were completed in September across most of the Nordic and Baltic regions, though the report stated that certain areas suffered from dry soils, resulting in delayed emergence. In France and Germany, wet conditions were said to be favourable for planting, and the warmer weather ideal for crop establishment.

Elsewhere in Europe, plantings continue into November. Spain, Portugal, and Northern Italy ordinarily start winter cereal sowing in mid-October, though current dry conditions could delay the start of plantings.

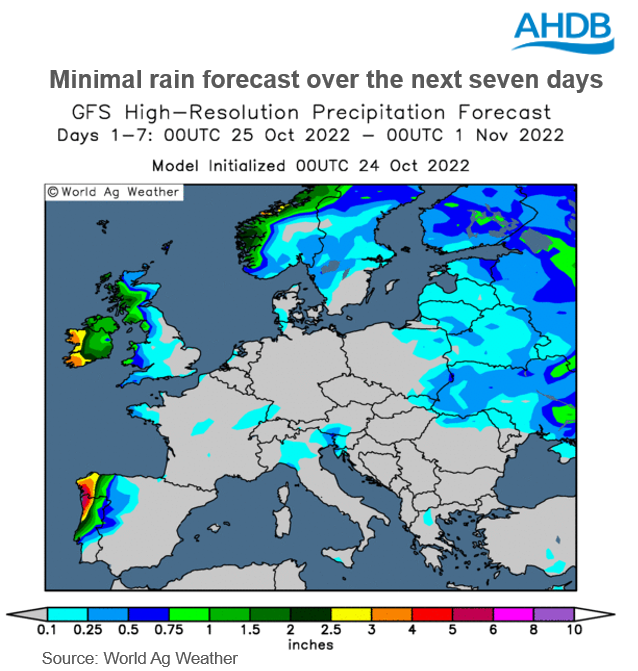

Over the next week, most of Europe is forecast minimal rain. Therefore, those that currently have adequate soil moisture will be able to accelerate plantings, but those with inadequate moisture could still struggle.

As mentioned in Anthony's analysis last week, parts of the US are also battling drought. With the US and Argentina due welcome rain this coming week, considering recent dry conditions, weather and its impact on global grain supply this season and next season continues to be something to monitor going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.