US winter wheat is a critical watchpoint: Grain market daily

Tuesday, 18 October 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £272.50/t, down £6.10/t from Friday’s close. The Nov-23 contract closed at £267.25/t down £2.75/t over the same period.

- Domestic markets followed the Paris market, which was optimistically down from increasing expectations that commodities will continue to leave Ukraine via the Black Sea, despite concerns over the renewal of the grain export deal. Further losses were recorded on the domestic market as sterling strengthened against the euro (+0.5%) and dollar (+1.64%) yesterday to close at £1 = €1.1541 and $1.1353.

- Paris rapeseed futures (Nov-22) closed yesterday at €620.75/t, down €13.00/t from Friday’s close.

US winter wheat is a critical watchpoint

With the war in Ukraine adding uncertainty around global supply and volatility to markets, weather in other key grain producing regions, such as the US, becomes even more important than ever.

Although the US’ wheat area has slowly been consolidating since the 1980’s, at the advantage of maize and soyabeans, they are still a large global producer and exporter of wheat. Globally, the US is expected to be the fifth largest producer and exporter of wheat this season (2022/23), accounting for 6% and 10% of output and trade respectively.

Putting US wheat exports into context, 47% of US production from harvest 22 is expected to be exported to the global market. With the US exporting a large proportion of its crop each year, any weather impacts to their 2023 crop will be felt on the global market.

Although harvest 23 may seem light years away, weather in the US is a critical watch point for winter wheat plantings and development. Current plantings (as of 16 Oct) are estimated at 69% complete in in the US, matching the same point last year and slightly above the five-year average (68%), according to latest data from the USDA.

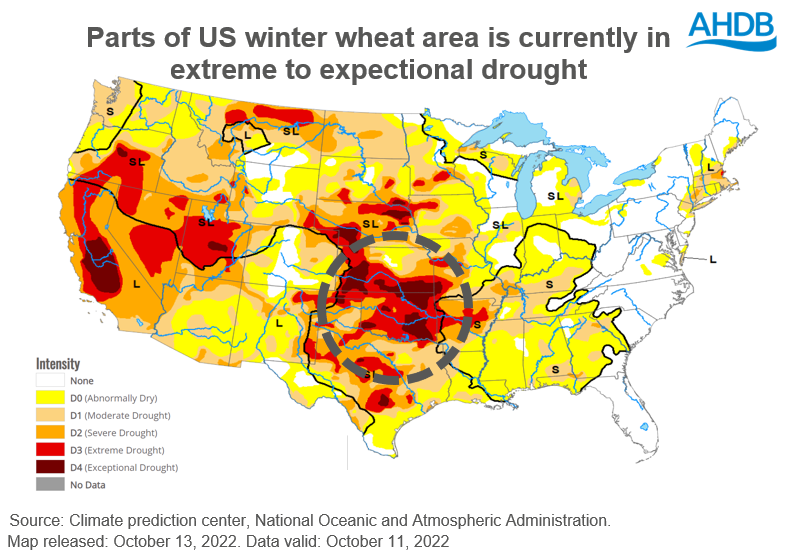

Right now, there is soil moisture deficits in the central and southern parts of the plains where the majority of US winter wheat is grown.

As the figure above shows, the majority of Oklahoma is in extreme to exceptional drought state-wide and most of Kansas is in severe to exceptional drought. Based on last year’s plantings, these two states accounted to near 35% of total US winter wheat plantings.

As of Sunday, over 30% of winter wheat in these two respective states had emerged, which means this heat stress could have implications to the crops in these areas.

Over the next seven days these two states are expecting widespread rains, up to three inches in parts. This is welcomed, however weather in this region is a critical watchpoint.

With Russia-Ukraine contributing to increased market volatility, weather stories in key producing regions, such as the US, could also influence market movements as they have the potential to tighten global supply for next season.

There are a lot of unknowns around whether supplies will continue to flow from the Black Sea. What we do know is that production for harvest 2023 will most likely be down in Ukraine. This will increase the reliance on supplies from other key exporters, such as the US. Therefore, any weather impact on US production, will filter into global and domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.