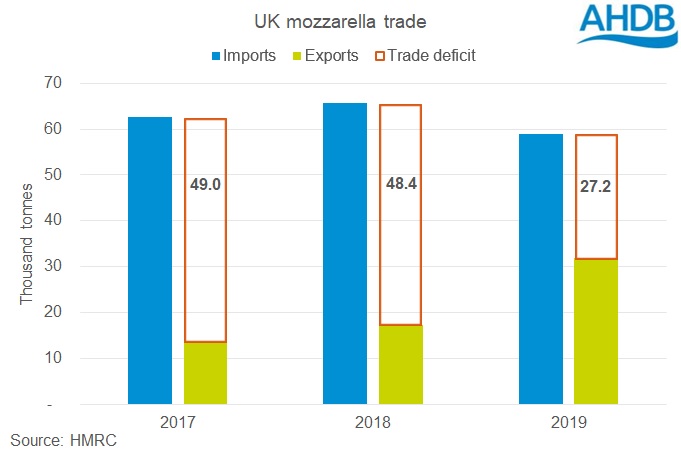

Mozzarella trade deficit nearly halved in 2019

Wednesday, 19 February 2020

By Kat Jack

The UK’s mozzarella trade deficit totalled 27.2k tonnes in 2019 - 44% smaller than in 2018. This was driven by changes in both imports and exports. UK imports of mozzarella dropped by 6.6k tonnes (10%) in 2019 compared with 2018. Meanwhile, exports went up by 14.6k tonnes – a massive 85% increase on 2018.

Strong mozzarella exports were evident throughout 2019, with monthly figures nearly always exceeding their 2017 and 2018 counterparts. However, there was a particular uplift in the last quarter of the year, with nearly 13k tonnes exported – double that of the other quarters in 2019. In fact, in December 2019 UK mozzarella exports exceeded imports for the first time on record*.

What’s causing the shift?

This Q4 uplift might have come from buyers stocking up ahead of the October and January Brexit deadlines. However, there was not a similar uplift prior to the April deadline, so this is not certain. In spring 2019, we determined that the UK would struggle to meet mozzarella demand if trade with the EU was disrupted. Although the trade deficit has shrunk, the UK is still reliant on the EU. In 2019, 99.9% of UK mozzarella imports came from the EU, and 91.4% of exports went to the EU.

Ireland was a big destination for UK mozzarella, with 14.9k tonnes exported there in 2019. This is 6.5k tonnes higher than 2018, and accounted for 25% of total mozzarella exports.

Historically as milk production has risen in Northern Ireland, so have net exports of milk. In other words, the extra milk has been processed in the Republic of Ireland. This does not appear to be the case in 2019. Milk production in Northern Ireland did increase in 2019 but there was a reduction in exports of milk over the border. The trade data suggests that a good proportion of the extra milk retained within Northern Ireland was turned into mozzarella and exported.

There have been investments in mozzarella processing in the UK, and announcements of significant investments in mozzarella in the republic of Ireland. Some of that investment is by UK companies, and it is plausible that processors were building up supplies in Ireland to either prepare for Brexit disruption, or to build a market ready for when new processing becomes available.

*Mozzarella trade records start in January 2015, when it was split from fresh cheese into its own trade code.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.