Mozzarella - Filling the Brexit void

Thursday, 18 April 2019

By Felicity Rusk

Under a no-deal scenario, the UK would face the EU common external tariff on any exports sent to the EU. For mozzarella, this means a tariff of €185.20/100kg, approximately 45% of the value of the product. As a result, the majority of UK mozzarella would be unable to compete on EU markets.

The UK Government has recently announced the no-deal tariff rates for imported products. The proposed import tariff rate for fresh mozzarella is zero. Therefore the impact on imports and exports is likely to be significantly different.

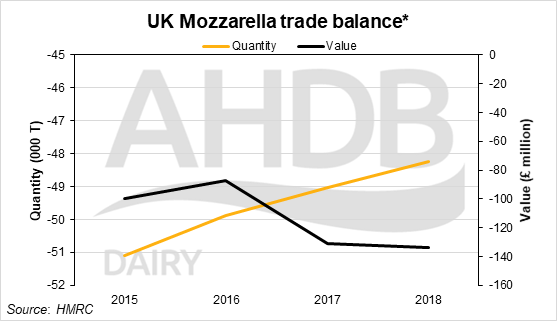

The UK is in a mozzarella deficit in both value and volume terms. In other words, we import more than we export. In 2018, we imported 48k tonnes more mozzarella than we exported.

Trade in mozzarella has increased each year for the last three years. However, with exports increasing more quickly than imports, the trade deficit has gradually reduced. Yet in monetary terms, the UK's trade position has worsened.

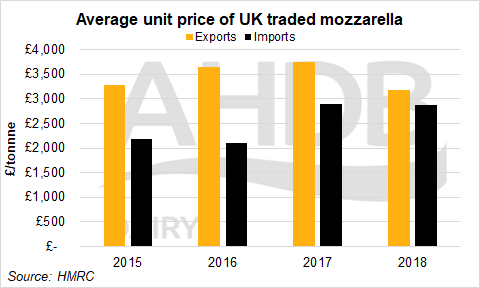

Over the last couple of years, the difference between the value of imports and exports has narrowed. In 2016, the average unit export price was £1,540/t more than the price of imports. In 2018, the difference narrowed to just £300/t.

Nearly all of the UK mozzarella is sourced from the EU, with around 40% sourced from Denmark. Imports have declined from France, Germany and Ireland since 2015 and shifted towards Belgium, Italy and the Netherlands.

Could the UK dairy industry make up for the volume shortfall?

Despite tariffs on exported mozzarella only, a no-deal will still likely impact trade in both directions. Some food service companies are already making changes in preparation for Brexit. ASK Italian and Zizzi’s, both part of the Azzurri Restaurant group, recently switched sourcing product from Italy to Wales over concerns of a disrupted supply chain.

In simple terms, if trade stopped entirely, the UK would have a 48K tonne deficit of mozzarella. Producing this domestically would need around 472 million litres of milk; or 3% of national milk production.

Although there have been investments by UK manufacturers, the UK does not have enough processing capacity to produce another 48k tonnes of mozzarella.

Without an export home to go to, the product that would have traditionally been exported could enter the domestic market. However, with competition remaining from imports, domestic prices could be put under pressure.

Conclusion

At the time of writing, it is unclear what the post-Brexit landscape looks like for the industry. Limited spare processing capacity means the UK can’t produce all the mozzarella required to be self-sufficient. However, under no-deal, UK exporters could find they have no home for their cheese, while product is still entering the UK market from the EU.

Such circumstances could have a significant detrimental impact on UK mozzarella manufacturers. The level of the impact on individual businesses will be determined by what proportion of their cheese is exported, and what back-up plan they have put in place during these uncertain times.

Note: The fresh mozzarella HS code 04061030 was only formed in 2015. Before that, it was part of a combined fresh cheese HS code 04061020.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.