More actions and higher payment rates for ELMs in 2024: Grain market daily

Tuesday, 16 January 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £187.00/t, down £2.00/t from Friday’s close. New-crop futures (Nov-24) closed yesterday at £201.00/t, down £1.35/t over the same period.

- Domestic futures felt some pressure yesterday, despite Paris wheat ending the session slightly higher. Though prices on the continent edged down initially, they then found some support levels later on, as traders awaited news on an Algerian wheat tender. US markets were shut yesterday for a holiday, though prices fell last Friday after the release of the latest US quarterly stocks and USDA World Agricultural Supply and Demand Estimates.

- Russian wheat remains competitive on the global market, with Egypt’s state buyer GASC purchasing 420 Kt of Russian and Ukrainian wheat last week, for shipment at the end of Feb. This remains in focus for EU competitiveness and price direction.

- Cold weather in Germany and France is thought to caused limited damage to waterlogged grain fields (LSEG). Though rain continues to delay sowing.

- Paris rapeseed futures (May-24) gained €3.75/t yesterday, to close at €425.00/t. Prices gained with Winnipeg canola yesterday, despite weakness in the wider oils complex and with US markets closed.

More actions and higher payment rates for ELMs in 2024

More information has been recently released regarding the Environmental Land Management Schemes (ELMs), at this year’s Oxford Farming Conference.

Up to 50 new actions will be launched in Summer 2024.

These will be based around agroforestry, precision farming, supporting recovery of priority habitats and threatened native species, enhancing and restoring waterbodies and watercourses, and protecting lowland peatland.

Importantly too, payment rates will be increased by an average of 10% for the Sustainable Farming Incentive (SFI) and Countryside Stewardship (CS) agreements, and a premium paid for high ambition actions.

Some payment rates for new actions of interest to arable farmers (available from Summer 2024):

- No-till farming – £73 / ha.

- Spring, summer or autumn multi-species cover crop – £153 / ha to £163 / ha.

- Precision farming – £27 / ha to £150 / ha depending on the action.

These are all annual payments over the three-year duration of an SFI agreement.

For more information on payment rates, visit the GOV.UK website.

Later this year, Defra will publish further information on actions, eligibility, rules for actions combined on the same land, as well as details of when you can apply. Defra have also stated that a regular review of SFI actions and payment rates will be introduced from 2025 over a rolling three-year period.

So, what does this mean for arable farm finances?

Back in November, analysis was released looking at stacking SFI actions and the impact on finances of farm businesses, when applying to a 455 ha arable virtual farm in the East of England. Following the new payment rates, this analysis has been updated; view the stacking options.

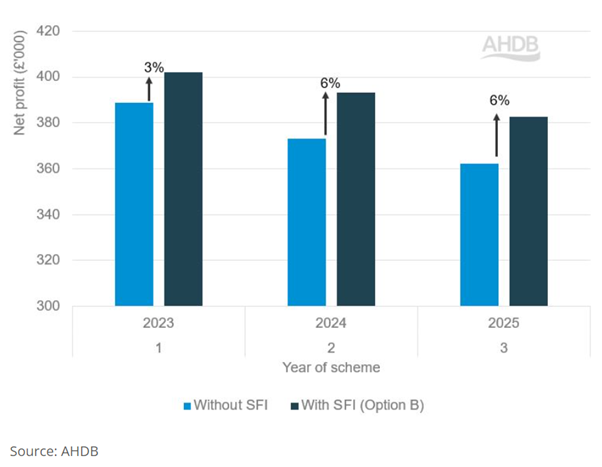

Before the recent increase in payment rates, the net profit (total costs minus revenue) of the 455 ha arable farm increased by 2–4% over the three years of the SFI agreement if ambitious actions were mostly carried out on unproductive land. With the revised payment rates, the net profit of the farm increases by 3–6% under the same circumstances. However, if crop area is sacrificed to carry out these ambitious actions, the net profit of the farm declines.

In terms of additional income, the farm now receives an additional £35,000 – £42,000 for carrying out ambitious SFI actions compared with £29,000 – £36,000 as was the case before the payment revision.

Effect on 455 ha arable farm’s net profit level after implementing an ‘SFI Ambitious’ option on unproductive fields

An important key takeaway is that while the uplift in payment rates is welcome, SFI alone will not mitigate the loss of Direct Payments. Though by taking part in the SFI scheme, this can provide substantial extra income for an arable business and can help play a role in stabilising farm business incomes.

Importantly, look at options that best suit your farm business to maximise the potential of every hectare.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.