Mixed wheat market signals, near term support and long term pressure? Grain Market Daily

Wednesday, 11 March 2020

Market Commentary

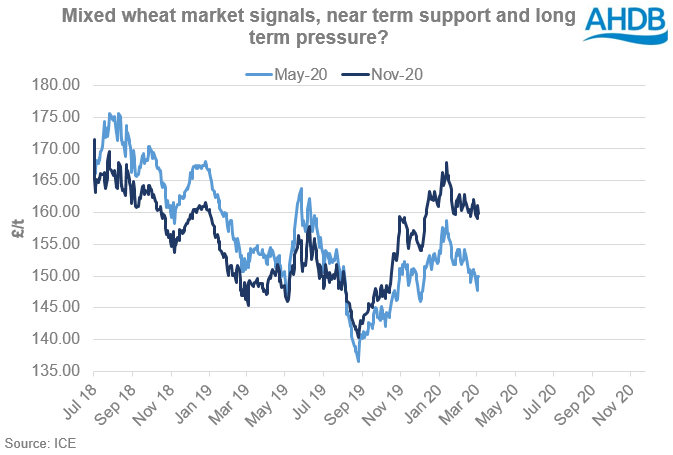

- A slight recovery in global commodity markets yesterday, following large falls early on this week, led UK feed wheat futures (May-20) to gain £2.25/t yesterday, while new crop (Nov-20) gained £1.05/t, closing at £150.00/t and £161.05/t respectively. However, global commodity markets remain under pressure as Covid-19 continues to dominate headlines and impact the global economy and demand outlooks.

- Today’s Government budget has the potential to impact the value of the pound, commitments for public spending may provide some support for the pound after this morning’s interest rate cut.

- Amid record Brazilian soyabean production estimates there is a long term bearish oilseed market outlook.

Mixed wheat market signals, near term support and long term pressure?

The domestic supply and demand outlook will keep new crop wheat markets at import parity and this is unlikely to change any time soon. This therefore leaves UK markets driven by just two factors, global outlooks and domestic currency, both with potentially bearish long-term implications.

Domestic currency

Since mid- February there has been a weakening of the pound, falling from £1 = €1.20 to trade below £1 = €1.14 over the last couple days. The recent devaluing of the pound has been linked to Covid-19 global economic implications, similar to the devaluing of the pound during the 2008 financial crash.

Should the global economic outlook continue to worsen then further pressure could be exerted on the value of the pound providing support to domestic old and new crop prices. However, depending upon the longer term outlook into 2020/21, the pound could well strengthen removing a degree of this currency support once short-term fears are allayed.

Black Sea wheat

Two competing factors are currently at play for the short term outlook for Russian old crop wheat, stocks and currency. Yesterday’s otherwise uninspiring USDA WASDE, increased the Russian export forecast by 1Mt to 35Mt, thereby reducing ending stocks to below 7.5Mt, the lowest since 2015/16.

A tighter end of season Russian wheat outlook would lend support to global export markets. However this is being offset by a weakening of the rouble relative to the US dollar, allowing domestic prices to rise while capping global market gains. Yet there remains the outside possibility that, as has happened previously, the export pace could be slowed as domestic prices rise to curb inflation.

A long term pressured oil market would keep the Rouble weak, adding further long term negativity to the global wheat export market.

Southern Hemisphere

Following multiple years of drought in Australia, recent rainfall across main wheat producing regions has created far better soil moisture. Forecasts from ABARES place the Australian wheat area for 2020/21 at 12Mha, up from 10.1Mha in 2019/20.

Early Australian wheat production estimates are over 40% larger than the current drought impacted 2019/20 crop at 21.3Mt. Should these early forecasts come to be reality, then this would inject a far greater amount of competition and pressure on the global export market in the latter half of 2020/21.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.