Crude oil continues to control oilseed rape: Grain Market Daily

Tuesday, 10 March 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £147.75/t, down £1.80/t on Friday’s close. Furthermore, the November-20 contract closed at £159.00/t, down £0.75/t.

- Chicago soyabean futures (May-20) closed yesterday at $319.67/t, down $7.81/t on Friday’s close.

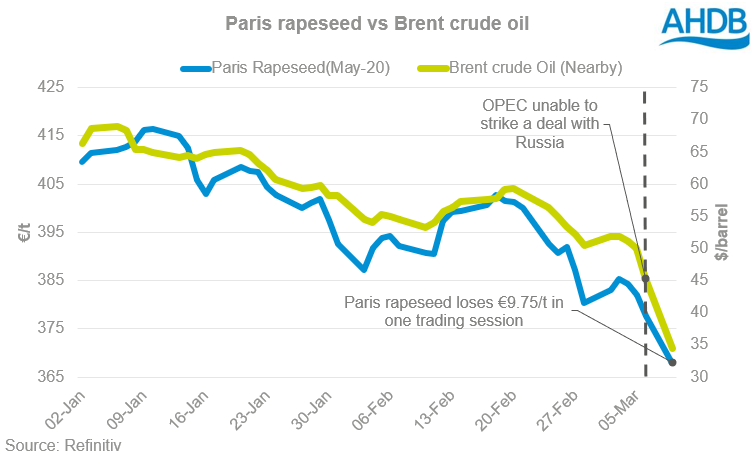

- Yesterday all global commodities declined in sympathy to energy and equity markets as OPEC were unable to strike a deal with Russia on oil production outputs. Continue to read how this will affect your ex-farm rapeseed price.

Crude oil continues to control oilseed rape

Yesterday was a hard-hitting day for global commodities. We saw Brent crude oil futures trade at its lowest since 2016. Furthermore, the nearby contract closed yesterday at $34.36/barrel, down $10.91/barrel on Friday’s close. Throughout yesterday, the contract traded as low as $31.27/barrel.

The ongoing impact of the coronavirus (COVID-19) has caused shockwaves on global stock markets pressurising commodities, simultaneously while there is unrest in oil markets.

As Alice discussed last week, The Organisation of Petroleum Exporting Countries (OPEC) were attempting to reduce the global output of oil to stabilise prices with allied energy exporters.

OPEC has not successfully struck a deal with Russia about oil production cuts. This has caused Saudi Arabia to cut oil prices, and there are reports that their production will also be ramped up.

The coronavirus outbreak had already put pressure on crude oil. As crude oil can have a knock-on effect on the global oilseeds complex, political discourse between OPEC and allies will be something to closely monitor going forward as this could affect your ex-farm rapeseed price.

As yesterday we saw the benchmark Paris rapeseed contract (May-20) close at €368.00/t, down €9.75/t from Friday’s close. The contract traded yesterday as low as €364.75/t.

This contract is analysed closely as it is the benchmark for domestic rapeseed pricing. The fluctuation between GBP/EUR exchange rate can further alter prices.

Aside from political discourse, other key parameters to observe will be the weather conditions in large oilseed rape producing nations. For example, the climatic conditions affecting Ukraine’s increased OSR area for the 2020/21 marketing year (MY).

Furthermore, weather conditions in Australia within the coming months will be a watch point. It’s predicted by the Australian Government that a favourable weather scenario could increase Australia’s canola (rapeseed) production to 2.6Mt for the 2020/21 MY, up 300Kt year-on-year.

Weather will be key to observe in large rapeseed producing nations, as we progress throughout the year. As this will have an impact on the progression of growth which in turn will affect the yield, ultimately be affecting global markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.