Rapeseed prices up as global markets bounce: Grain Market Daily

Wednesday, 4 March 2020

Market Commentary

- Old-crop UK feed wheat futures (May-20) closed yesterday at £151.00/t, up £1.95/t since Friday. Similar gains were seen in new-crop futures (Nov-20) too, up £2.20/t since Friday, closing yesterday at £161.50/t.

- A rise in Chicago maize futures (May-20) of $5.12/t from Friday, to close yesterday at $150.10/t is the likely driver of this. This has dragged Chicago wheat and European wheat futures higher too.

- EU imports of rapeseed (week ending 01/03/2020) were 68Kt lower than the previous week, bringing the total for the current season to 4.3Mt. Rapeseed imports are significantly up from last season (+40%) but tailing off now with other oils and oilseeds potentially displacing it. Imports of sunflower seed are up 87% compared to last season at 630Kt.

Rapeseed prices up as global markets bounce

May-20 oilseeds contracts have seemingly recorded gains in the past few days, following declines lead by coronavirus concerns. US soyabeans (May-20) have gained $3.95/t since Friday, while Paris rapeseed has seen a rise of €5.00/t, to close yesterday at €385.25/t.

For the UK, a drop in sterling strengthens its relationship with price rises seen in Europe. A further drop of 1.4% for the value of sterling against the euro means that the €5.00/t rise in May-20 Paris rapeseed futures (Friday-Tuesday) equates to £8.95/t.

Where is the driving force for these gains?

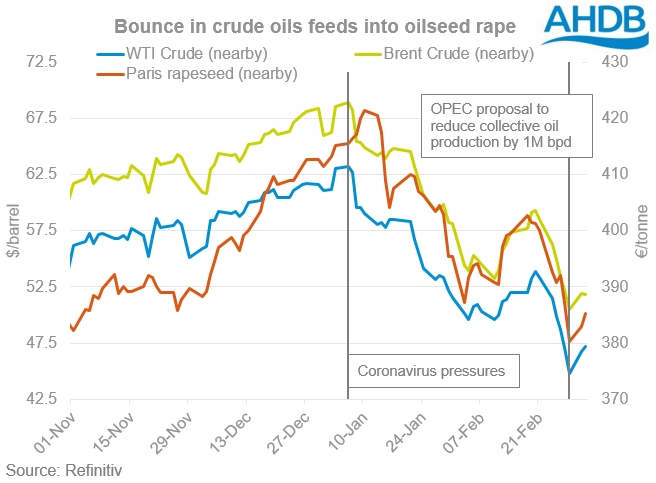

Oil. Two key contracts to look at are Brent Crude and West Texas Intermediate (WTI) Crude. Both nearby futures contracts have lost 25%-30% since their peak in early January to Fridays close. The continued spread of coronavirus across the globe reducing demand has lead this. However, these futures have since jumped, with the nearby WTI Crude futures price gaining 5.4% (Friday-Tuesday).

This comes on the back of news that OPEC producers (most prominent, Saudi Arabia) proposes to further cut collective oil production by 1 million barrels per day (bpd). This is significantly more than the initial plans of a 600K bpd cut. A meeting is due to take place later this week between OPEC and non-OPEC producers (Russia, being key) where an agreement will be made regarding the reduction. A potential sticking point is that Moscow are generally happier with a lower price than Saudi Arabia. This will be a key watch point, as depending on the size of the cut we could see support for oil continue.

Further spread of coronavirus will continue to burden demand though and therefore it is unlikely oil prices will spike back to early January levels. This could see a slight rise in oilseed prices but again, this is unlikely to be long-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.