Analyst Insight: Long term OSR and oilseed market outlook

Tuesday, 10 March 2020

With a deficit of rapeseed in both the EU and the UK, the 2019/20 season has been characterised by a requirement to import rapeseed, rapeseed meal, alternative oilseeds, vegetable oil and biodiesel. Additionally, with a decline in OSR planting in the UK and continued below average EU planting for 2020/21, this is unlikely to be reversed.

Taking the best available trade and usage data, combined with Defra production figures, and 2019/20 has a domestic deficit of approximately 200Kt, with production at 1.75Mt. Yet looking forward to 2020/21, unless consumption changes this domestic deficit is likely to extend to closer to 700kt following reductions in the UK planted area and production likely to be in the region of 1.2Mt. To account for the domestic deficit in 2020/21, rapeseed and meal imports are likely to increase. Using the 5 year maximum monthly import figures for both rapeseed and rapeseed meal, this domestic deficit can be covered at historical maximum levels.

Yet the pricing structure of domestic rapeseed in the UK is heavily linked to European markets, owing to the mainly portside locations for domestic crushing facilities and reliance on cross channel trade. As such, the overall UK supply and demand outlook has historically led to minimal price divergence from continental prices and the Euronext Paris Rapeseed futures contract remains the basis for calculating domestic prices. Basing domestic prices on a European based futures market creates an additional currency risk for the 2020/21 season should the value of the pound find longer term support.

Although the EU as a whole is also in a rapeseed deficit, and likely to remain so, Ukraine, followed by Australia and Canada are the predominant export countries, coving this deficit. Changes in production for Canada and Ukraine at this stage appear unlikely to be large for 2020/21. However, following multiple years of drought in Australia, there is currently better soil moisture in many agricultural regions, and should a reversion to more historically average conditions prevail then exportable global rapeseed supply in the second half of 2020/21 may well ease.

Import requirement and pricing structure implications

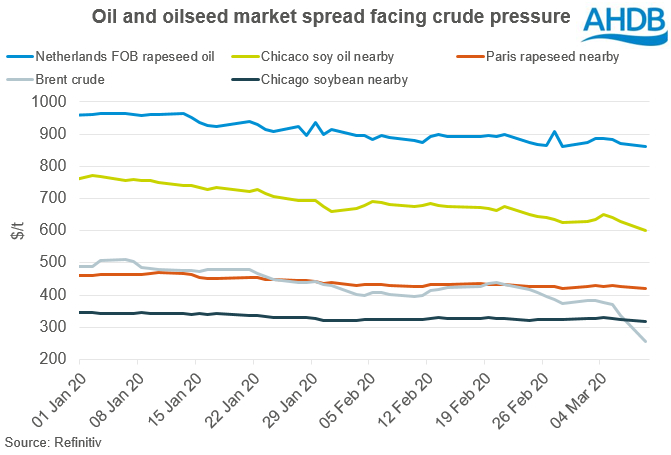

The requirement to import large volumes of rapeseed in the EU and UK widened the price spread between oilseeds and oils. However, rapeseed prices have been unable to climb higher than the substitution or partial substitution of alternative vegetable oils has allowed, and as the minor fraction of the oilseed and oil complex have limited impact on global price trends.

Current oilseed market outlook

Since the New Year, due to coronavirus fears, oil markets have fallen on demand fears, with palm oil futures falling over 20%. Similarly, Brent crude oil futures have fallen significantly, recently trading well below $40/bbl and at multi year lows.

Yet while major oil market influencers of crude and palm have recorded significant losses since the New Year, as has soy oil, soyabean markets have yet to fall to the same degree, leaving the underlying soyabean and rapeseed markets still at risk.

Yet the recent coronavirus driven pressures are not the only factors in this bearish oilseed market.

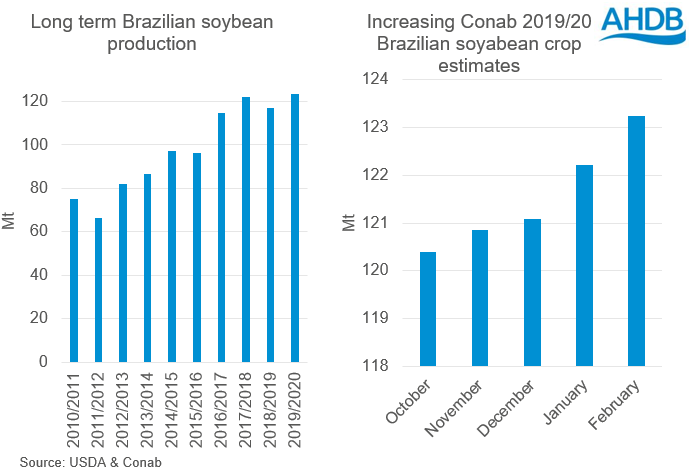

Longer term record Brazilian soyabean crop pressure

While Northern Hemisphere production is a known quantity, the size of the Brazilian soyabean harvest will now weigh on global oilseed markets well into the summer. Month on month upward revisions from Brazilian organisation Conab have consistently pushed up the crop estimates as yield expectations improved. With estimates upwards of 123.25Mt, the Brazilian soyabean crop is now likely to hit a new record.

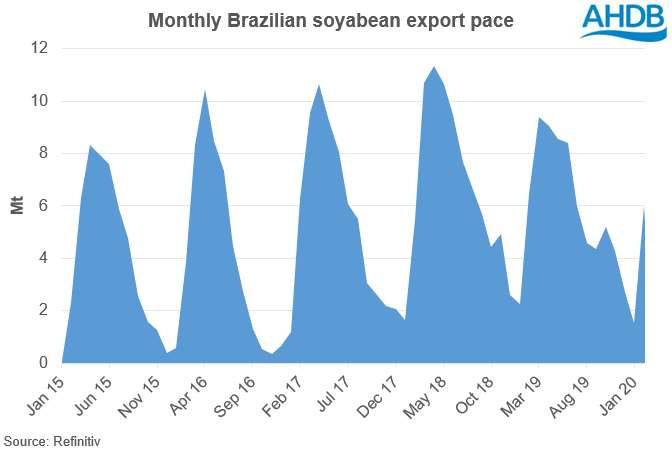

With the Brazilian harvest well under way, the export pace out of South America is likely to peak over the next few weeks.

As China is the largest market and purchaser of Brazilian soyabeans, not only has the large harvest added to global supply, but importantly may well slow and further delay Chinese purchases of US soyabeans, especially amid a potential global economic slowdown.

At a time where markets are anticipating Chinese commitments to purchase US goods, amid the Phase one China – US agreement, a preference for Brazilian soyabeans will likely maintain pressure on US and global oilseed markets.

Minimal US soyabean exports

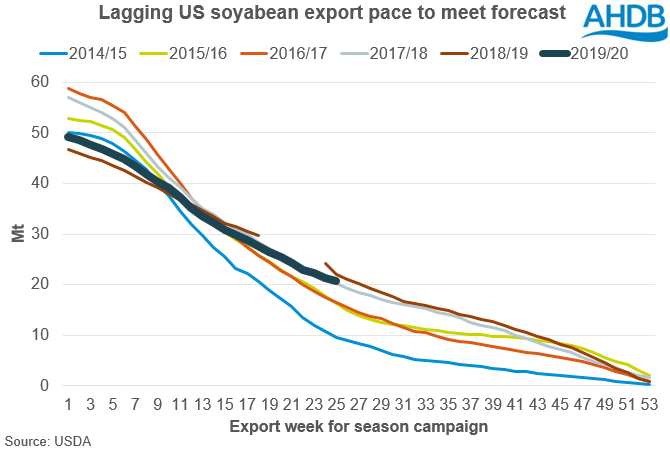

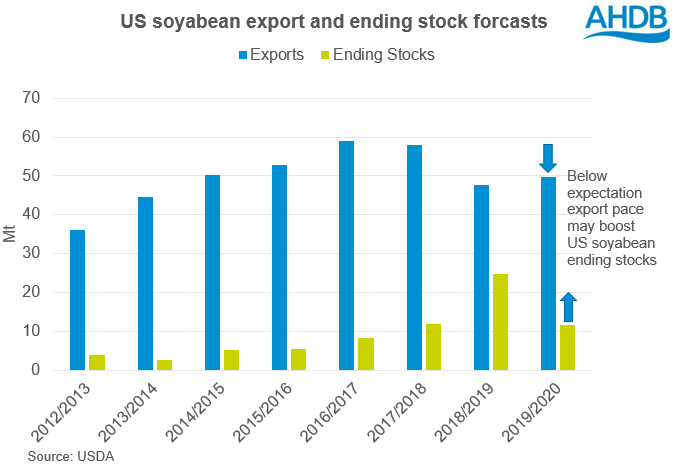

While global oil markets have recently declined, and a record Brazilian crop may hamper US export sales to China, US exports to date have also been far from exceptional. This is further reducing confidence for significant upward market movement, and US managed money funds have consistently remained in a short position.

Should the current USDA supply and demand estimates hold true, then at this point in the season, there remains the second largest volume of US soyabeans left to export, only marginally less than the 2018/19 season.

With over 20Mt of US soyabeans still remaining to be exported, there remains two possibilities. This first possibility is an upturn in sales to China, but for various reasons this seems unlikely to be fully realised. Alternatively, in the next USDA WASDE, there may be adjustments to forecast exports and ending stocks, which would send and confirm bearish signals to global oilseed markets.

With ample US stocks, and Brazilian soyabeans now readily available, it is hard to avoid the bearish short term and longer term fundamentals for the overall oilseed market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.