Mixed price reaction to USDA report: Grain market daily

Friday, 11 December 2020

Market commentary

- Global wheat prices rose yesterday, in part due to rumours about a possible tax on Russian wheat exports. Russian wheat prices have risen recently, because of weaker rouble and higher global prices. This is contributing to high inflation and the Russian government will meet to discuss the situation early next week.

- UK feed wheat futures (May-21) gained £2.65/t yesterday to £192.25/t. This follows higher global prices and sterling weakening against the euro, as the trade talks between the UK and EU stalled again. There are now just a few days to avoid a ’no-deal’ situation’.

- In October, the UK imported 167Kt of wheat, taking the season to date (Jul-Oct) total to 855Kt. This is 40% of the full season forecast in a third of the months. Imports by end-December will be important if we don’t get a trade deal with the EU and there is a £79/t tariff on imports of medium and feed quality wheat. We also imported 208Kt of maize and 65Kt of rapeseed in October.

- The UK exported another 141Kt of barley in October. In the season so far, we have exported 413Kt. This is less than half the amount we shipped in July-October 2019, despite total availability being 6% higher than last season.

Mixed price reaction to USDA report

The USDA trimmed its forecasts for global stocks of wheat, maize and soyabeans at the end of the 2020/21 season yesterday. Yet, the price reaction was mixed.

The cut to US and global wheat stocks caused a sharp rise in US wheat futures yesterday. Chicago May-21 futures rose $4.68/t yesterday to $219.43/t (approx. £165/t).

In contrast, both Chicago maize and soyabean May-21 futures fell slightly yesterday. The May-21 contract for Chicago soyabean futures fell $1.75/t and on Chicago maize, it decreased by $0.88/t. Industry had expected larger cuts to stocks than the USDA had made and this pushed prices down.

There was some surprise at the small reductions to South American production forecasts for maize and soyabeans, given recent dry weather. The USDA cut Argentine production of maize and soybeans by 1.0Mt each, but left its Brazilian estimates unchanged.

Yesterday Brazilian agency, Conab, cut its maize forecast by 2.3Mt and its soyabean forecast by 0.5Mt. The progress of South American crops will be a key area for price direction in the months ahead.

The USDA reduced its forecast for global wheat stocks by nearly 4.0Mt, compared to November. Demand increased by 5.1Mt due to higher animal feed demand in China, Australia, and the EU.

The market had expected an increase to stocks after official data on Australian and Canadian crops was included. As a result of the cut, Chicago wheat prices rose yesterday.

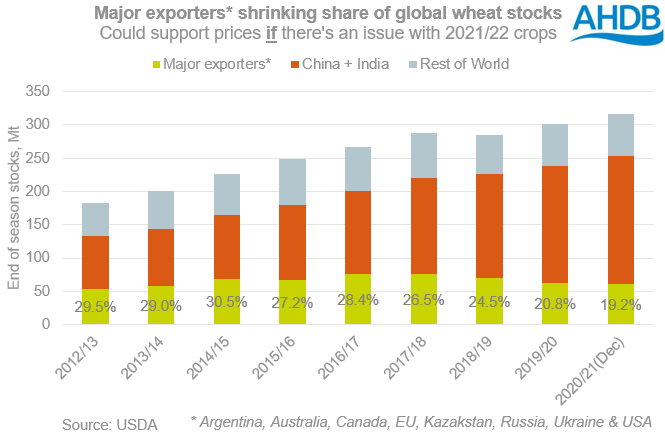

Even after yesterday’s cuts, global wheat stocks remain historically high. However, the proportion held by major exporters is coming down. Those stocks will be important if there are problems with the crops for 2021/22.

US wheat stocks at the end of 2020/21 are pegged at 23.5Mt, 0.4Mt less than last month because of good exports of white wheat to East Asian countries. However, Alex reported yesterday that analysts expected US stocks at 23.8Mt, a drop of just 0.1Mt.

US maize stocks were left unchanged, while analysts had expected a cut. This suggests that US demand (either export or domestic) might be slightly lower than expected. The quarterly stocks report, out 14 January, will provide more insight. Depending on what it reveals, it could cause some price volatility.

Global maize stocks were reduced by 2.5Mt, mainly due to higher animal feed demand by China. But the global stocks reduction was in line in expectations, leading to a small drop in prices.

US stocks are estimated at 4.8Mt. This is 0.4Mt less than in November and 9.5Mt less than last year. However, the market had expected a larger cut, according to a poll before the report was released by Refintiv, which put pressure on prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.