Could todays WASDE provide direction to global wheat markets? Analyst Insight

Thursday, 10 December 2020

Market Commentary

- London wheat futures tracked small gains in global wheat markets yesterday. Whilst old crop (May-21) closed up £0.35/t to £189.60/t, the new crop (Nov-21) contract fell £0.15/t to close at £157.85/t.

- China produced 260.67Mt of maize this year according to figures published by the Chinese National Bureau of Statistics this morning. This is barely changed from 260.77Mt last year, despite severe weather damage pre-harvest. As such, figures are met with some scepticism with analysts expecting a much larger drop. Chinese production figures are watched closely to anticipate future import demand.

- FranceAgriMer raised its season forecast for French soft wheat exports to non-EU destinations this morning. Figures are now expected to reach 6.95Mt, and is the third month in a row that forecasts have been raised. As such, French soft wheat ending stocks are expected at their lowest in seven years.

Could todays WASDE provide direction to global wheat markets?

The rally that began in late June for Chicago wheat markets seemingly has hit its brakes as prices retreat to levels seen at the end of September. Since hitting a contract high of $231.67/t (£178.98/t) on 23 October, the May-21 CBOT contract has fallen 9.0% by close yesterday. Much of this decline occurred last week, following better supply prospects for wheat markets. Later today is the release of the December World Agricultural Supply and Demand Estimates (WASDE) report by the USDA. Could this report offer incentives for sentiment to change?

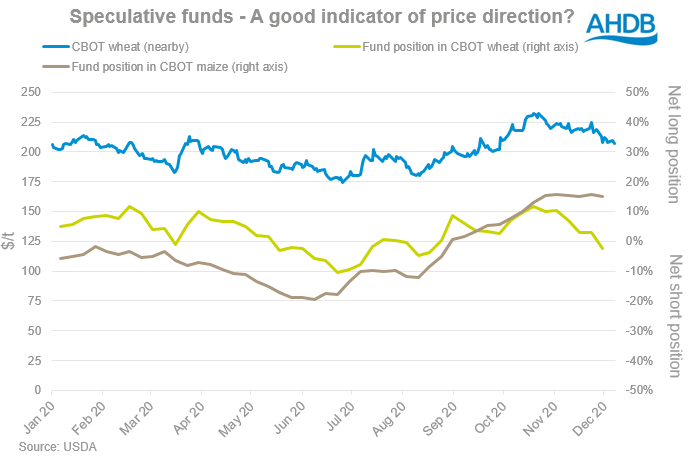

US speculative investment funds have sold off long positions in Chicago wheat futures over the second half of November, with funds dipping slightly into a net short position as of 1 December. Gains in US maize markets have lent support to wheat markets, though wheat has diverged following increased supply forecasts. These movements are an indicator of market sentiment for a commodity, with current positions expecting the wheat market to continue its decline.

December WASDE from a US point of view

The December WASDE report is usually a quieter affair from other months, with little changes generally made for the US domestic picture ahead of the January production and stock estimate reports. In the last five years, only the import/export and consequently ending stock figures for the US have been changed in these December reports. If any, changes to other countries are usually expected, with markets already aware of production estimates from the associated organisations.

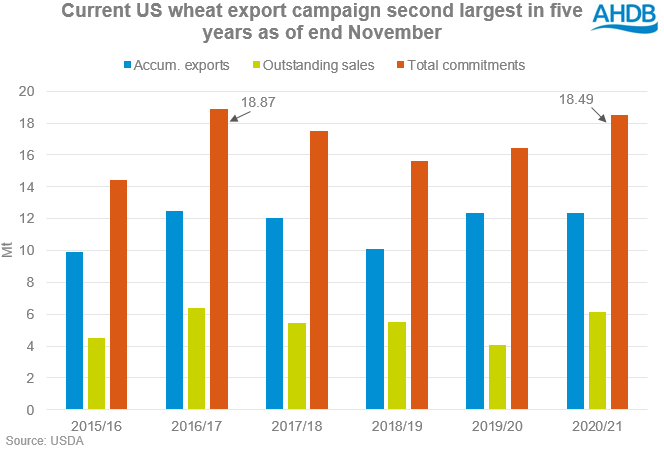

This report could see a small increase to US export figures following a healthy export campaign to China so far this season. China has been on a buying spree of US commodities following the phase-one deal, signed back in January. Though overall commitments have been below target levels, the volume of purchases have been enough to warrant price rises in maize, soyabean, wheat and other commodity markets. As of 26 November, season to date accumulated US wheat exports to China totalled 1.35Mt against 0.19Mt last season. Total season commitments (sales + actual) to 26 Nov are running 12% ahead of the five year average.

A stronger US export figure would then result in reductions to US wheat ending stocks, though decreases are anticipated to be small. A pre-report analyst poll by Reuters indicates an average figure of 23.78Mt, down from 23.86Mt published in November. Greater adjustments to ending stock figures could provide support in an otherwise pressured markets.

Are changes in the global exporters section expected?

Global wheat markets see pressure from improving production estimates in Australia, Canada and the EU + Britain. The latest production forecasts all point higher than November USDA estimates, so we could see adjustments.

Australia is now expected to harvest a 31.17Mt crop, according to ABARES, with USDA estimates requiring a 2.7Mt increase from November to reach this figure.

With Canada finishing its wheat harvest, final StatCan estimates put production at 35.18Mt, 7.7% higher than last year. The November WASDE report estimates a 35.0Mt crop.

The latest estimates from Coceral forecast EU + Britain soft wheat production at 143.0Mt, a hefty increase on last seasons estimated 127.9Mt crop. This rebound is driven by better planting and expected yield figures for the UK, France, Germany and the Balkan region. As such, increases to the USDA estimate for total EU + Britain wheat production could be seen.

Though the updated global production estimates are known to markets, confirmation by the USDA will keep market sentiment leaning bearish. Yesterday, movements in wheat markets saw futures contract bounce from the lows, anticipating potential slight cuts to US ending stocks.

What does this mean for UK wheat?

Any changes in the WASDE report will likely affect domestic grain prices little over the short-term. Pre-report chatter indicates minor changes to figures are expected, with major updates coming in the January reports. For domestic prices, supporting factors hinge upon an EU exit deal and the associated risks of tariffs on imported wheat. A weakening sterling is providing some room for rises for UK futures.

UK wheat (May-21) moved up £0.35/t yesterday, partly tracking gains in Paris and Chicago wheat futures. Taking a look at the UK May-21 futures contract, domestic supply uncertainty and a weakening sterling has kept it above the £187.00/t point. Interestingly last week, the price briefly fell through its 50-day moving average to then reject and bounce up to close consecutively above £188.50/t. This could be an indicator of longer term fundamental support in the contract.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.