Global wheat markets get the Monday blues: Grain market daily

Tuesday, 1 December 2020

Market commentary

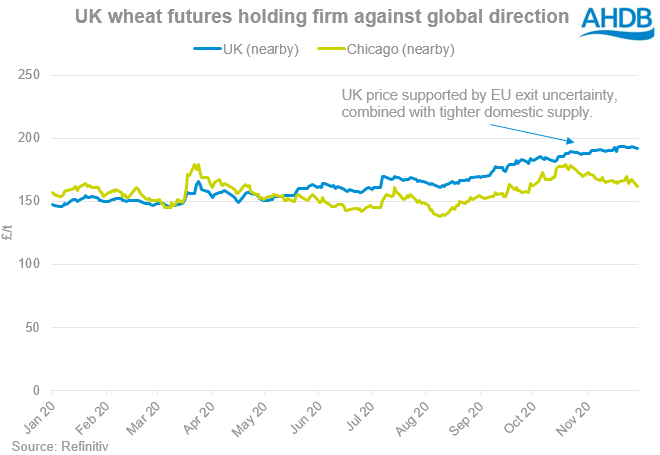

- May-21 UK wheat futures fell £1.60 yesterday from Friday, to be at £192.90/t. This decline was less so in the UK Nov-21 contract, which fell £1.45/t to £159.75/t at close.

- Russian IKAR consultancy estimates 22% of Russian winter grain sowings are currently in a ‘poor’ condition, the highest since 2013. This could potentially signal risks for the 2021/22 crop, though could improve with calmer weather forecast.

- October statistics for US soyabean crushings are to be released later this evening. It is forecast to be at 196.6 million bushels, according to a pre-release poll by Reuters analysts. If realised, this would be a new record monthly high, beating the previous set in March 2020.

Global wheat markets get the Monday blues

Yesterday, Chicago wheat futures (nearby) dropped 3.5% to close at $214.95/t (£161.32/t) following price pressuring news. This bearish news came in the form of increases to Australian wheat production estimates and a lift in the proposed Russian wheat export quota.

Australian crop increases

Timely rainfall for the Australian wheat crop during September and October came during critical growth stages. This has resulted in the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) increasing their estimate to 31.17Mt, up from September’s 28.91Mt forecast. Should this be realised, production will be near the record of 2016/17 and a 106% increase on last year’s drought impacted crop. The export surplus is likely bound for Asian and North African countries, where it will have to compete with Russian origin wheat for trade.

Russian import quota

Earlier this month, we examined the impact of the then proposed Russian 15.0Mt wheat export quota that would come into effect from February 2021 until season close. Yesterday, the Russian agricultural ministry drafted a resolution to increase this proposed quota to 17.50Mt, which will require formal government approval. Russian wheat exports are expected at 40.8Mt this season according to SovEcon, the highest since 41.50Mt in 2017/18. In that season, 16.50Mt was exported in the Feb-Jun window. Looking at export data to September, this season’s wheat exports so far total 11.90Mt (Jul-Sep), leaving 28.90Mt to be exported from then on. Should the expected large volumes be shipped in the months up to Feb, then the quota could be more of a target to reach than an imposed cap.

What does this mean?

Declines in global wheat markets yesterday were more muted in domestic markets, with the nearby futures contract dropping 0.47% (£0.90/t) to close at £192.25/t. This is largely due to a level of supply uncertainty coming from the EU exit in January. However, continued declines in global wheat markets will look to pressure domestic prices further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.