Milk price differentials reveal variations in margin pressure

Tuesday, 1 June 2021

By Patty Clayton

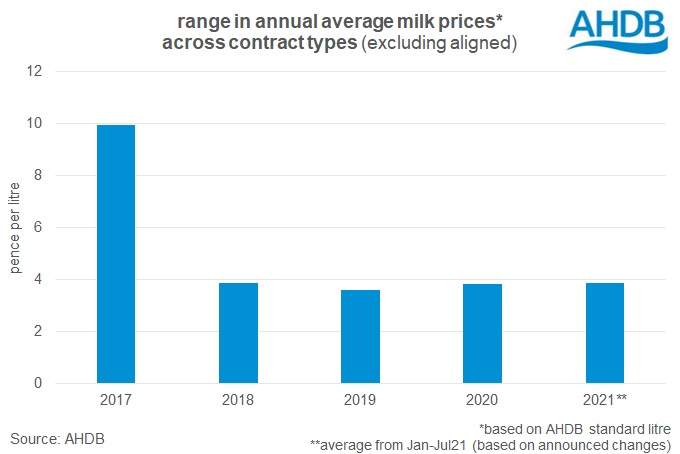

Variations in market returns across dairy product supply chains inevitably lead to differences in milk prices paid to farmers. However, as the range in prices widens, using averages to assess how rising production costs could affect milk production may not tell an accurate story.

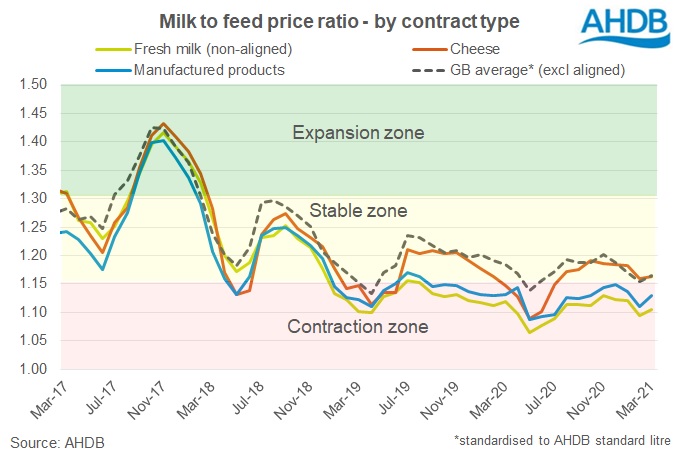

We’ve analysed how the growing price differentials impact on the milk-to-feed-price-ratio (MFPR) according to contract type. This has shown that farmers supplying into fresh milk or manufacturing supply chains have been facing margin pressure for an extended period[1].

Historically, we’ve seen contraction in milk volumes when the MFPR drops below 1.15, suggesting there is risk of reduced production from this group of farmers should margins remain in the ‘contraction’ zone.

Over the past few years, prices[2] paid on non-aligned liquid and manufacturing contracts have lagged behind those paid on cheese contracts. The differential between the highest and lowest prices has been relatively stable recently at around 3.6 – 3.8ppl.

However, with the significant disruption to markets in the past 12-18 months, and the shift in how and where dairy products are consumed, this range has widened and is now sitting above 4ppl.

The changes in demand have particularly affected supply chains where returns are more dependent on the out-of-home market, and on the buffer of excess cream sales.

The current trend in milk prices is positive, with most milk buyers having announced prices increases over the next few months. Whether these increases will be enough to reduce some of the margin pressure facing farmers will depend on how feed prices, along with other input costs, develop as we head into the second half of the year.

With feed and forage accounting for over 40 per cent of cash costs, any rise in input prices can have a major impact on farm margins. Equally, it presents a big area of opportunity to make efficiencies on farm. AHDB's Forage First guide offers guidance for those looking to review and improve forage utilisation.

You can keep up to date with feed markets with our monthly commentary or by tracking AHDB’s weekly feed ingredients prices.

[1] circumstances will vary across individual farms according to their reliance on grazing and purchased feed, as well as how well they have contracted feed requirements.

[2] Based on annual average milk prices for the AHDB standard litre (4.1% butterfat, 3.35% protein, 1.5m litres). Excludes prices paid on aligned retailer contracts as these are not directly linked to market returns.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.