Mid-week market update: Grain market daily

Wednesday, 9 April 2025

Market commentary

- UK feed wheat futures (May-25) closed at £172.80/t yesterday, up £1.55/t from Monday’s close. The Nov-25 contract fell £0.45/t over the same period, ending the session at £190.05/t.

- Domestic wheat prices closed higher yesterday partly supported by weaker sterling against the euro. Chicago wheat and Paris milling wheat futures (May-25) were up 0.7% and unchanged respectively at yesterday’s close. A strong euro is pressuring European futures.

- Paris rapeseed futures (May-25) gained €0.75/t from Monday’s close, to settle at €517.00/t. New crop futures (Nov-25) ended the session at €478.25/t, up €0.25/t over the same period. May-25 Winnipeg canola futures were up 1.4% yesterday, supporting Paris rapeseed futures.

Mid-week market update

In this mid-week market update, we explore the factors driving global grain and oilseed markets and their effects on the domestic market.

Grains

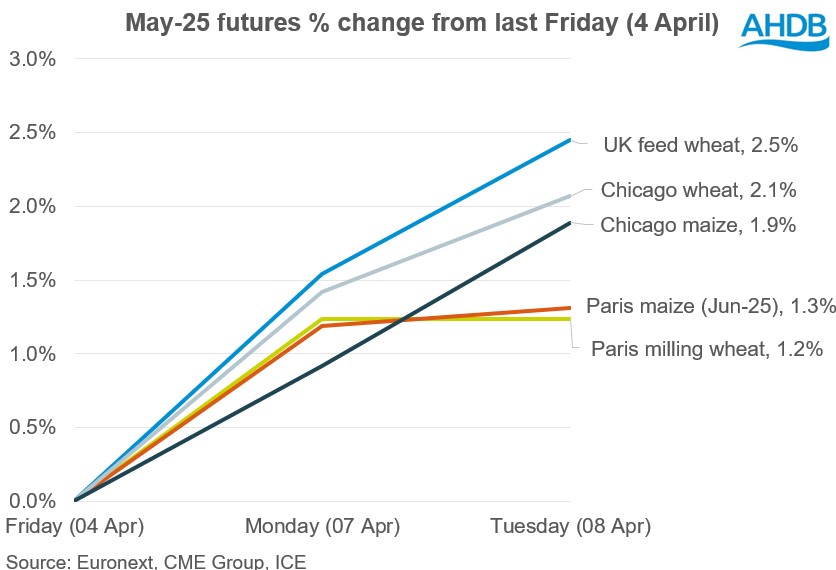

The global wheat market has recently corrected from earlier declines, with weather concerns for the new crop currently supporting prices. Since Friday (4 Apr), global wheat markets have risen, with a lower US wheat area, US winter wheat conditions and the US weather forecast lending support. However, with sterling weakening against both the US dollar and euro, UK feed wheat futures have recorded the largest gain (compared with Chicago and Paris), with the May-25 contract rising 2.5% from Friday's close (4 Apr) to yesterday.

Paris milling wheat futures have found some support from potential export demand. However, a strengthening euro did not help to achieve competitive prices.

In the Northern Hemisphere, winter wheat is emerging from dormancy under mixed conditions in parts of Europe, Russia, Ukraine, and the US.

A strong hailstorm hit Russia's third largest wheat producing region of Stavropol, a local governor said yesterday, damaging grain crops (LSEG).

Sovecon has updated its own Russian wheat export estimate for March to 1.9 Mt, well below the 4.8 Mt exported in March last year. The forecast for April wheat exports is in the range of 1.6-2.0 Mt, compared to 5 Mt in April 2024.

Oilseeds

Oilseeds are theoretically more affected by tariff concerns due to their higher export share of world production. Almost 44 % of global soyabean production is exported on average over the last five years, compared with 16% and 27% for maize and wheat respectively.

Vegetable oils remain in a situation where palm oil has a premium over soyabean, rapeseed and sunflower oils. Chicago soyabean oil futures from mid-March showed a trend of rising prices, which supported beans. However, US tariffs, particularly on Chinese goods, and falling crude oil prices have pressured soyabean oil prices over the last four trading sessions.

Brent crude oil futures (Jun-25) have fallen 16% since last Wednesday (2 Apr). The vegetable oil complex is now showing some resistance to this significant fall in crude oil, but it could have an impact in the medium term.

EU rapeseed imports in the current season totalled 5.18 Mt (up to 6 Apr), up from 4.55 Mt a year earlier. Australia and Canada continue to increase their share of EU rapeseed imports compared to last year.

Where next?

Grains look more resilient to tariff tensions than oilseeds, but global economic worries are growing by the day and could eventually impact both.

Global wheat trading activity is currently slowing due to the unpredictability of tariffs and limited supply from the Black Sea region. For the new crop, the main influencing factor is weather risk in the northern hemisphere. One of the effects of tariff concerns could be an increase in price differentials between destinations.

In the medium and long term, we could see higher price volatility in a physical market, with a shift from a buyer's market to a seller's market and vice versa.

Ahead of the USDA's April WASDE report on Thursday this week, traders' average estimates don't differ much from March's figures. But there is more scope for some surprises.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.