Could the US acreage decline support wheat prices? Grain market daily

Tuesday, 1 April 2025

Market commentary

- UK feed wheat futures (May-25) closed at £166.40/t yesterday, up £1.40/t from Fridays’ close. The Nov-25 contract gained £2.00/t over the same period, ending the session at £185.60/t. Difference between old and new crop contracts reached a near the highest level of £19.20/t.

- Domestic wheat prices tracked global wheat markets gained. Chicago wheat and Paris milling wheat futures (May-25) were both up 1.7% and 0.7% respectively at yesterday’s close. Chicago wheat futures were supported by the lower planed area in the US (see below), while Paris milling futures’ gains were limited by low export demand.

- May-25 Paris rapeseed futures closed at €516.75/t, down €8.75/t from Friday’s close. The Nov-25 contract fell €2.50/t over the same period. Paris rapeseed futures had a downside correction yesterday after increasing for nine trading days in a row.

Could the US acreage decline support wheat prices?

After the recent fall in wheat prices, yesterday's USDA Prospective Plantings report supported global prices, especially Chicago futures. However, according to wheat market analysts, it is difficult to find further supportive factors for the time being.

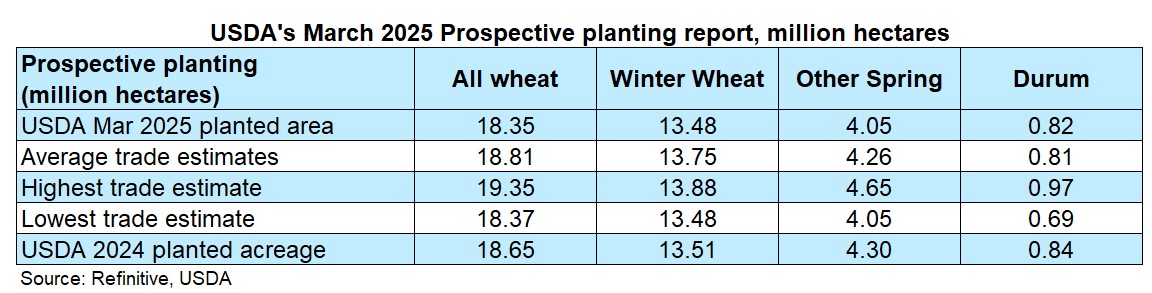

According to yesterday's USDA Prospective Plantings report total wheat plantings for 2025 are estimated at 18.4 million hectares (Mha), down 2% from 2024. If realised, this would be the second lowest total wheat planted area since records began in 1919.

The 2025 winter wheat area is estimated at 13.5 Mha, down 2% from the previous estimate and down less than 1% from last year.

However, the most interesting aspect is that the area expected to be planted to other spring wheat for 2025 is estimated at 4.05 Mha, down 6% from the 2024 estimate.

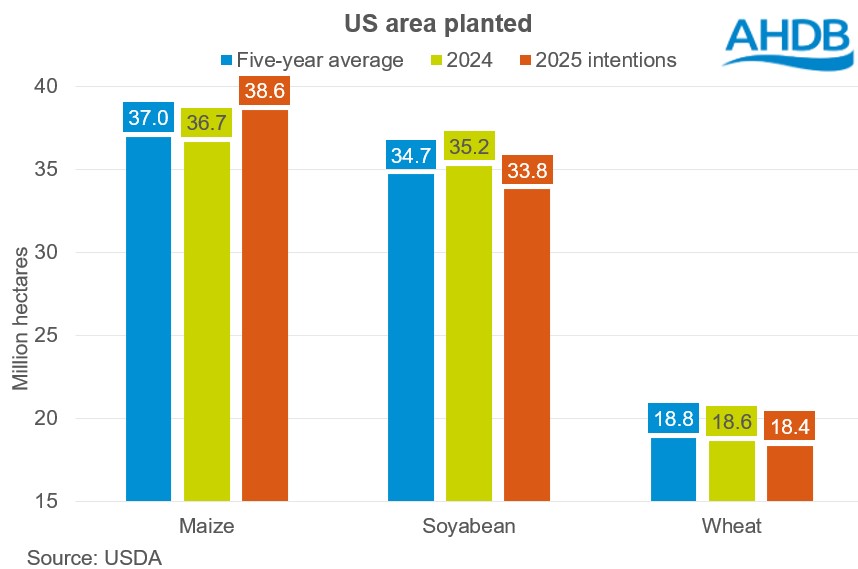

On the other hand, the area planted with maize in 2025 is estimated at 38.6 Mha, an increase of 5% compared to last year. The increase in maize area is mainly due to a 4% decrease in the soyabean area compared to last year. The soybean to maize price ratio has encouraged growers to plant more maize. However, not only has the ratio encouraged more maize planting in the US, but there may also be a risk of trade uncertainty due to tariff tensions. The share of US maize production that is exported is more than three times lower than for soyabeans.

Where next?

The decline in US wheat acreage is obviously a supportive factor for wheat, but we also need to pay attention to crop conditions and the weather forecast in the US.

The first USDA crop progress report of the spring will also be released on 7 April. In this we will see how the US crops are faring following some challenging conditions, with particular focus on winter wheat.

The US has seen a trend of rising wheat yields over the past 10 years, so the decline in area may not have a significant impact on final wheat production.

For the domestic market more maize area in the US could put pressure on global feed grain complex for the 2025 crop. On the other hand, lower US wheat area could support the milling wheat premium over feed grains, though yields and quality will also be important.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.