Markets rise despite cautious USDA report: Analyst's insight

Thursday, 10 February 2022

Market commentary

- US grain and oilseed futures rose sharply yesterday despite a relatively cautious USDA report (see below). The report was out at the end of the trading day in the UK markets (5pm GMT). As a result, UK futures recorded small rises yesterday but are trading higher so far today (midday).

- Yesterday, May-22 UK feed wheat futures gained £0.25/t to close at £219.25/t, while the Nov-22 contract rose £1.15/t to close at £199.70/t.

- The Rosario Grain Exchange pegged the Argentine soyabean crop at 40.5Mt yesterday, vs the USDA at 45.0Mt. The Rosario Grain Exchange looks at commercial production rather than total, so its estimates tend to be a little lower than other sources. But, the warning from the Rosario Grain Exchange was clear: without ample rain in the rest of February, yields will suffer further.

Markets rise despite cautious USDA report

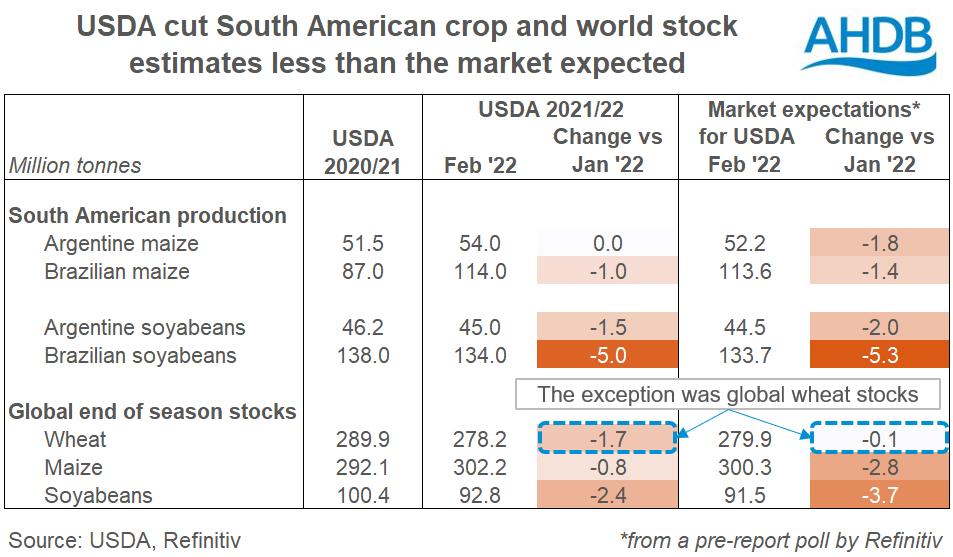

US grain and oilseed futures rose sharply yesterday despite a relatively cautious USDA report on world agricultural supply and demand. Last night’s report contained smaller than expected cuts to South American crop forecasts, and global stocks.

However, US futures prices rose anyway. It seems that the industry expects the USDA to make further cuts to production in the coming months and tighten global stocks as a result. For now, the focus is on the lower private crop estimates. There were also rumours about Chinese purchases of US goods and buying by speculative traders.

For soyabeans at least, the upward moment seems likely to continue today. Conab, Brazil’s official forecaster, slashed its estimate of the soyabean crop due to dry weather in the southern regions. The crop is now pegged at 125.5Mt, 15.0Mt lower than Conab’s January estimate and 8.5Mt below last night’s USDA forecast. Conab also trimmed 0.6Mt from its maize crop forecast to 112.3Mt, now 1.7Mt below the USDA.

What does this mean?

Wheat

The latest cuts to global stock reverse the increases made in January and re-affirm the tightness in old crop supplies. So, the tightness of the old crop situation could limit the market downside in the short term, unless we hear strong positive news about the global 2022/23 crops.

Maize

The market is relying on the South American maize crops to prop up global grain supplies in 2021/22. The USDA’s small cuts tighten the margin for error slightly. The risk of even smaller crops, especially given the latest news from Brazil, will keep an undercurrent of support for prices for the time being.

Another part of the reason US maize prices rose yesterday was to stop them losing more ground to soyabeans. US farmers are finalising their planting intentions for harvest 2022 and the relative prices for maize and soyabeans are a key aspect of these decisions. To avoid losing area to soyabeans, US maize prices need to track those of soyabeans.

Oilseeds

The USDA still tightened global soyabean supply and demand. This was despite the cuts being smaller than expected and Chinese soyabean and soyameal imports being scaled back. But, today’s news from Brazil will further tighten supply and keep a bullish tone for soyabean prices in the short term.

Rapeseed prices are taking less influence from soyabeans currently than they often can. But, there is still an influence, particularly for old crop prices, so the rally in soyabeans could push up rapeseed prices too. What’s more, if the 2022/23 rapeseed crop rebounds as expected, rapeseed may need to compete harder for demand again. If this happens, soyabean’s influence may grow again for new crop rapeseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.