Markets rise after USDA shrinks US crops: Grain market daily

Friday, 13 October 2023

Market commentary

- Nov-23 UK feed wheat futures closed at £182.90/t yesterday, while the May-24 contract closed at £196.40/t. Both contracts rose £0.95/t from Wednesday’s close.

- Paris rapeseed futures Nov-23 contract gained €3.50/t yesterday to close at €415.00/t, while the May-24 contract rose €2.00/t to €439.75/t.

- The Nov-23 contracts on UK feed wheat and Paris rapeseed futures are now approaching their last trading days. Options expired on Nov-23 UK feed wheat futures yesterday, and the contract’s last trading day is 23 November. So, the May-24 wheat contract will be increasingly important to understanding old crop price trends over the coming days and weeks. Similarly, the Nov-23 Paris rapeseed futures contract has just 12 trading days left after today and the Feb-24 contract now has the most open contracts.

- Global grain futures were broadly stable ahead of yesterday’s USDA supply and demand reports at 5:00pm BST, while global oilseed prices edged higher. However, the Chicago markets rose after the report’s release (see below for details).

- Egypt again bought Black Sea wheat in its latest tender. The state buying agency, GASC, bought 470 Kt of wheat yesterday including 300 Kt of Russian, 120 Kt of Romanian and 50 Kt of Bulgarian wheat (Refinitiv).

Markets rise after USDA shrinks US crops

The USDA last night cut its forecasts for US maize and soyabean production, triggering price rises in the Chicago futures markets. The cuts to output from last month’s yield and production estimates were bigger than the market had expected according to a pre-report by Refinitiv. The USDA cut the US maize crop estimated by 1.8 Mt to 382.6 Mt, and the soyabean crop by 1.1 Mt to 111.7 Mt.

Short covering by speculative traders may also have added to the price rises. Recently speculative traders have held large short positions in the Chicago wheat and maize futures, and a nearly neutral position in Chicago soyabean futures. Refinitiv reports notable buying across the commodities by speculative traders yesterday.

As a result:

- Chicago maize futures (Dec-23) gained $3.15/t to close at $195.28/t.

- Chicago soyabeans futures (Nov-23) rose $13.78/t to $473.95/t, the contract’s highest price since 28 September.

- Chicago wheat futures (Dec-23) rose $5.70/t to $209.97/t. The upward moves in maize and soyabean prices, plus a trim to global wheat ending stocks, pulled Chicago wheat futures higher. This is despite US wheat 2023/24 end of season stocks being larger than anticipated.

The USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) were out at the very end of the trading days in Europe. As a result, the UK and Paris futures prices rose less than US prices. However, initial trades on Paris wheat and rapeseed futures this morning (13 October) are above last night’s close.

There’s more detail on the latest USDA forecasts below.

The USDA was expected to increase to the US end of season stock forecast for 2023/24 from the September WASDE, after it increased its 2023 US wheat crop estimate a few weeks ago.

The increase in US stocks was larger than expected but is offset by cuts to 2023/24 crops sizes and stocks elsewhere in the world. The USDA cut 3.9 Mt from its global wheat crop estimate as it incorporated the effect of difficult growing conditions in Australia, Kazakhstan and Ethiopia.

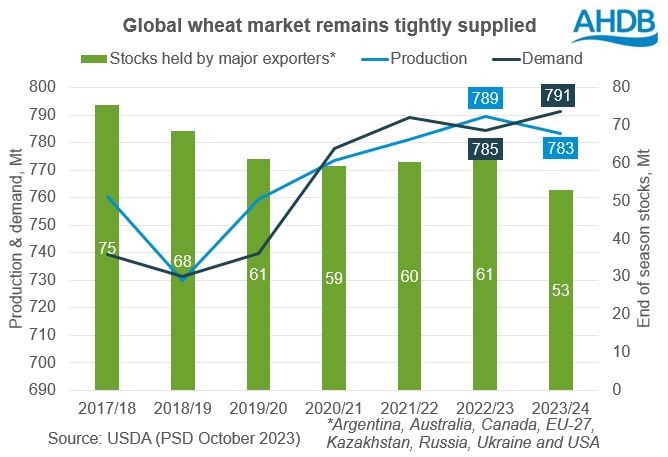

Despite lowering its forecast for global consumption of wheat, the USDA still reduced its projection of global 2023/24 end of season stocks by 0.5 Mt. At 258.1 Mt, stocks are projected to fall to their lowest since 2015/16, with the stocks held by major exporting nations even tighter. This is likely to mean wheat needs to keep a premium over maize to limit global feed demand, where possible.

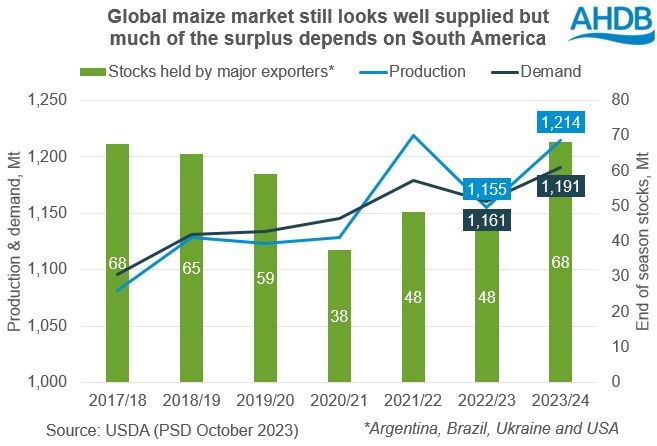

Despite the USDA’s cuts to US maize production, total global maize output is still estimated at 1,214 Mt. This is near unchanged from September’s WASDE, as the smaller US crop is offset by larger crops in Argentina and France. The USDA’s new forecast for Argentina (55.0 Mt) is in line with local forecaster the Buenos Aries Grain Exchange (BAGE). However, both the BAGE and Rosario Stock Exchange are cautioning that the current dry weather could reduce the total maize area and so crop size.

Total global demand is near unchanged from September too. With adjustments to the estimates for stock carried over from 2022/23, the end of season stocks for 2023/24 are reduced slightly (-1.6 Mt). The maize market still looks comfortable for now, but if production is reduced in South America, it’s likely to reduce that level of comfort.

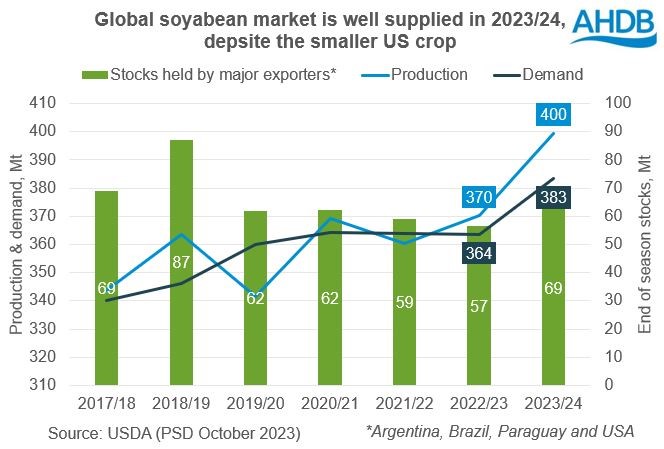

Due to the smaller than expected US crop, the US soyabean stock forecast was left unchanged when the market had expected a rise. The cut to the US crop was offset by a lower US export projection, with Brazil’s exports benefiting.

Higher global crush demand in China and the USA, plus the higher exports for Brazil, meant the USDA cut 3.6 Mt from its global 2023/24 end of season stock projection. Despite the cut, the global soyabean market still looks well-supplied, it’s just a little less well supplied than before.

But it’s worth noting that the USDA held its projection for the 2023/24 Argentina soyabean crop unchanged from September at 48.0Mt. This is 2.0 Mt below the Rosario Stock Exchange, which increased its forecast yesterday to 50.0 Mt. Dry weather is impacting early maize planting and the Exchange predicts that more area will switch from maize to soyabeans, which are planted later.

EU-27 rapeseed production was tweaked higher (+0.3 Mt) to 20.0 Mt, following similar increases by the European Commission and Stratégie Grains. But from a global perspective, the rise was offset by a 0.4 Mt reduction to the Canadian crop following dry weather this summer. This leaves the global rapeseed supply and demand picture broadly unchanged from last month and likely to depend on soyabeans for the market direction, at least short-term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.