Market volatility, selling opportunities for wheat? Grain market daily

Friday, 21 July 2023

Market commentary

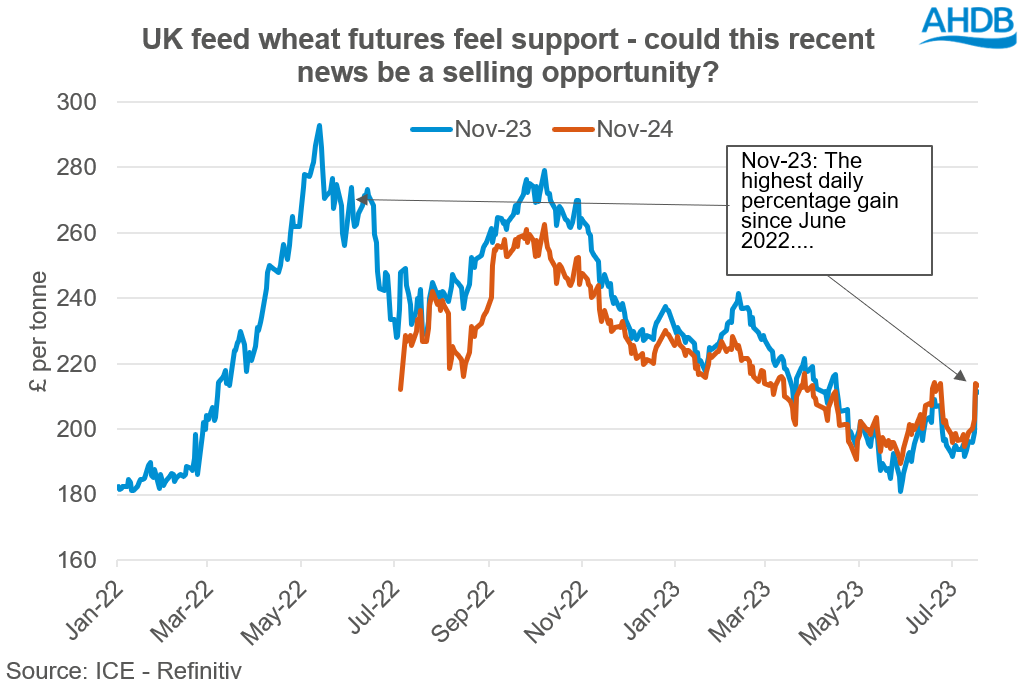

- UK feed wheat futures (Nov-23) closed yesterday at £211.20/t, down £0.95/t on Wednesday’s close. New crop futures (Nov-24) closed at £213.50/t, down £0.45/t over the same period. This morning the market has opened down with Nov-23 futures trading at £204.00/t (13:00).

- Both Paris and Chicago markets ended mixed yesterday as volatility continued. Some traders were cover buying as concerns mounted around shipments from the Black Sea, while others booked profit after the sharp rise in prices.

- Further to that, it appears the market is assessing the situation on Russia quitting the Black Sea Grain Initiative. With conflict on-going, there is a lot of unknowns currently. Ukraine’s Defence Ministry said yesterday that it would consider all ships travelling to Russian and Ukrainian ports, operated by Russia, as potential carriers of military cargo from today.

- In other market news, yesterday the International Grains Council raised its forecast for the 2023/24 global maize production by 9 Mt, with total production now estimated at 1,220 Mt; this was reflecting larger US acreage.

- Paris rapeseed futures (Nov-23) closed yesterday at €504.75/t, down €3.50/t on Wednesday’s close. Chicago soyabean markets were mixed, but the weakness was on profit-taking.

- Yesterday the first set of the Recommended List harvest results (for winter barley) were released on the AHDB website.

Market volatility, selling opportunities for wheat?

News this week surrounding Russia quitting the Black Sea Grain Initiative has rattled agricultural commodity markets. Despite the threats from Russia to quit the deal over the last few months, markets seemed tame up until this week.

However, with conflict ongoing and attacks on Ukrainian grain terminals, UK feed wheat futures (Nov-23) gained 6.7% on Wednesday, following global grain markets, this was the biggest percentage daily gain since 06 June 2022. We see domestic markets once again above £200.00/t for feed wheat.

Yesterday, UK feed wheat futures (Nov-23) managed to drop and are trading lower today (see market commentary above). Thinking back to 2022, the global market has a feeling of déjà vu; it has been in a similar situation before, with exports from Ukraine’s main ports being constrained. There are reports that grain buyers in the Middle East and North Africa have reacted more calmly to the end of the Black Sea Grain Initiative, compared to 2022 where there was panic buying spurring the market higher.

It appears the market is assessing the situation, and the bullish spur seems to have been constrained. Which begs the question: is this recent news already priced into the market to some extent? Longer term, global grain markets are relatively well-supplied as we enter the 2023/24 marketing year. Though news on the war remains a watchpoint for ongoing price volatility.

Is this a marketing opportunity?

This is an active war, and it’s inevitable that markets will remain volatile. However, there are large supplies currently coming to market in the Northern Hemisphere, notably from the EU and Russia, meaning that grain can be supplied from these origins. Though weather and quality will be something to monitor.

So, does this pose an opportunity for a domestic grower to market some of their 2023 harvest if they haven’t already? Well, we are coming to a point where pressure on the market is usually expected from harvest, though with some global supply watchpoints continuing, keeping price volatility short term. Knowing your cost of production and break-even point will be a key opportunity to understanding what a good price is and inform decision-making.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.