Market Report - 26 April 2021

Monday, 26 April 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

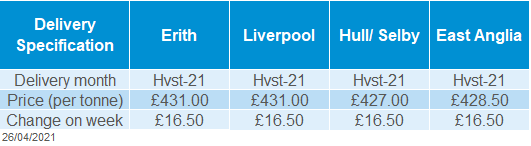

UK delivered rapeseed prices jumped £16.50/t Friday-Friday for Nov delivery quoted at £440.50/t (Erith). Prices tracked wider gains in global rapeseed and soyabean markets.

The USDA FAS reported its forecasts for the 2021/22 UK rapeseed crop last week. UK rapeseed production is estimated at 995Kt, owing to a reduced harvest area. UK consumption of rapeseed is expected to increase to 1.61Mt, highlighting the large import requirement the UK faces next season. Imports are forecast at 675Kt, up 58.5% from 2019/20.

Global rapeseed markets are looking to the first Canadian canola area estimates, released tomorrow (27 April 2021). Significant area changes year-on-year will provide sentiment to markets, though low soil moistures at the moment could affect planting progress.

Drought is also affecting parts of the French rapeseed crop, with the planted area at its lowest since 1997. France is forecast to produce 3.19Mt of rapeseed this year, 60Kt below last season according to Stratégie Grains. The EU-27 rapeseed balance looks to be increasingly tight next season, with 6Mt+ of imports required once again.

Wheat

New crop concerns for maize have filtered into the wheat market, driving prices higher. Crop conditions will be monitored closely as Europe remains dry.

Global grain markets

Maize

Crop concerns for North and South America, combined with a large long position for managed money funds, is supporting prices. Weather will be key in the next few months for direction.

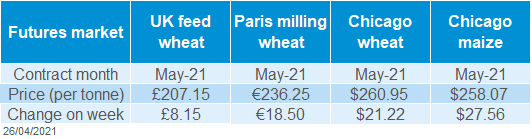

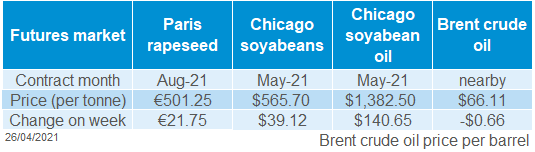

Global grain futures

Barley

Barley is taking its steer from global grain values. Further, strong demand in the short term has supported domestic prices.

UK focus

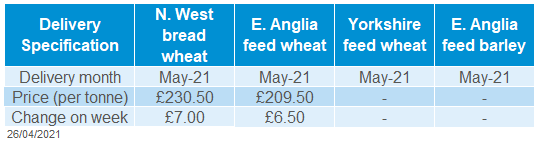

Delivered cereals

Grain markets moved rampantly higher last week. New crop Chicago maize was a leader for prices, moving $15.26/t higher Friday-Friday, closing at $216.82/t. Global weather concerns are key for markets at present. In the US, cold conditions and a lack of rainfall have driven concerns for supply in an already tight market. Over the next week, forecasts are improved slightly across parts of the US.

Concerns are equally strong for the Safrinha maize crop. Planting delays, coupled with poor weather, have led some to reduce their forecasts for the new crop. In an update last week, IHS Markit reduced its Safrinha crop production estimate by 5.6Mt, to 79.5Mt. Conab currently estimate the Safrinha crop at 82.6Mt, with the next Conab forecast is due on 12 May.

Other weather concerns are also key at present. Europe remains dry and French crop condition ratings fell marginally again last week. The amount of French soft wheat rated as good or excellent fell one percentage point, to 85% in the week ending 19 April. French winter barley is now rated as 81% good or excellent, down two percentage points.

Ukraine’s Institute of Agrarian Economy sees Ukraine’s wheat crop at 28.5Mt and maize at 31.1Mt. Both figures are up on the 2020 crop, 25.1Mt for wheat and 30.3Mt for maize, but down on the government’s official estimates.

Demand is also firm for grains, supporting prices, China is an ongoing source of support for prices. Further, concerns over food price inflation in Argentina, may spark grain export taxes.

Oilseeds

UK markets followed the lead of global price movements last week. New crop (Nov-21) feed wheat futures ended the week at £185.25/t, a rise of £11.30/t Friday-Friday. The UK remains dry which may cause one or two concerns for the new crop, although there is still some time to go until harvest.

The old crop market firmed last week too, though the full rise was not seen in physical markets, with a further squeeze on old crop delivered premiums. East Anglian feed wheat delivered May was quoted on Thursday at £1.50/t over futures, down from £4.00/t over futures on 31 March.

The first tender day for May-21 feed wheat futures is tomorrow (27 April), with open interest of 2,683. The May-21 contract could become very technical as the market looks to balance positions.

Rapeseed

Rapeseed markets look to track wider gains in the bullish soyabean market. The large EU + UK rapeseed import requirement will support prices, particularly if production amongst global exporters is reduced.

Global oilseed markets

Soyabeans

US weather conditions and the potential effect on soyabean planting is the main driver of oilseed markets. Low 2021/22 carry-in stocks are a worry, especially if production is delayed by late planting.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

As with grains, the focus for oilseed markets last week was weather forecasts, as the US fast approaches its peak soyabean planting window. Rains in Argentina have drastically slowed the soyabean harvest with pace far behind last year. Further, the coronavirus situation in India is weighing on palm oil prices from a demand perspective, as the latest outbreak sadly looks to be heavily affecting the country.

Last week’s cold snap across the US Midwest sent futures prices to highs not seen since 2013. The Nov-21 US soyabean futures contract jumped $24.80/t, to $492.92/t (£355.28/t). The next US crop progress report is due later this afternoon, which will indicate planting progress and potentially emergence rates. A belt of rain is expected in the next seven days across some southern states, including Arkansas where around 3.5% of total US supply is produced.

Palm oil prices look to be pressured by the surge in Covid-19 cases in India. Nearly 60% of India’s palm oil consumption comes from the hospitality sector, which is being severely affected by lockdown measures.

India is the main palm oil importer globally. Refiners in the country have already reduced production levels. As palm oil is typically on the cheaper end of the oilseed complex, this pressure could weigh on other vegetable oil markets.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.