Funds are mental, driving prices higher: Grain market daily

Wednesday, 21 April 2021

Market commentary

- New crop UK feed wheat futures (Nov-21) continued their charge higher yesterday, closing at £178.00/t, a gain of £3.40/t. Yesterday marked the sixth consecutive day of gains for the contract.

- May-21 UK wheat futures made more modest gains, closing at £201.35/t, up £2.15/t. Both the old crop and new crop took their steer from wider movements in global grain futures.

- Gains for grains were seen in both Paris and Chicago futures markets, driven by new crop weather concerns and cuts to production forecasts. Yesterday, IHS Markit downgraded its estimate of the Safrinha maize crop by 5.6Mt, to 79.5Mt.

Funds are mental, driving prices higher

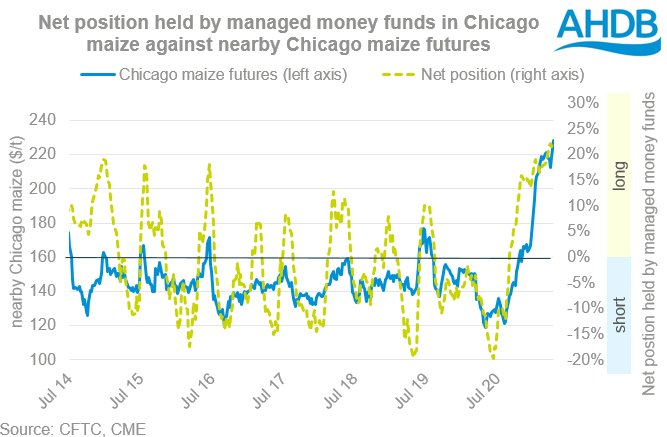

Over the past year, we have seen the strong influence of funds in the global grain trade. The recent rally in markets is proving no different. New crop weather worries, be it frosts in the US or cuts to Brazilian maize forecasts, are driving prices higher, multiplied by the huge long position held by managed money funds.

In the latest data, published by the Commodity Futures Trading Commission (CFTC), the net long position held by managed money funds in Chicago maize futures reached 22.2%. In layman's terms, the number of long positions (bullish) held by managed money is almost 18 times greater than the number of short positions (bearish).

In the last few days futures have moved into overbought territory, so we could see a slight degree of profit taking over the next week. However, there is still a longer term bullish sentiment, particularly for maize.

This is no great surprise, as we’ve mentioned before the supply and demand situation is incredibly tight globally. As such, prices need to continue to work in order to ration demand. Further, crop concerns as mentioned above, continue to support the view that prices need to rise.

However, at present there is a large element of the price rise which is driven purely by uncertainty. At the moment, and as we see practically every season, there are a lot of unknowns;

- How much maize will the US plant?

- How big will the Brazilian maize crop be?

- How will Northern Hemisphere wheat develop?

- How will the Russian export tax play out?

- How much grain does China actually need?

As these questions slowly get answered we need to be aware of the risk of funds unwinding their positions. It should be noted, it isn’t necessarily the case that prices will fall and we could get bullish confirmation across all of these questions. However, if we were to see improvement in these conditions, more US acres or risks for the Chinese pig herd, futures could fall, quickly.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.