USDA FAS forecast UK wheat to stay net-importer for 2021/22: Grain market daily

Friday, 23 April 2021

Market commentary

- The UK May-21 futures contract increased £2.70/t yesterday to £208.0/t tracking gains in US grain markets. The Nov-21 UK contract gained £6.30/t to be at £186.05/t. This morning prices for both contracts have eased back, with the Nov-21 contract at £184.75/t at 12pm GMT.

- US wheat and maize futures contracts limited up yesterday (hit daily increase limits) amid dry and cold weather forecasts for much of the US crop belts. An estimated 78% of US spring wheat production and 17% of maize production is within an area in drought condition.

- Weather concerns for the Brazilian safrinha crop also lent an arm of support with 45% - 50% of the crop in moisture stress. It is estimated 30% - 50% of the crop was planted after the ideal planting window.

- The Russian agricultural consultancy firm IKAR lowered its forecast for the 2021/22 Russian wheat crop, now estimated at 79.5Mt from 81Mt. This is a result of an increase in winter kill levels.

USDA FAS forecast UK wheat to stay net-importer for 2021/22

As we all know, better planting progress for winter and spring cereals has laid the foundations for an increased UK grain production figure. But nearly a month without substantial rainfall across the UK has threatened crop health, with yields likely affected. Production figure forecasts from industry can create a ballpark figure on where the UK could be at next season. The USDA Foreign Agricultural Service (FAS) released its analyst’s opinions on UK grain and oilseed production for 2021/22. Whilst this is not official stamped USDA data, it provides a necessary opinion.

Wheat

The FAS has indicated a production figure of 14.75Mt, based on a planted area of 1.775Mha and an average yield of 8.3t/ha. This is slightly above initial estimates conducted by my colleague James but sits within this likely 14Mt-15Mt range. This figure is 7.5% above the five-year average and would sit close to 2017/18 levels. Whilst this would be 5Mt above 2020/21 figures, rising consumption figures anticipated for next season quickly evaporate this increased availability.

For the 2021/22 season, total domestic consumption is estimated 19.5% higher at 15.73Mt, with increases stemming mainly from a restored level of wheat usage in feed manufacturing. In this season to February, wheat usage in feed manufacturing was down 15.8% against 2019/20, in favour of barley, oats and maize, which all recorded increases. With beef and lamb prices at multi-year highs currently, herd numbers could rise next season, instilling further demand in feed markets.

Human and industrial wheat usage is also expected to increase, with demand created from the government’s E10 mandate. Better wheat demand would come from the UK biofuel sector, namely Ensus and Vivergo in North England. My colleague James took a look at this wheat sector usage here. The FAS estimate a 14.3% increase for food, seed and industrial usage (FSI) with 2021/22 figures at 8.18Mt. A return to a pre-pandemic society hopefully next season will also lead to a better level of demand for millers with events and office catering back on the menu.

Barley

Barley production is expected at a large decline from the two previous seasons on account of better wheat drilling progress. The FAS forecast a figure of 7.2Mt, an 11.3% decline from this season. This is a 1.4% decline from the five-year average and is based on an area of 1.15Mha and an average yield of 6.3t/ha. A beginning stocks figure of 846Kt would be the lowest since 2008/09 if realised.

The replenished wheat feed usage figures will have an effect on barley usage in feed. The FAS expect barley feed consumption to return to 4Mt, identical levels to the 2019/20 forecasts.

The easing of lockdown measures and rapid vaccination progress will spell better news for the brewing, malting and distilling sectors. In the week beginning 12 April (first easing of lockdown measures) a CGA survey found 44% of adults had visited the hospitality sector. With better demand expected next season, FSI consumption is forecast at 2.04Mt, 7.9% above 2020/21.

Oats

Our Early Bird Survey indicated a small increase to the UK oat area to a forecast 214Kha. The FAS forecast production at 1.08Mt which if realised would be the largest oat production figure this millennium and a third successive 1Mt+ oat crop. Forecast ending stocks at 132Kt would be the highest since 2017/18.

Total oat consumption is forecast to decline from this season, owing to lower feed demand. As I have said, a better wheat production figure could displace other feed grains like oats out of feed rations.

On the flip side, FSI consumption is expected to rebound next season. Better milling demand for oats is expected to continue as the consumer popularity of oats increases. In the first half of this season (Jul – Dec) 3% more oats were milled in the UK than 2019/20. The FAS expect FSI consumption at 595Kt, which if realised would be a record high. The new UK oat milling facilities set to open in 2023 will add further demand to the oat milling sector.

Oilseed rape

The FAS forecast rapeseed production to fall below 1Mt, expected to reach 995Kt next season. The FAS forecast a harvested area of 314Kha, down 17% from 2020/21. Our crop progress report highlights winter OSR crop in a much better condition, with 41% rated ‘good to excellent’ against 26% in March 2020.

Total domestic consumption of OSR is expected to increase 100Kt to 1.61Mt next season. The closure of the Erith crushing plant for the opening months of this season reduced UK crushing levels. If the domestic consumption figure is realised, it would be 500Kt lower than 2019/20. However, the 600Kt deficit between production and consumption highlights the increased need for imports which are forecast at 675Kt, up 58.5% from 2019/20 levels.

Better rapeseed meal demand from the livestock sector could be seen if herd numbers increase next season. The closure of hospitality sectors through lockdown periods reduced vegetable oil usage, though this is expected to rebound once restrictions are eased.

What about crop conditions currently?

The better planting progress has provided some supply optimism for next season, with demand levels too expected to rebound. The UK will be a net-importer next season with new-crop global crop conditions a key watch point at the moment for price direction.

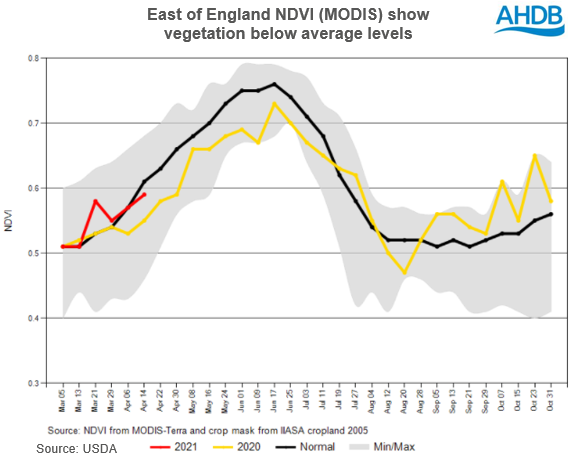

One concern at the moment is the lack of any substantial rainfall in the UK. Looking at rainfall amounts in April so far paints a dire picture with widespread areas receiving less than 20% of usual April averages. If we look at crop vegetation density levels which can be used as an indicator of overall crop health. NDVI (Normalized Difference Vegetation Index) levels point towards a more average situation, in a better position than 2020. Our next UK crop progress report is due towards the end of May and will highlight the effects this dry period has had.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.