Oat milling demand boosted in first half of 2020/21: Grain market daily

Friday, 19 February 2021

Market commentary

- UK feed wheat futures (May-21) rose by £2.25/t yesterday, to £204.25/t. The Nov-21 futures contract rose by £1.35/t, reaching £169.00/t. The gains followed higher global wheat prices, but stronger sterling capped UK futures.

- Global wheat prices rose as cold weather remains a threat to wheat in the US, and SovEcon cut 1.5Mt from its 2021 Russian wheat crop forecast.

- US farmers may plant 0.5Mha more maize and 2.8Mha more soyabeans for harvest 2021 than harvest 2020, according to the USDA. The USDA released the forecasts at its annual outlook conference yesterday. The higher forecasts pushed prices for both crops lower.

- Paris rapeseed futures (May-21) gained €1.50/t to €460.00/t yesterday, despite falls in Chicago soyabean prices. The forecast 4% rise in the 2021 Canadian canola (rapeseed) area is smaller than some in industry had expected. This, and short covering, pushed May-21 Canadian canola futures to the highest price yet.

Oat milling demand boosted in first half of 2020/21

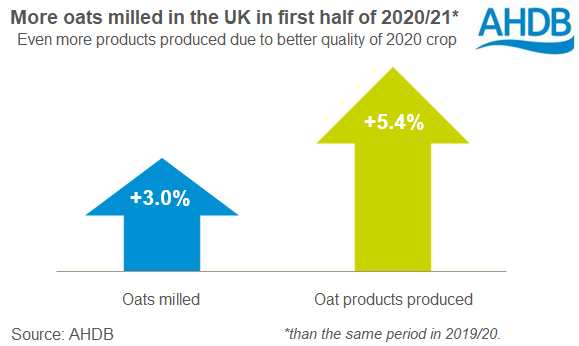

In the first half of this season (Jul-Dec) 275Kt of oats were milled in the UK, 3% more than in the same period in 2019/20. This was despite the better quality of the 2020 crop, reducing the amount of oats needed for the same volume of finished products.

Higher exports of oat products, such as oat flakes, supported the volume milled. Between July and December 2020, the UK exported 49Kt of oat flakes, compared to 26Kt in July to December 2019.

Sales to EU and non-EU destinations both rose sharply in late 2020. There was a risk of high tariffs on oat product exports to the EU if the UK and EU had not agreed a trade deal by 31 December. Non-EU exports were potentially higher because of the risk that all UK exports could be disrupted as the UK adapted to its new trading arrangements.

In November, AHDB forecast UK demand to be static in 2020/21 based on the information available then. If the current usage pace continues, this forecast may rise.

Pandemic positives

Unlike most other grains, the coronavirus pandemic restrictions have been positive for oats. More people are eating breakfast, and eating it at home. This pushed up retail sales value of breakfast cereals, including muesli and granola (Kantar, via The Grocer). Plus, although retailers offered fewer promotions on hot breakfasts, such as porridge, the volume sold didn’t suffer. Encouragingly, this suggests an increased appetite for the products.

People may or may not keep their new breakfast habits after restrictions are eased. But, if they do keep the habit of eating breakfast, it will be positive for the oat and breakfast cereal industries in the longer-term.

Could higher milling demand continue?

In the second half of the season, there could be smaller year-on-year rises in milling demand. This is because of:

- Higher demand last spring & summer. Oat milling demand rose in the second half of 2019/20, so season-on-season growth may not last into the second half of this season.

- Trade friction with the EU. The UK’s trade deal with the EU-27 means that trade continues without tariffs for both oats and oat products, but there is more trade friction. Overseas markets are important for UK oat products. So, this trade friction means there’s uncertainty over the total demand for oat products and so oats for the Jan-Jun period.

- Product stocks. Overseas buyers potentially increased their stocks of UK oat products ahead of the EU exit deadline. If so, they may buy less export demand in the next few months, which would reduce demand for oats in the second half of 2020/21.

Strong incentive to feed oats continues

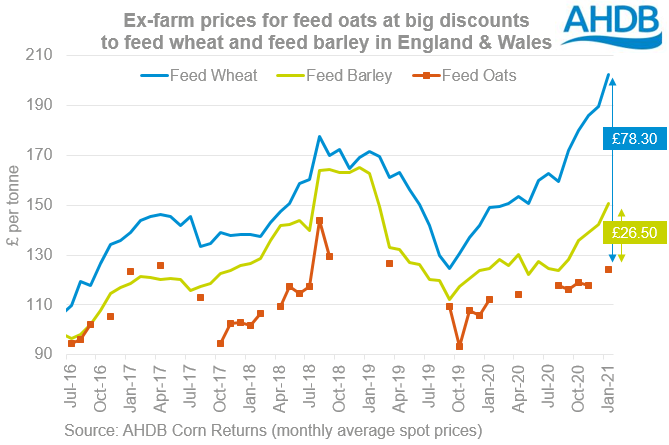

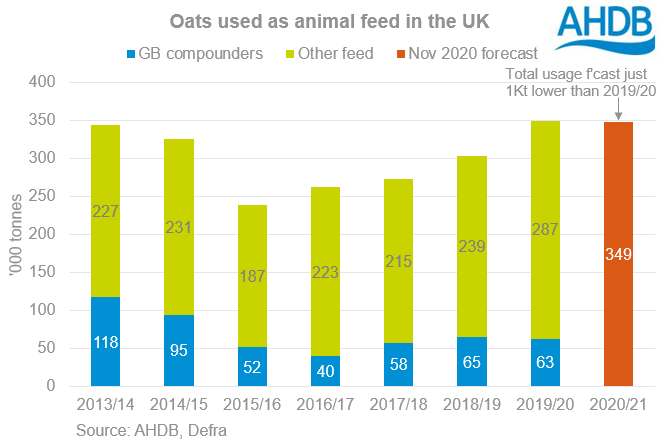

Prices continue to show a strong incentive to use oats as animal feed. In January, ex-farm feed oat prices averaged just £124.10/t in England and Wales. This was £78.30/t less than the average for feed wheat and £26.50/t less than feed barley in the same month. Wider discounts to feed barley tend to be linked with higher usage of oats as animal feed in compound feed and on farm. This was seen in 2017/18 and 2018/19, when a large discount to feed barley saw increases in the amount of oats used for animal feed.

So far this season (Jul-Dec), 36Kt oats have been used in compound feed. This is up on the first six months of last season (29Kt) and similar to the same period in 2018/19 (37Kt).

Last week, the gap between spot ex-farm feed oat and feed barley prices was reported even wider than in January, at £35.30/t. There are nutritional and practical limits to the amount of oats that can be fed to ruminant and mono-gastric animals. But if this price gap continues, the amount of animal feeding could be at least as high as last season.

Higher demand needed to offset big crop(s)

Defra confirmed the 2020 UK oat crop at 1.03Mt in December. This is 15Kt more than the provisional estimate made in October. Although the crop is 45Kt smaller than 2019, it’s still a big crop; 148Kt above the 2015-2019 average. In addition, the better quality of the 2020 crop means fewer milling oats are needed to get the same volume of end product.

This big crop is weighing on ‘free market’ oat prices. Ex-farm oat prices have not risen anywhere near as much as for feed wheat and barley since last autumn.

However, it is important to draw a clear distinction between the price of oats for export and animal feed demand, and the oats going into mills. The milling market, particularly in England, is heavily geared towards contracted supplies. These contracts will have been agreed 12 to 18 months ago, in line with wheat futures markets.

Last season, high exports were a key part of reducing the carryout. But this season, exports are far lower. By the end of December, unprocessed oat exports totalled 23Kt compared to 80Kt in the first half of 2019/20. So the focus is on demand to reduce the carryout into next season.

The carryout will be important as a bigger area is expected for harvest 2021. The Early Bird Survey indicates that the UK oat area could rise a further 2% to 214Kha as the OSR area reduces. If spring planting intentions go as planned, we could be looking at our third successive 1Mt oat crop.

If high demand, primarily for feed, is confirmed for this season, as currently seems possible, free market prices could rise relative to those for other grains. This would reduce the carryover and could help reduce the pressure on free market prices next season too – depending on yields and quality.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.