Market Report - 22 March 2021

Monday, 22 March 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

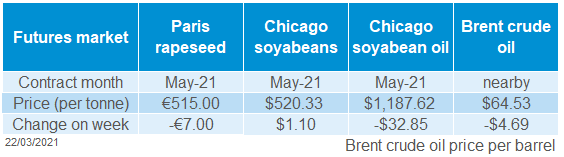

Last week, Paris rapeseed futures for May-21 fell by €7/t to €515.00/t. Dips on Thursday were caused by the oil price plummets and South American rains easing supply concerns but some recovery on Friday.

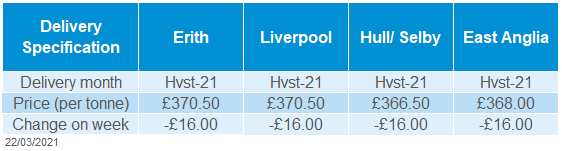

Delivered rapeseed prices into Erith for harvest fell week-on-week by £16/t, to £370.50/t on Friday. Nov-21 prices fell by marginally less (£15/t) to £380.50/t.

Canadian canola ending stocks for 2020/21 were forecasted last week by the USDA attaché at 700Kt, down from 1.2Mt forecasted by USDA officials. This is on account of reduced production and increased crushing. 2021/22 production is forecast up 7% on expectation of high pricing encouraging planting. Statistics Canada planting intentions are due the end of April.

Global grain markets

Global grain futures

Wheat

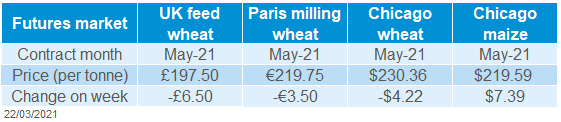

Wheat markets tumbled last week, pressured by favourable weather conditions and increased Black Sea production estimates. Domestic old-crop futures closed below £200/t for the first time in over a month.

Maize

Strong US export sales to China last week lend support to maize markets. Signs that a quarter of the Brazilian safrinha crop will be planted outside of ideal window also offers incentives to rise.

UK focus

Barley

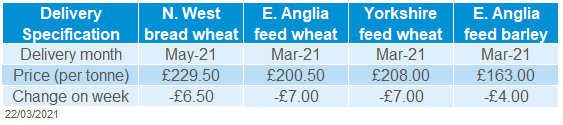

Domestic barley markets fell in union with wheat markets. Markets await indications of the spring barley area for production estimates and malting availability next season.

Delivered cereals

The May-21 Paris wheat futures contract lost 2% last week (Fri-Fri) in part to increased grain production estimates for Ukraine and favourable weather conditions for some regions globally. The contract closed at €219.75/t (£188.61/t) down €4.75/t.

Maize futures however moved up on the week, bolstered by hefty US export sales to China. In the four days up to Friday, daily flash sales amounted to 3.9Mt sold to China for 2020/21 delivery. This brings the total volume of US sales to China so far to around 23.2Mt.

If sales are fully realised, it seems very likely the USDA figure for Chinese maize imports will need adjusting higher than the current 24Mt. We know China has been looking beyond the US for maize imports too, namely Ukraine and Russia.

Brazil’s safrinha planting campaign will have an estimated 25% of the crop sown outside its ideal planting window. A tighter global supply and demand outlook for maize will offer incentive for maize prices to increase. This will help domestic feed wheat and particularly feed barley prices too.

US managed money funds increased their net-long position in US maize markets in data up to 16 March, to the furthest point since April 2014. With heightened hedge fund interest in commodities at present, a lack of bullish news could potentially incite a sell-off with prices high currently. Over the next few days, markets will move in anticipation of the key US grain stocks and prospective plantings reports due on 31 March.

Oilseeds

Domestic wheat markets felt the impact of the drops in global wheat futures. The May-21 contract at £197.50/t fell £6.50/t on the week. Last week saw the contract close below £200.00/t for the first time since 10 February. This drop was mirrored in new-crop futures. The Nov-21 contract closed at £165.75/t on Friday, dropped £4.25/t.

This drop in futures prices was also felt in domestic delivered prices. Feed wheat into East Anglia fell £7.00/t on the week to £202.50 for May delivery. Feed barley into East Anglia fell £4.00/t on the week to £163.00/t for March delivery. Last week, my colleague Helen took a look at fundamentals for new-crop domestic barley, which can be found here.

Global oilseed markets

Global oilseed futures

Rapeseed

Rapeseed remains supported by tight global vegetable oil supplies and high crush margins. New-crop rapeseed in the EU looks tight, providing support to pricing.

Soyabeans

Global demand continues to provide support for soyabeans. Direction for pricing relies on South American crops, both size and condition given current weather forecasts.

Rapeseed focus

UK delivered oilseed prices

Despite Chicago soyabean May-21 futures falling to the lowest level in over 2 weeks on Thursday ($511.15/t), prices rose week-on-week due to recovery on Friday.

On Thursday, nearby brent crude oil closed 7% down from the previous day to $63.28/barrel, in response to vaccine worries, stricter lockdown measures across several European countries and the associated falling fuel demand. Although on Friday, prices recovered by $1.25/barrel to $64.53/barrel.

Recent rains in Argentina also contributed to falls in soyabean futures last week, easing imminent concerns over soyabean yield losses. The Bolsa de Comercio de Rosario reported 600Kha of soyabeans moved from ‘fair/bad’ to ‘good’ crop condition from last week, reducing forecasted losses by 50Kha to 200Kha.

In the latest Buenos Aires Grains Exchange report, 5% of the soyabean crop were moved from ‘poor/dry’ moisture condition to ‘optimum/favourable’ from the previous week. However, the report increased the percentage of soyabean crop condition rated ‘poor/very poor’ by 1% week-on-week and the weather outlook forecasts very little rain for the rest of March, so one to watch.

From a slow start to Brazil’s harvest, Chinese imports of Brazilian soyabeans January/February 2021 totalled 1.03Mt, down 80% from the same period in 2020 with China opting for US origin instead (Refinitiv). Though exports are increasing, with 2.72Mt leaving Brazil in the week ending 14 March.

Last week 62.7% of Brazil’s record soyabean crop has been sold according to Safras and Mercado. This is up 2% from last month and in line with last year. New-crop 2021/22 national figures are expected in April, though Mato Grosso growers have already sold 20%, a record for this time of year.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.