Market Report - 20 December 2021

Monday, 20 December 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

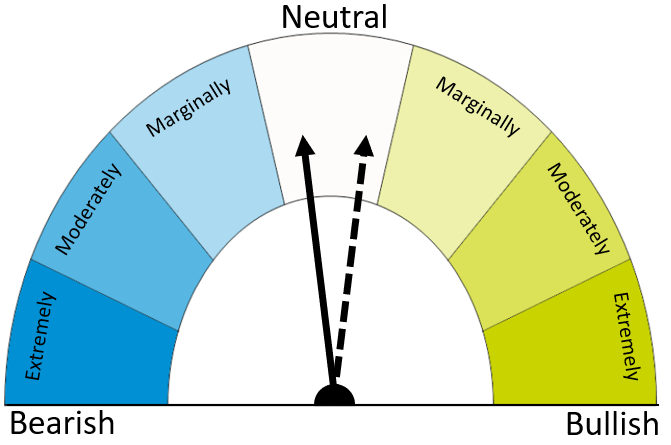

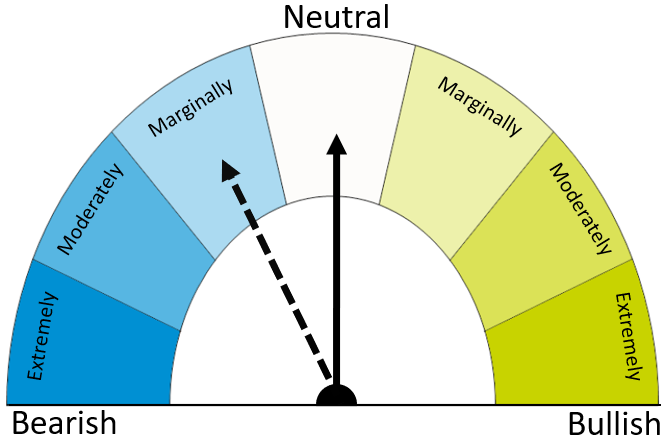

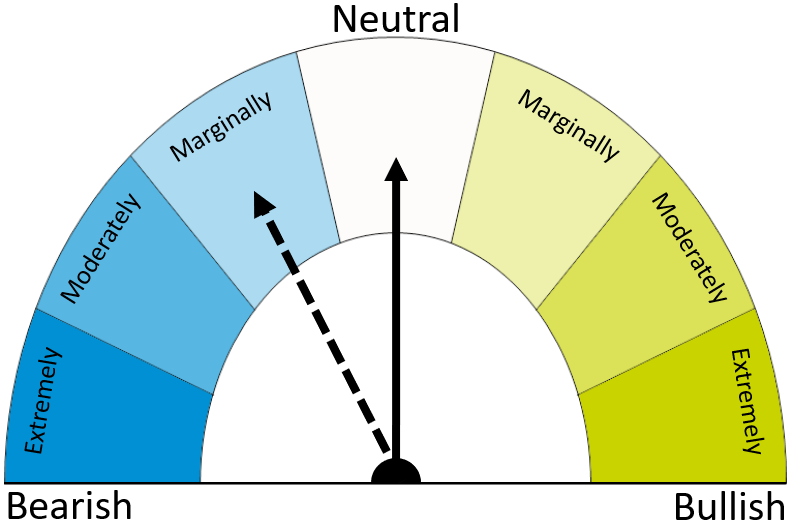

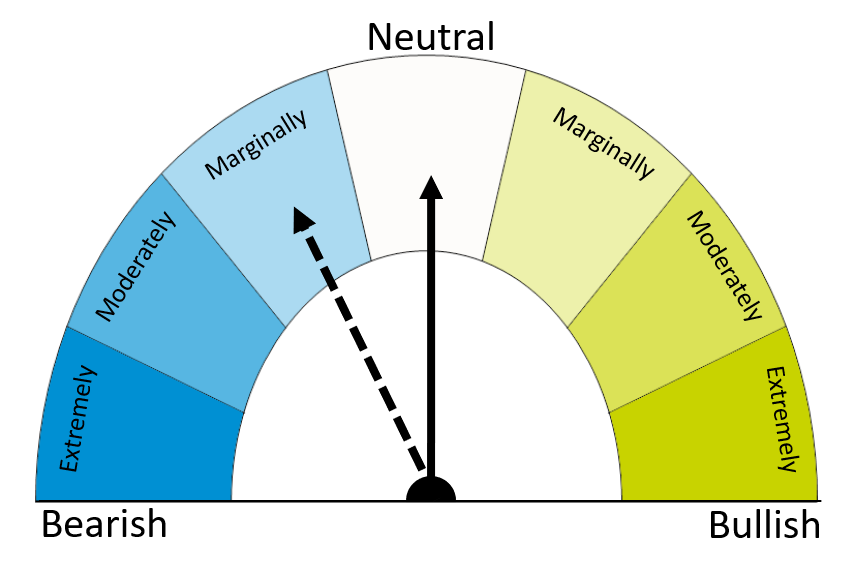

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Wheat supplies in 2021/22 remain tight but increasingly secured as the Southern Hemisphere harvests progress. Meanwhile, the Omicron variant continues to cause uncertainty about global demand. The maize market will also exert influence over wheat in the coming weeks.

Maize

The South American harvests are critical to global grain supplies in the rest of 2021/22. If record crops are realised, expect pressure on prices but this depends on the weather and markets remain nervous.

Barley

Tight global barley supplies mean that the grain can’t take extra demand from other grains so will continue to follow wheat and maize. But, if COVID-19 restrictions start to dent malting demand, we could see a shift in this outlook.

Global grain markets

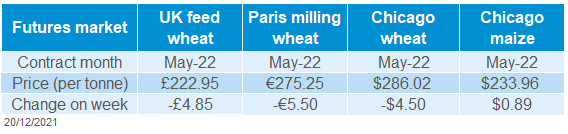

Global grain futures

Wheat prices fell in the early part of last week after the flow of bullish news slowed and the rise of the Omicron variant cast uncertainty over demand. This is still a threat to prices looking ahead.

However, prices recovered some of the losses at the end of the week. China bought French feed wheat and feed barley, following the drop in prices (Refintiv).

In Brazil, AgRural trimmed the size of the maize crop by 1.1Mt following recent dry weather. The crop is now pegged at 114.1Mt by AgRural, versus 117.2Mt by Conab. Meanwhile, the Argentine grain belt is expecting challenging weather this week. Both these will keep the market edgy.

Argentina will limit exports of wheat and maize in 2021/22 to 12.5Mt and 41.6Mt respectively, due to domestic high inflation rates (Refintiv). This is below the current USDA forecast for wheat (13.5Mt) but above the maize forecast of 39.0Mt.

Russia is considering limiting wheat exports to 8.0Mt from 15 February – 30 June 2022, 1.0Mt less than previously planned. But the limit is still more than the average volume exported in the past three seasons within this period (7.9Mt, Refintiv), so the impact may be limited.

New crop uncertainty also persists. Dry weather is causing uncertainty for US winter wheat, while there are concerns about the frost tolerance of Black Sea crops.

Across most parts of Europe, favourable weather allowed a ‘fair start’ for winter cereal crops. EU-27 soft wheat production is predicted to fall in 2022/23 by both Stratégie Grains and Coceral, down 2% and 3% respectively. Coceral also initially pegs the 2022 UK wheat crop at 14.5Mt.

UK focus

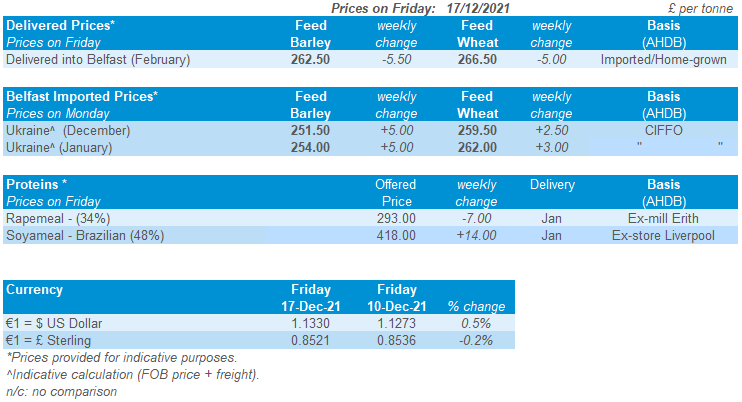

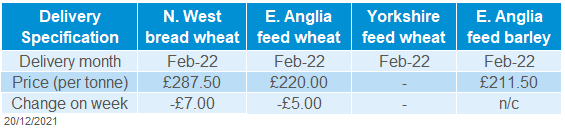

Delivered cereals

UK prices followed the global trend lower last week. Prices picked up a bit on Friday, but this was not enough to offset the losses earlier in the week.

Delivered feed wheat prices for both old and new crop delivery generally fell in line with UK futures Thursday – Thursday. E.g., Nov-22 feed wheat into Fife/Edinburgh was down £5.50/t to £208.00/t. The Nov-22 futures fell £5.85/t over the same period.

However, old crop delivered bread wheat prices recorded slightly bigger falls. This is partly due to the uncertainty about demand following the introduction of tighter COVID-19 restrictions.

Defra’s final estimate of the 2021 UK wheat crop pegs the crop at 13.99Mt. This is down slightly from 14.02Mt estimated in October, but still well above last year’s crop. The barley and oat crop also shrink slightly from October due to smaller yields, down 147Kt to 6.96Mt and down 26Kt to 1.12Mt respectively.

These Defra results also allow us to revisit our Early Bird Survey of planting intentions for harvest 2022 at a regional level. Read more about the regional changes for wheat, barley and oats here.

Oilseeds

Rapeseed

Tight global supply and demand supports prices short term. However, increased global covid restrictions remains a concern for vegetable oil demand. Longer term, large South American soyabean crops are forecast.

Soyabeans

Chinese demand supports soyabean prices short term. Longer term, record South American crops are forecast but, South American weather remains a watchpoint. Sentiment may change if dryness persists.

Global oilseed markets

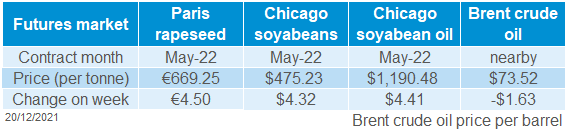

Global oilseed futures

Chicago soyabeans (May-22) gained $4.32/t Friday to Friday, to close at $475.23/t. Chicago soyabeans have been gaining from Chicago soyameal strength, where the May-22 contract rose $9.37/t to close on Friday at $414.13/t.

China reportedly imported 3.63Mt of US soyabeans in November. This is up from 775Kt in October, capped by export disruptions from Hurricane Ida. In November, China also imported 3.75Mt of Brazilian soyabeans (up 37% from a year earlier). Total November Chinese imports were down year-on-year, but this is perhaps unsurprising with challenging pig margins.

Last week, Chicago soyaoil (May-22) also made small gains. The contract rose $4.41/t to $1190.48/t. On Wednesday, the National Oilseed Processors Associations (NOPA) said US soyaoil stocks fell for the first time since June, falling 0.2% to 1.832Blbs (830.98Mt). The trade expected a rise in stocks.

However, concerns for the impact of Omicron remain, with Brent crude oil (nearby) pulling back again. Increased travel and social restrictions could reduce demand for oils, including vegetable oils, and therefore pressures prices. This will remain something to watch.

South American weather also remains a watchpoint for global oilseed markets. The Bolsa de Cereales said that dry weather in the coming months presented a ‘big challenge’ for soyabean and maize production in Argentina. Though high temperatures are expected, rain is forecast to follow across Argentina, particularly the Northwest. In Brazil, the next 10 days continue to look very wet for the north, but the south remains dry. How much rain arrives and where, will be key.

Rapeseed focus

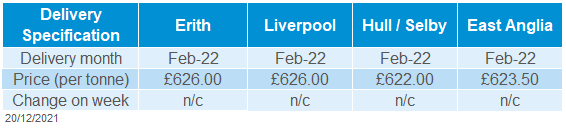

UK delivered oilseed prices

Paris rapeseed futures (May-22) gained €4.50/t last week, to close on Friday at €669.25/t. Arguably, rapeseed gained on soyabean strength last week.

Delivered rapeseed prices into Erith (May-22) were quoted at £627.00/t on Friday. There is no week-on-week comparison available, though this price is higher than on 03 December.

Regional figures for the Early Bird Survey were released on Friday. High prices look to have boosted planting this year, with total expected area for 2022 at 359Kha. This is up 17% from last year, and up from initial estimates too.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.