Market Report - 19 April 2021

Monday, 19 April 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

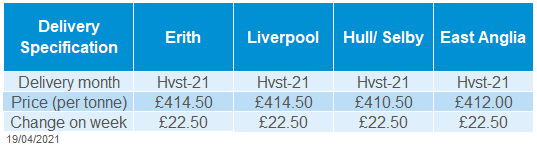

For UK delivered values, the harvest price for Erith gained £22.50/t week-on-week, quoted at £414.50/t on Friday. Rises were on the back of Paris futures gaining. Last week we heard reports of dry and frosty weather causing new crop concerns, as well as potential larvae damage. However, it is unknown how widespread these concerns are. The next AHDB crop condition report is due at the end of May.

Paris new-crop rapeseed futures (Nov 21) gained €23.75/t last week (Fri-Fri) to close at €474.25/t. Gains were made on the back of soyabean supply concerns and high vegetable oil prices.

Germany’s 2021 winter rapeseed crop is projected to rise 1.6% from last year, to 3.57Mt, according to the association of farm co-operatives, DRV. Recent cold weather has slowed growth, though yield potential looks strong. EU supply and demand is still expected to be tight heading into next season, with the French crop forecasted smaller year-on-year.

In Canada, soil moisture is very limited in key canola growing regions as drilling gets underway. Canadian planting intentions are due on 27 April, which may tell us more about the new crop.

Wheat

Worries about weather are currently supporting prices. But, the market will need to see evidence of crop damage to sustain a more bullish outlook longer-term.

Global grain markets

Maize

Markets remain supported by tight supplies in 2020/21, which will be the case even if Brazilian crop estimates are fully realised. This tightness could carry over into 2021/22. The industry will be looking to further global new crop supply and demand estimates, later this month and next, for ‘confirmation’.

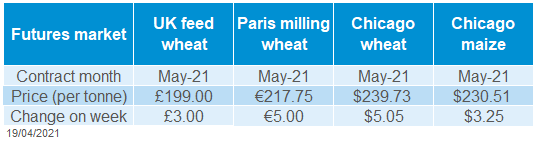

Global grain futures

Barley

Old crop barley prices are currently subdued with any rises dependent on the wider grains market. A large UK crop is expected this year, which is also weighing on new crop prices.

UK focus

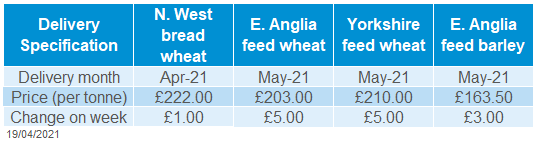

Delivered cereals

Prices rose last week on concerns about cold and dry weather in the US, where maize and spring wheat planting is underway. Weather has also been less ideal in Brazil, parts of Europe and Canada. Speculative traders buying into maize was also potentially a factor in price rises. Low stocks of wheat and maize in the major exporting countries place extra importance on the 2020/21 Brazilian maize and northern hemisphere 2021/22 grain crops.

Dry weather in Brazil is of concern for the second or ‘Safrinha’ maize crops, which have started ‘grain fill’. Last week's Brazilian crop progress report showed for the 2nd maize crop, as at 10 April, 22% of crops were flowering and 1% at grain fill. Rain is expected this week in some areas, which could partially ease concerns.

Soils are abnormally dry as well in Canada, where spring crop planting is soon to start, but only light showers are forecast.

In Europe, French crop condition scores for spring barley show the effect of recent frosts. 88% of spring barley is now rated good or very good, down 4 percentage points on the previous week. There were also smaller declines for wheat and winter barley. Although the scores are still relatively high, dry weather is forecast for the next 10 days. This is causing concerns for the crops.

Wheat crops in Germany are two to three weeks behind usual progress but in a positive condition, according to DRV. This is despite recent cold and dry weather. The association for farm co-operatives raised its estimate of the German 2021 wheat crop by 0.3Mt to 22.6Mt last week.

Oilseeds

UK Nov-21 feed wheat futures gained £6.45/t last week, closing at the contract’s highest price to date of £173.95/t on Friday.

The first GB wheat production forecast for 2021 suggests GB wheat production could reach 14.57Mt. This is well ahead of last year’s poor crop and 6.6% ahead of the five year average. But, given the very low stocks after this season’s tiny crop, imports will still be required.

New crop delivered feed wheat prices rose in line with the futures market (Thu-Thu), while Nov-21 bread wheat prices gained slightly more than the futures. Uncertainty over the current weather outlook and crop quality is supporting prices at the moment. This uncertainty premium may come out if weather concerns ease as we get closer to harvest.

Old crop (May-21) delivered feed wheat prices made smaller gains, further shrinking the premium to futures due to slow old crop demand. On Thursday, the price for feed wheat delivered in East Anglia in May-21 was £203.00/t, just a £2.00/t premium to May-21 futures. On 8 April, the premium was £3.00/t and on 31 March it was £4.00/t. Feed barley prices rose by less than wheat last week.

Rapeseed

Short supply and high crush margins is likely to support old-crop prices for the remainder of the season. For new crop, forecasted tight UK and EU supply is supporting values.

Global oilseed markets

Soyabeans

Tight supply and demand continues to elevate prices. US and South American weather is playing a key role in aiding new-crop values, though forecasts can change between now and the new season.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

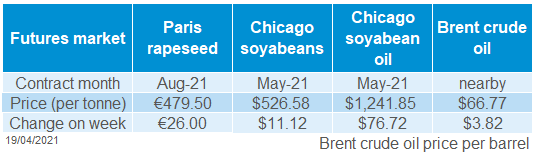

Chicago soyabean futures (May-21) gained $11.12/t Friday-to-Friday, to close at $526.58/t. On the Nov-21 contract gains were smaller, up $3.95/t, to close at $468.07/t on Friday.

Last week, cold weather across the US Midwest and plains contributed to rising prices. Cold temperatures are forecast to continue to the end of the month across key soyabean producing areas.

Old crop export sales of US soyabeans were quiet for the week ending 8 April, at just 90.4Kt. Old crop cancellations from China and unknown destinations totalled 100.1Kt, but sales of new crop to China stood at 264Kt.

On Friday, the Chinese government released pork production figures showing Quarter 1 output up 32% from last year. Some concerns are arising around Chinese soyameal demand. This is due to some switching from maize to wheat in pig and poultry rations, but the extent of this is still unknown.

March US soyabean crush figures were released last week, totalling 4.82Mt. This was below trade expectations, but up from February’s 17 month low. Soyabean oil stocks were also up from February, but still below trade estimates, adding upward pressure to vegetable oil prices.

Thursday’s Argentinian harvest report showed slow progress after wet weather. The first soyabean harvest was 10.5% complete, down from the 5-year average (2015-20) of 37.7%. Overall, soybean crops look slightly better week-on-week, with a reduction in area of dry soils. The Brazilian soyabean harvest was 85.0% complete, as at 10 April, 4.4 percentage points behind the five year average. The weather outlook for South America looks reasonably dry.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.