US planting off to a strong start amid developing dryness: Grain Market Daily

Tuesday, 13 April 2021

Market Commentary

- The UK May-21 feed wheat futures gained £0.65/t from Friday, to close at £196.65/t yesterday. But, the Nov-21 contract declined by £0.55/t, to close at £166.95/t yesterday.

- Customs data for China highlights the huge level of demand from the country. Imports of soyabeans were up 82% year-on-year in March, bolstered by strong purchases and late arrivals of vessels booked for January and February. Total Chinese Q1 (Jan-Mar 2021) maize imports were 6.73Mt, up more than fivefold on last year.

- The Russian agricultural consultancy firm IKAR increased its forecast for Russian wheat production in 2021 to 81Mt, from 79.8Mt. The increase is a result of a period of favourable weather across the Black Sea region.

US planting off to a strong start amid developing dryness

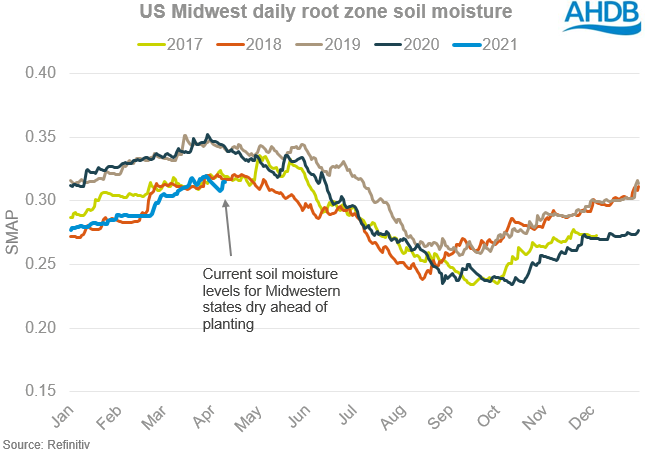

The release of the second USDA crop progress report of 2021 yesterday pressured US grain markets to ease back. The report highlighted US farmers had made good progress in maize and spring wheat planting. But, over a third of US cropland (topsoil and subsoil) were ‘short’ to ‘very short’ of moisture. This is a worry given the short-term weather forecast is relatively dry.

This dry weather will also provide a clear window of opportunity for farmers to push on and make good drilling progress. Already this early on, maize planting progress at 4% is ahead of the five-year average, if only by 1%. Spring wheat at 11% drilled is also ahead of the five-year average (6%) as of 12 April. Whilst the drilling campaign is only beginning, good progress and a clear forecast will offer pressure to global grain prices as the increased maize area gets drilled without disruption.

US fund positions eased back their bullish view very slightly last week. This was likely on account of the ideal drilling conditions and a degree of profit-taking. These positions are a typical marker for overall US market sentiment. As of 12 April, 21.5% of total positions in maize were for a net-long view (bullish). This indicates an opinion that prices will remain supported over the short-term.

As we can see, 2021 moisture content is currently at the lowest in the last four years. This is within normal levels but could develop into a yield-affecting issue if dryness persists through crop emergence.

Over 70% of the state of North Dakota is considered to be in ‘extreme drought’ condition currently. The state produced 8.5Mt of wheat and 6.2Mt of maize in 2020. This dryness could become a real issue for the state if rains do not arrive soon.

A dry forecast for the Midwest over the next couple weeks is a double edged sword. On one hand, the ability to make good drilling progress will offer a degree of pressure to global grain prices. But, should dryness persist and cause concerns for crop emergence then a degree of support could develop for global grain prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.