Market Report - 14 February 2022

Monday, 14 February 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

A relatively cautious USDA report leaves the short-term picture drifting, but the sentiment could turn bullish if Russian-Ukrainian tensions escalate. Longer-term, there is expectation for some recovery in output, although Canadian areas and soil moistures will need to be monitored come Spring.

Global reliance on South American crops still stands, where the Safrinha crop is only just being planted. However, there is also uncertainty around the US 2022 area, leaving the market awaiting some new news.

Barley tends to track wheat markets and again, Canadian planting intentions will be one to watch. If North Africa remains dry, it could increase barley import demand, in turn offering support to prices.

Global grain markets

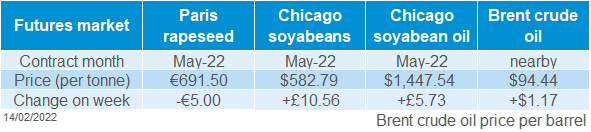

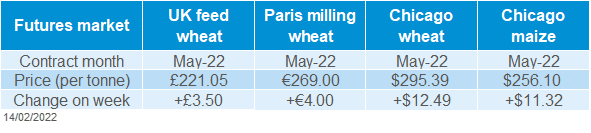

Global grain futures

Last week’s USDA report gave limited direction to markets, but prices still ended the week higher. Many within the trade suggest the USDA’s South American crop cuts were too cautious. There is an expectation for estimates to be reduced further in the coming months. Conab, Brazil’s official forecaster, cut 0.6Mt from its maize forecast pegging it 1.7Mt lower than the USDA estimate, at 112.3Mt.

The Chicago May-22 maize futures contract gained $11.32/t across the week (Friday-to-Friday) despite the USDA’s bearish estimates. Closing the week at $256.10/t, it reached an all-time contract high. New crop (Dec-22) also closed the week on a contract high of $234.15/t, up $8.26/t from the previous Friday.

Wheat markets also found support last week. Friday saw a jump in global wheat markets on the back of increased concerns about a possible Russian invasion of Ukraine potentially disrupting exports. Both countries are major exporters of wheat. They are expected to make up 29% of global wheat exports combined in 2021/22 (USDA). This means any disruption to exports would inevitably cause global availability issues. Russia and global media accuse the US of causing panic but the situation is aiding market sentiment and will be a watch point.

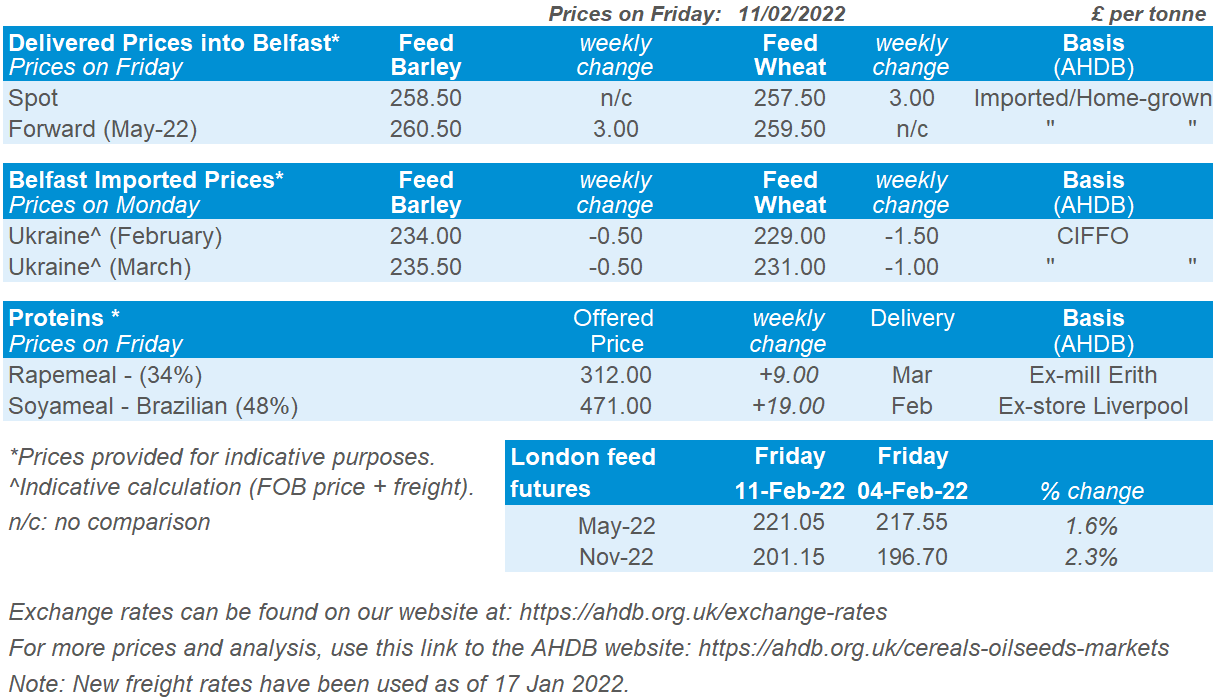

UK focus

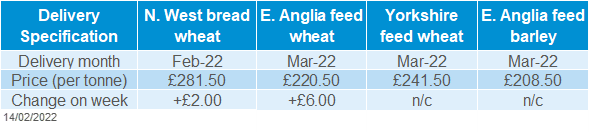

Delivered cereals

UK feed wheat futures followed trends in global markets. Friday saw a jump up in both May-22 and Nov-22 values, closing the week at £221.05/t and £201.15/t respectively.

Despite a week-on-week price rise for delivered bread wheat into the North West, the premium over May-22 futures squeezed further (May delivery). The premium was £66.50/t over feed wheat futures on Thursday (10 Feb) versus £68.00/t the week before.

The survey quoted a new crop (Nov-22) bread wheat price for the first time this year in Friday’s report. November delivery of bread wheat into Northampton averaged £238.00/t, or c.£38.00/t over futures. The premium at the same point last year (versus Nov-21 futures) was just £27.00/t. This indicates some nervousness for bread wheat availability next marketing year.

Oilseeds

Rapeseed

Soyabeans

Old crop supply remains tight until the Northern Hemisphere harvests. Canadian planting intentions will drive sentiment but currently production is anticipated to rebound for the 2022/23 marketing year.

Downward revisions to South American crops, combined with tightening global supply and demand supports soyabeans. There could be longer-term support if the US new crop is delayed or experiences adverse weather.

Global oilseed markets

Global oilseed futures

The Chicago soyabeans May-22 contract gained 1.8% from Friday-to-Friday, to close at $582.79/t.

Driving this gain is the on-going dry weather curbing soyabean production from South America. Last week there were cuts from the USDA to Argentinian (-1.5Mt) and Brazilian (-5.0Mt) soyabean production estimates.

Further to that, Conab slashed Brazilian soyabean production by 15.0Mt in its monthly update. It now estimates the crop at 125.5Mt, citing dry weather in the southern states as the reason for the cut.

Commodity funds were net-buyers of Chicago soyabeans future contracts over the last week. Further support for soyabean prices has been the run of US export sales. Between 04 and 10 Feb over 1.8Mt of old and new crop soyabean sales have been reported to China and unknown destinations.

The focus over this next week will continue to be South American conditions. Argentina is expecting some rain but temperatures remain hotter-than-usual in parts. Brazil is expecting widespread rains over the next week, which could delay the harvest.

Another factor driving edible oil markets is Brent crude oil. The nearby contract rose 3.3% on Friday closing the week at $94.44/barrel. Support in oil comes from fears Russia could invade Ukraine, disrupting energy exports.

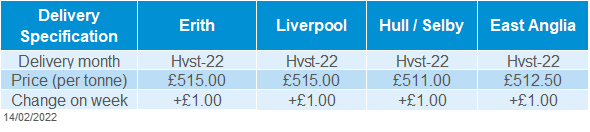

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Aug-22) closed Friday at €619.00/t, gaining €16.00/t across the week. UK delivered rapeseed (into Erith, hvst-22) was quoted at £515.00/t, gaining £1.00/t across the week.

UK prices did not encapsulate the same gains as Paris futures because our delivered survey was conducted late morning on Friday and Paris rapeseed futures were volatile throughout the day. The Aug-22 futures contract traded in a €9.25/t range.

Further to that, Sterling strengthened (+1.11%) against the Euro across the week, closing Friday at £1 = €1.1941.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.PNG)

.PNG)

.PNG)