Market Report - 13 September 2021

Monday, 13 September 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Global wheat supply and demand remains tight, although not quite as tight as last month. Wheat needs to hold a premium over maize to avoid gaining demand.

Maize

A larger than expected increase to the US and global maize crop by the USDA increases global supplies. But, there’s still uncertainty over South American crops due to potential for a second La Niña weather event.

Barley

In the UK, the gap between feed wheat and feed barley prices has closed considerably in recent weeks. Tight global supplies will continue to support barley prices in the short term. But, longer-term the reduced price gap to other grains may start to cut feed demand.

Global grain markets

Global grain futures

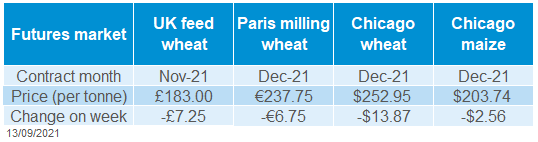

Global grain prices fell last week due to anticipation of a larger US maize crop in Friday night’s USDA report.

The US maize crop was larger than the market expected at 380.9Mt by the USDA. This is up 6.3Mt from the August report when the market expected a rise of 4.9Mt according to a poll by Reuters. However, Chicago maize futures (Dec-21) rose on Friday, suggesting the change was already priced in.

The USDA also increased the Argentine maize crop by 2.0Mt to 53.0Mt as the USDA expects farmers to increase the planted area. Earlier in the week, the Rosario Grains Exchange estimated a 7.3% rise in the planted area from 2020/21. Plus, the USDA added 5.0Mt to the Chinese maize harvest after good rainfall. The result is bigger global maize supplies and, despite higher demand, a year on year rise in end-of-season stocks.

However, a longer-term caveat remains the risk of another La Niña weather event. The US Climate Prediction Centre now pegs the chance at 70-80% this winter. The impact of these events can vary, but the chance of drier weather means the South American forecasts can’t be taken for granted.

For wheat, another cut to the Canadian crop was more than offset by bigger crops in Australia, India, China and the EU-27. Due to the larger Australian crop, wheat stocks held by major exporters would be bigger than last month, although still the lowest since 2007/08.

UK focus

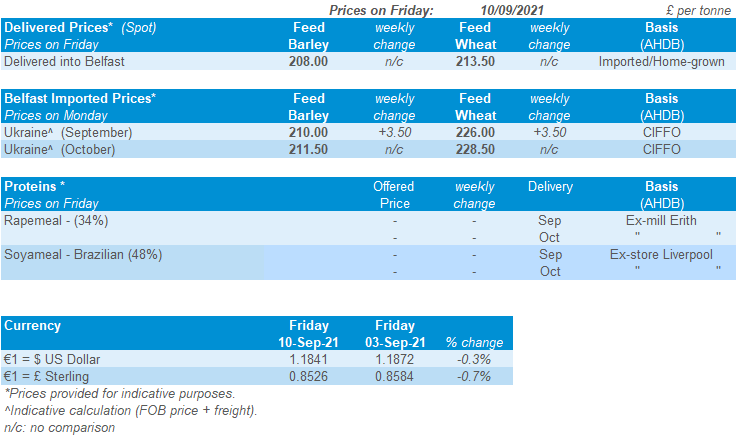

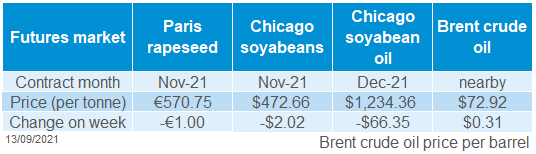

Delivered cereals

The 2021 GB harvest is now in its latter stages, with 90% of winter wheat, 85% of spring barley, and 77% of oats harvested by 7 September. The main areas remaining are in the north of England and Scotland.

The yield range for wheat has narrowed as harvest progressed, but remains just above the five-year average. If this continues, the UK wheat crop could be around 14.5Mt. Last year we harvested 9.7Mt.

Feed barley prices have closed the gap to feed wheat in recent weeks. This trend continued last week. In AHDB’s delivered price survey, on 9 September feed barley delivered to Avonmouth in Sep-21 was £176.00/t. This was just £6.00/t less than feed wheat for the same delivery. A fortnight ago (26 Aug), the gap was £19.00/t. Could this shrinking gap reduce the amount of barley used in animal feed?

The premium for bread wheat over feed wheat also continued to rise last week. For example, bread wheat delivered into the North West in November was £224.50/t on Thursday. This was £41.50/t more than the Nov-21 futures price, while a fortnight ago the premium was £38.00/t.

Oilseeds

Rapeseed

EU supply and demand remains tight, supporting prices. With a trimmed Canadian rapeseed crop, global availability for export is reduced. Increased US soyabean production caps gains.

Soyabeans

Increased US production boosts supply. However, a fine balance of supply and demand continues globally. South American crop sizes are still under question, with a possible La Niña in 2021/22.

Global oilseed markets

Global oilseed futures

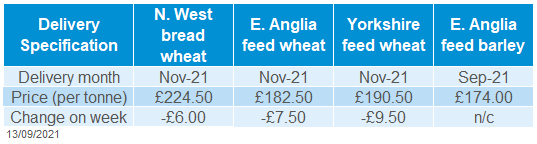

Global markets drifted lower last week, expecting a bearish USDA world agricultural supply and demand estimate (WASDE). This seemed like ‘sell the rumour, buy the fact’ for soyabeans. On Friday, Chicago soyabean futures (Nov-21) closed at $472.66/t. This is down $2.02/t on the week, but up $5.88/t from Thursday.

Friday’s WASDE, released after UK markets closed, increased US soyabean production by 0.96Mt to 119.05Mt. This was in line with trade expectations. Production increased due to improved yields from August rains (to 3.4t/ha), despite a reduction in harvested area (121Kha). Trade was expecting harvested area to remain unchanged.

Global 2021/22 soyabean ending stocks increased by 2.74Mt to 98.89Mt, on higher beginning stocks from reduced 2020/21 crush and increased 2021/22 production. But supply and demand are finely balanced. Small changes to either supply or demand could change the outlook.

Last week, Argentina’s Rosario Grains Exchange trimmed its 2021/22 soyabean production forecast by 200Kt to 48.8Mt. This was due to a reduced planted area, important considering earlier dry weather. The September WASDE kept its forecast at 52.0Mt, so is something to watch.

Disruptions to US Gulf Coast exports from Hurricane Ida also contributed to some pressure on US soyabean futures last week. However, power is being restored, with some terminals expecting power later this week.

Demand remains a watch point too, with Chinese purchasing of US soyabeans providing some price support last week and preventing prices drifting much lower. The USDA reported three new sales of soyabeans last week to China for 2021/22 delivery, totalling 370Kt.

Malaysian palm oil futures fell at the end of last week on news Malaysian stocks were at the highest point in 14 months (up 25.3% to 1.87Mt). Production was up 11.8%, whereas exports down 17.1%. This led to pressure on the vegetable oil complex.

Rapeseed focus

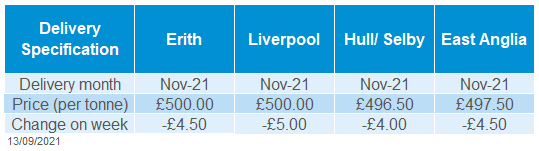

UK delivered oilseed prices

Paris rapeseed futures (Nov-21) closed on Friday at €570.75/t, down €1.00/t Friday to Friday.

UK delivered rapeseed prices (Erith, Nov-21) fell £4.50/t last week to £500.00/t on Friday. Prices followed Paris futures and factored in the bearish sentiment ahead of the WASDE report.

The USDA reduced global oilseed production outside of the US by 1.5Mt to 499.8Mt on lower rapeseed production in the EU and Canada. However, these falls were partially offset by increases in Australian rapeseed production. A smaller Canadian crop reduces global rapeseed availability for export.

Last week, Australia forecast its 2021/22 canola (rapeseed) production at a record of 5.04Mt, up 11.33% from 2020/21.

Canadian canola stocks totalled 1.77Mt on 31 July 2021 (Statistics Canada). This is down from 7.74Mt in March and 3.44Mt in July 2020, but ahead of trade expectations of 0.90 – 1.50Mt (Reuters).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.