Market Report - 09 November 2020

Monday, 9 November 2020

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

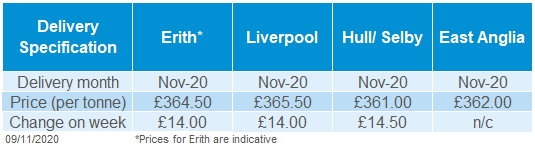

UK delivered rapeseed prices followed the global trend higher, though the gains weren’t quite to the same extent due to changes in the value of sterling. On Friday, rapeseed delivered to Liverpool (Nov-20) was reported at £365.50/t, up £14.00/t from 30 October, more than was lost between 23 and 30 October.

The UK market continues to wait for confirmation of when Erith will begin taking in rapeseed again, with testing underway.

Strategie Grains expects the EU+UK to import 5.9Mt of rapeseed this season, 0.4Mt less than it expected a month ago and was imported last season. This is due to a smaller gap between European and global prices, along with lower demand for biodiesel because of the coronavirus pandemic.

Wheat

Despite political uncertainty pressuring some momentum midweek, global wheat prices witnessed some overall gains in response to continued international demand and weather concerns.

Global grain markets

Maize

Higher Chinese demand is set to continue, with a revised import outlook for maize up from 7Mt to 22Mt for the 2020/21 marketing year. There could also be support if the USDA forecast of a 0.4Mha reduction to 2021/22 US maize planting is confirmed.

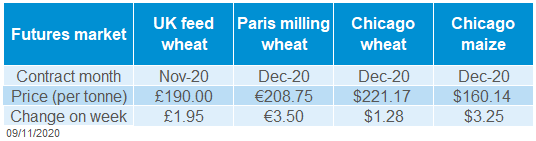

Global grain futures

Barley

Barley continues to price at a large discount to wheat, with the onset of a second English lockdown providing a bleak outlook for malting barley usage.

UK focus

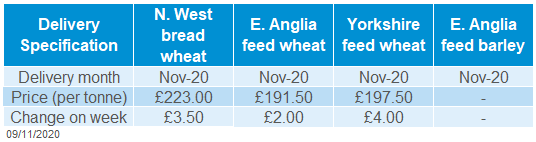

Delivered cereals

Global wheat contracts regained a little momentum at the end of last week, due to international tender demand. Still it was a variable week, with US political uncertainty causing some disturbance. Paris May-21 wheat futures gained £2.26/t to £185.61/t Friday to Friday, while the Chicago May-21 wheat contract gained £0.89/t, closing at £170.95/t. Chicago grain prices gains seemed to be constrained by the falling exchange rate of the US dollar following Tuesday’s election and a long-awaited result.

International wheat purchasing continues to support prices, with large tenders issued by Turkey (555Kt) and Pakistan (320Kt) last week. Saudi Arabia’s state buyer, SAGO, also announced the purchase of 860Kt of wheat for delivery February to March 2021 from mixed origins, including the EU, Black Sea, US, and Australia.

Despite rising concerns over increased coronavirus cases, export demand for US maize remained strong last week, supporting US maize futures prices. On the week, CBOT maize May-21 price gained £2.04/t Friday to Friday, closing at £125.30/t. Continued Chinese demand is supporting prices and the trend for increased imports seems set to continue. The U.S. Department of Agriculture’s Beijing office increased its import outlook for China in 2020-21 from 7Mt to 22Mt, having sold 10.8Mt to China as of 29 October already.

Looking further ahead, the USDA projects a reduction in maize plantings, but increase for wheat plantings for 2021/22 as part of its annual 10-year outlook. US farmers are forecast to increase wheat plantings to 18.6Mha, a rise of 0.7Mha from 2020/21. In contrast, maize plantings are expected to reduce by 0.4Mha, to 36.4Mha for 2021/22. However, La Niña weather concerns still remain for southern US states, potentially impacting winter wheat planting and early development.

Oilseeds

UK May-21 feed wheat futures closed on Friday at £190.80/t, a rise of £3.00/t Friday to Friday coinciding with a strengthening of Sterling against the Dollar.

Delivered prices saw a lift too last week, with East Anglian feed wheat for May-21 delivery up £2.00/t to £198.00/t last week (Thu-Thu). This equated to a premium of £8.00/t over May-21 futures.

Dec-20 delivered feed barley into Avonmouth increased £0.50/t on the week, to £149.50/t. With an imposed second lockdown forcing pubs, bars and restaurants in England to close, malting barley demand by brewers, maltsters and distillers could see further falls contributing to an uncertain and somewhat bleak sector outlook.

Bread wheat delivered prices also gained across the board last week. Dec-20 prices for London/Essex were up £3.50/t from 29 October to £214.50/t, while North West Dec-20 prices increased £4.00/t to £224.50/t. May-21 delivered bread wheat prices in the North West were up £4.00/t from the week before to £234.50/t last week, a premium of £44.50/t over the May-21 futures contract.

Rapeseed

Rapeseed continues to follow the global oilseed trend, with short-term support also provided by the palm oil market. Longer-term prices will depend on confirmation of the Australian crop and the Northern Hemisphere areas for harvest 2021.

Global oilseed markets

Soyabeans

The global market is dependent on record crops being harvested in South America and the current weather casts a shadow on those forecasts. There’s still time for crops, but South American weather will be in the driving seat for many weeks yet.

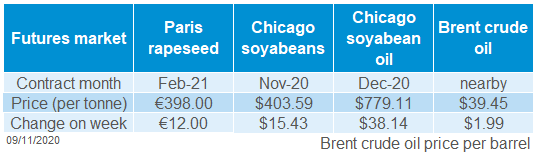

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Global oilseed prices last week regained more than the previous week’s losses due to worries about dry weather in South America. A weaker dollar and firmer crude oil prices also supported markets. Nearby Chicago soyabean futures reached the highest level since July 2016 on Thursday, before easing slightly on Friday.

This season’s South American soyabean crop is currently forecast to be the largest on record (USDA), but global production is already expected to be very close to demand. If the dry weather persists and yields are reduced, we could be looking at a second season of shrinking global soyabean stocks.

US exporters reported another 1.5Mt of soyabean export sales in the week ending 29 October, mostly to China. This takes total commitments for 2020/21 to 48.5Mt, more than was exported in the entire 2019/20 season. There is potential for the pace to slow as the US attaches forecast Chinese imports to decline slightly in 2020/21 because of building stocks. Also, there’s reports this morning that China will seek to renegotiate the US-China phase one deal under a Biden presidency.

Palm oil prices also rallied and the nearby Malaysian futures contract reached an eight-year high on Thursday, ahead of key data on production and stocks this Tuesday. A poll by Refintiv showed industry are expecting stocks to hit a three year low as production is curtailed, partly by wet weather. Longer-term the wet weather could boost production.

Key data out Tuesday: Malaysian Palm oil stats, Brazilian crop forecasts and USDA supply and demand estimates.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.