Market Report - 05 July 2021

Monday, 5 July 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK delivered prices jumped last week tracking large increases in oilseed markets. Rapeseed delivered into Erith (Hvst) was quoted at £462.50/t on 2 July, up £29.00/t. Looking back to this time last season, the same delivery into Erith was quoted at £335.50/t, £127.00/t lower than current price levels.

Canadian canola futures gained on Friday to contract highs, supported heavily by the ongoing severe heatwave afflicting the country. The most active contract (Nov-21) gained 2.4% on Friday to close at CA $830.90 (£486.88/t). An estimated 71% of Alberta’s canola was in good – excellent condition, as of 28 June. Conditions are sure to be affected by the duration of the heatwave if it continues.

Our planting and variety survey (PVS) figures are due for release on 8 July and will give an updated estimate for the domestic rapeseed area.

Global grain markets

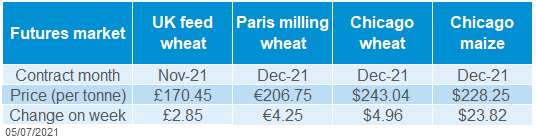

Global grain futures

Wheat

Wheat has very much been a follower of maize. The surplus of production to consumption in 2021/22 (IGC), has kept wheat markets pressured.

Maize

While grain markets remain finely balanced, last weeks US acreage and stocks reports provided some fresh impetus. However, with this now priced in, more information will be needed to add to support.

UK focus

Barley

The barley market remains split. Old crop domestic availability is tight to say the least, however, with demand for new crop likely to be reduced on 2020/21 levels, new crop discounts to wheat are more “normal”.

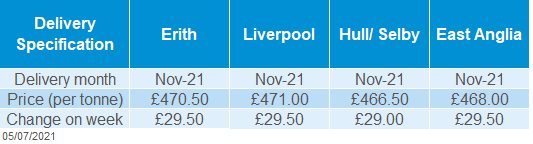

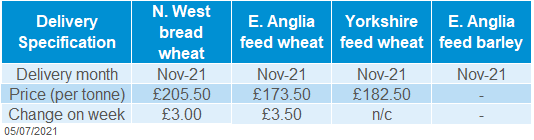

Delivered cereals

After an exciting week for markets last week, the benchmark new crop wheat and maize markets (Chicago and Paris), dipped slightly into the weekend. However, a flurry of bullish news stories from the US to start the week pushed Dec-21 maize futures up $23.82/t (Friday-Friday), at $228.25/t.

The USDA increased the forecast of area planted to maize for harvest 2021, up 2.1% on the year to 37.5Mha. Of that crop 34.2Mha is expected to be carried through to harvest. While increases in crop acreage are typically bearish, the reaction of maize prices, going limit up on Thursday, highlights that the market expected a much bigger area.

Stocks were also deemed to be tighter than the market expected. Stocks of maize on 1 June 2021 were seen marginally below the average of trade expectations, and 17.8% behind year ago levels.

Wheat markets followed maize prices higher last week, although gains for wheat were more limited. Chicago wheat futures (Dec-21) gained $13.59/t Friday-Wednesday, but ended the week just $4.96/t higher Friday-Friday, at $243.04/t. Minneapolis spring wheat futures continue to show strength. Ongoing hot and dry weather has seen the spring wheat premium to Chicago wheat futures grow.

Much of the direction for grains over the next few weeks will be led by weather and crop conditions, particularly in North America. The 14-day outlook is little changed on last week, remaining warm and dry in the Northern States and milder and wetter in the Midwest. This will likely pressure maize and if conditions continue to deteriorate, support spring wheat.

Oilseeds

UK delivered cereal prices followed the global market higher through to last Thursday. Feed wheat delivered into East Anglia (Nov 2021) gained £3.50/t Thursday to Thursday, quoted at £173.50/t. Similar increases were seen across regions for both milling and feed wheat.

Once again, feed barley trade remains very thin, with little being traded. Harvest feed barley, delivered Avonmouth, was quoted at £151.00/t, £21.50/t underneath the respective feed wheat market. This time last year the discount of Avonmouth feed barley to feed wheat stood at £36.50/t.

The latest GB animal feed and UK human and industrial usage statistics were published last week. Both sets of data displayed strong barley usage, which combined with strong feed usage in 2021, has led to the tight old crop (2020/21) market we find ourselves in.

Global oilseed markets

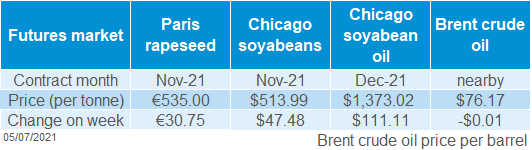

Global oilseed futures

Rapeseed

Domestic prices gained heavily last week, tracking global oilseed price increases. Rapeseed markets are awaiting initial estimates for heatwave damage on Canadian crop conditions.

Soyabeans

A bullish week for soyabean markets, helped by a lower-than-expected US acreage figure. Rainfall hitting parts of the US could bring pressure to prices in the coming days.

Rapeseed focus

UK delivered oilseed prices

Oilseed markets rebounded last week following the bullish stocks and acreage reports for US soyabean markets. Large purchases of US soyabeans by China (1.15Mt) last week supported prices too. Outside of the US, gains in crude oil markets ahead of the next OPEC+ meeting have added to support. Finally, palm oil markets have offered pressure through expectations of 9-month high stockpiles, following weak export demand.

US soyabeans futures (Nov-21) gained $47.48/t Friday-Friday last week, to close at $513.99/t (£373.89/t). US markets and the USDA are closed today observing Independence Day. As such, the next USDA crop condition report released tomorrow.

Whilst the US soybean acreage is still 1.8Mha above plantings last season, at 35.4Mha, figures were below industry expectations. The ongoing dry weather concerns particularly for the Northern Plains and Upper Midwest have contributed to worries surrounding supply. This is especially so with a lower than anticipated planted area. Rainfall is forecast in the near-term for some afflicted regions.

In vegetable oil markets, India has resumed purchases of refined palm oil. This follows the reduction of import taxes for the country. This will look to help reduce the global supply overhang of palm oil, with Malaysian inventories forecast at nine-month highs.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.