Barley in demand in May: Grain market daily

Friday, 2 July 2021

Market commentary

- Global grain markets stabilised yesterday, after rising on Wednesday following the US planted maize area and stocks US wheat prices dropped due to profit taking by speculative traders and lower export sales than last week.

- UK feed wheat futures (Nov-21) gained £0.10/t to £172.80/t, while Nov-22 gained £1.05/t to £170.00/t.

- In France, rain slowed winter barley harvesting, with just 2% of the crop cut by 28 June. This up from 1% on 22 June, but well behind the 38% cut at the end of June 2020. The last few days have been drier, but rain is forecast for next week.

- Nov-21 Paris rapeseed futures rose another €5.75/t to €535.25/t yesterday. This follows worries about the impact of continued hot, dry weather on Canadian canola crops despite Statistics Canada confirming that the planted area is up 8.3% this year. Agriculture and Agri-Food Canada had forecast a rise of 3.6%.

Barley in demand in May

In May, barley was in demand by both animal feed compounders and the human and industrial (H&I) sectors.

Animal feed continued apace

The amount of barley used in GB compound feed remained high in May. The sector, including Integrated Poultry Units (IPUs), used 145.2Kt of barley. This was 45% more than May 2020 and a record for the month.

Barley usage in animal feed was high throughout the 2020/21 season due to the small UK wheat crop. But, the rate of inclusion slowed slightly in April and May as the UK barley supply began to tighten. Barley peaked at 15.1% of all raw materials used in March. This was down to 14.5% in May, though still well above the 2015/16 -2019/20 average of 8.6%.

As supply tightened, ex-farm feed barley prices (UK average, spot) closed the gap to feed wheat. From over £50/t in January, the gap was £15.30/t last week, suggesting less barley was used in animal feed in June. We will get the data on 5 August.

Malting barley demand picked up

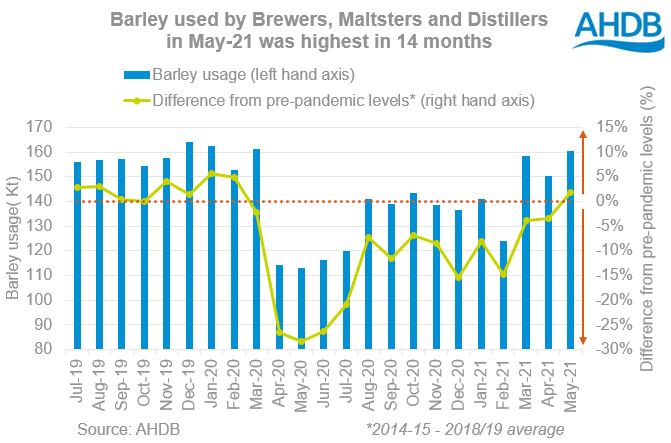

In May, brewers, maltsters and distillers (BMD) used the largest tonnage of barley since March 2020. It is the biggest volume used since the pandemic began. This reflects the growth in the number of venues trading since customers were able to return in April.

However, at the end of May nearly a quarter of licensed venues across the UK remained closed (CGA). A number of music festivals, including Glastonbury, have also been unable to go ahead this summer. So, we will have to wait and see if the more ‘normal’ barley usage continued into June.

Looking ahead

Year to date (July-May) usage of barley by both the BMD and animal feed sectors is higher than AHDB forecast back in May. For example, AHDB forecast barley usage by GB compounders in the whole of 2020/21 up 30% on 2019/20. For the year to date (July-May) usage is up 36%. Depending on the rates of usage in June and trade levels, UK barley stocks may be slightly lower than we forecast in May.

As the 2021/22 season begins, the pick-up in BMD demand in May is encouraging but as always in the COVID era, this is subject to how the pandemic and easing of lockdown restrictions continue to unfold. Meanwhile, a drop in animal feed demand is likely due to a smaller barley area and an expected recovery in wheat availability.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.