Majority have not replaced harvest 2024 cropped area with SFI: Grain market daily

Thursday, 25 July 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £196.00/t yesterday, no change from Tuesday’s close. The May-25 contract gained £0.75/t over the same period, to close at £205.90/t.

- Ample wheat supply in the Black Sea region is pricing competitively as Russian milling wheat (12.5% protein) was quoted at $217.50/t (FOB – Novorossiysk) yesterday, pressuring European wheat markets. However, continued uncertainty over how impactful heavy rains in western Europe have been for harvests in France and Germany offers support.

- Paris rapeseed futures (Nov-24) closed at €492.75/t yesterday, down €6.75/t from Tuesday’s close. The May-25 contract fell €5.75/t over the same period, to close at €493.00/t.

- Paris rapeseed futures tracked weakness in the oilseeds complex as Chicago soyabean futures fell following expectations of lower demand while Malaysian palm oil futures depreciated in response to the Malaysian Palm Oil Association estimating greater production in July.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Majority have not replaced harvest 2024 cropped area with SFI

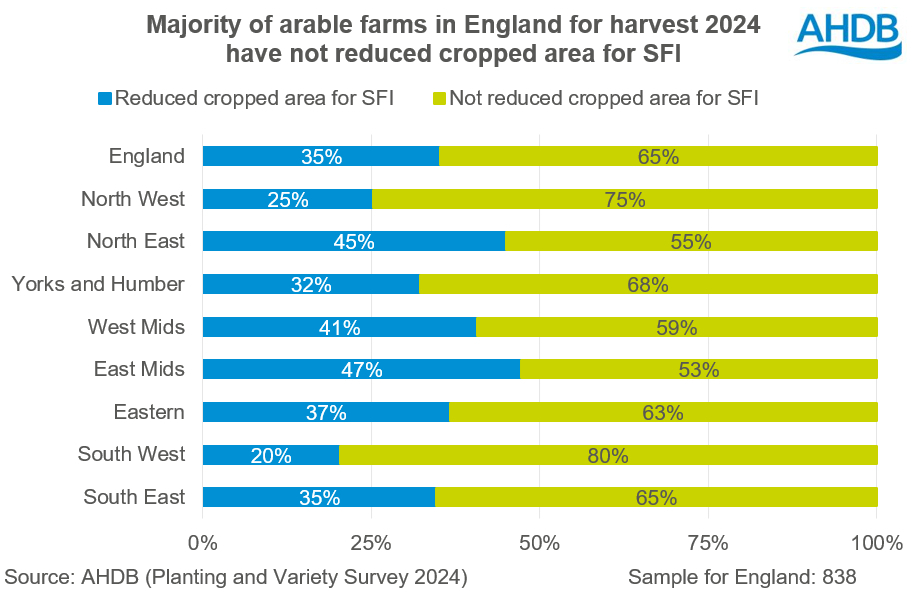

As part of the AHDB Planting and Variety Survey (PVS) 2024, questions were asked regarding SFI uptake. Results show that 65% of arable farm businesses in England surveyed did not reduce their cropped arable area for harvest 2024 with SFI options. While this percentage does vary regionally, considering sample size for each region too, the majority of arable farm businesses surveyed in England opted not to take cropped land out for SFI options.

This proportion aligns closely with recent Defra statistics too, covering all farming sectors, where analysis shows the majority of farms (53%) have not taken land out of production for SFI.

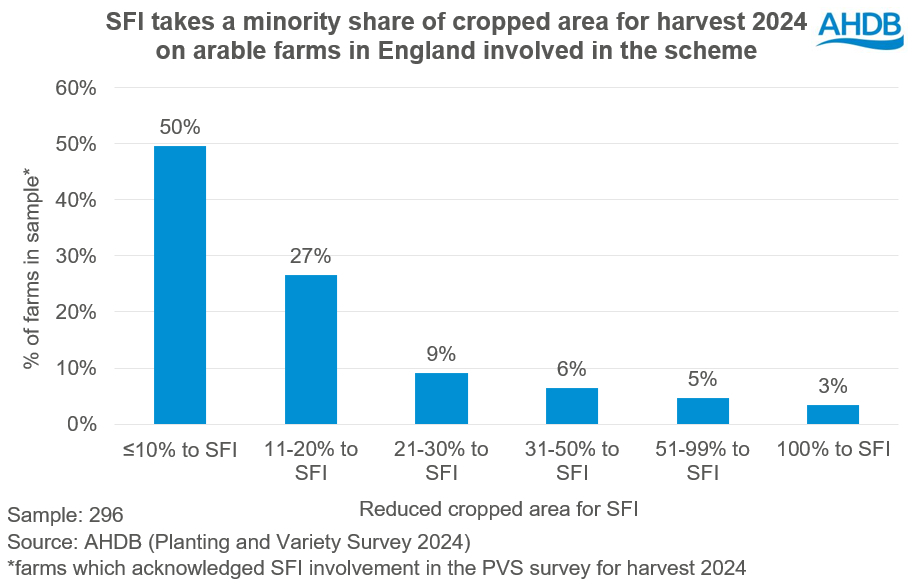

In addition, of the sample who had taken land out for SFI, half of them substituted equal to or less than 10% of their cropped land. While just over a quarter (27%) took 11-20% of cropped area out and just under a quarter (23%) took 21% or more of cropped area out. Overall, the larger the percentage of cropped area taken out for SFI actions on farm, the smaller the percentage uptake of farms going down that route in the sample.

This also aligns with the recent Defra SFI 2023 uptake figures, where the majority of farms had less than 10% of farmland for selected SFI options and then uptake largely reduces as area for SFI increases.

SFI as part of an arable rotation

The benefits of SFI may vary due to the individuality of farm businesses, for example, the payments for herbal lays and legume fallows that the scheme offers has appealed to some as an alternative to a break crop. Plus, there are non-financial benefits of improving soil health too, which may benefit rotations mid to longer term.

However, although price volatility in agricultural markets can lead to uncertain margins, model analysis undertaken by AHDB highlights how break crop OSR can still return a better income than SFI, unless prone to consistent crop failure.

Top tips for farmers looking at SFI:

- Avoid taking generic advice – pick and deploy options that best suit the business, farm and objectives

- Hunt out the value – margin over costs (not the payment rate) and look for the indirect productivity gains

- Start at a manageable level and build up with experience

- Keep plenty of records and photographs

- Look out for ongoing AHDB analysis

Looking ahead to SFI 2024

Recent AHDB analysis identified that for more ambitious SFI actions requiring additional land, where cash crop area must be compromised, net profit levels are likely to suffer. But if actions can be carried out on unproductive areas without sacrificing cash crop area, it is likely to increase net profit, while also helping to regenerate land long term and help stabilise farm business incomes in years of average or low crop prices. This is perhaps a theme we have started to see play out in the uptake data of SFI options impacting harvest 2024, though there is no one size fits all.

You can access more SFI analysis on the AHDB website and on the latest AHDB Agonomics podcast.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.