Lower quality from 2023 harvest confirmed: Grain market daily

Friday, 27 October 2023

Market commentary

- Nov-23 and May-24 UK feed wheat futures both gained £0.65/t yesterday. The Nov-23 contract closed at £185.45/t, while the May-24 contract closed at £197.65/t.

- Global wheat prices edged higher yesterday on uncertainty over Ukrainian exports, after reports yesterday that the new export corridor had been suspended. The Ukrainian Deputy Prime Minister has denied these reports.

- Many areas of Argentina received more than 30mm of rain last week according to the Rosario Stock Exchange. This has reportedly stopped further wheat yield losses and will support soyabean planting, with an estimated 200 Kha switching to soyabeans from maize due to the earlier dry weather.

- Feb-24 Paris rapeseed futures lost €0.25/t to close at €431.25/t. The Nov-23 contract closed at €406.50/t, down €5.00/t over the day due to technical factors ahead of the contract finishing trading on Tuesday 31 October.

- The rain in Argentina weighed on oilseed prices as it supports the chance of larger soyabean areas being planted there. However, markets continue to watch the weather forecasts for Brazil, which limited price falls.

Lower quality from 2023 harvest confirmed

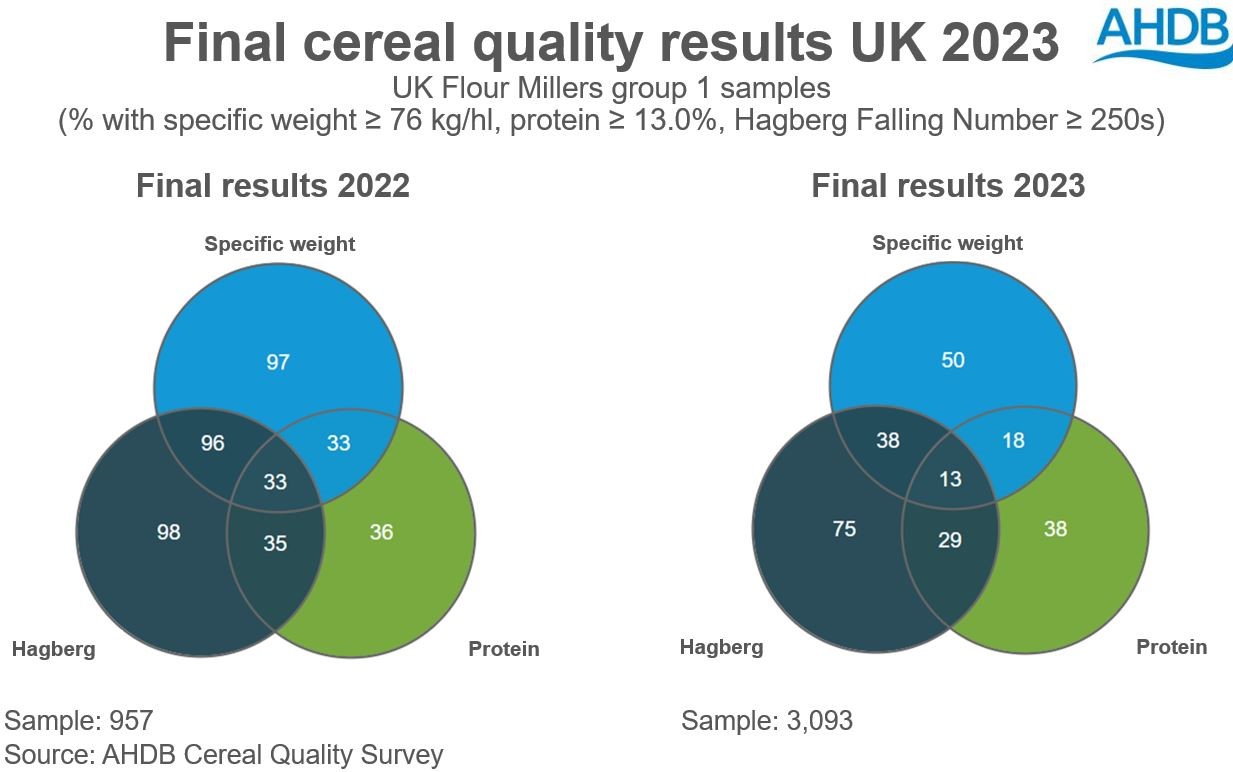

Results from the Cereal Quality Survey confirm lower quality for both wheat and barley from the 2023 harvest, including specific weights. Unsurprisingly moisture contents are also higher due to the wet weather at harvest, along with lower Hagberg Falling Numbers (HFNs) for wheat.

Wheat

The survey shows that just 13% of UK Flour Millers group 1 samples meet a typical specification (protein ≥13%, HFN ≥250s & specific weight ≥76kg/hl). This is down from 33% last year and 20% in 2021. While highly variable, industry sources suggest the 2023 crop is reasonably functional with imports currently forecast to be stable year-on-year.

Nonetheless, the lower GB quality, along with poorer quality in Europe, have pushed up delivered bread wheat premiums from last year’s high levels. Last Thursday (19 Oct), bread wheat (meeting a typical specification) delivered to the North West was reported at £273.00/t, a £84.50/t premium over Nov-23 futures. A year ago (27 Oct 2022), the premium for Nov-22 delivery was £76.00/t over Nov-22 futures.

Highlights from the survey include:

- HFN: The results confirm lower HFNs, which were widely expected due to wet weather during the harvest. Historical comparisons are only indicative due to a change to the methodology last year. That said, at 282 seconds the 2023 average GB HFN is likely the lowest since 2017 (248s) when many farmers had to wait for a break in the rain to harvest ripe crops.

- Specific weight: The GB average is 75.6kg/hl, down from last year’s high level of 81.2kg/hl and the three-year average of 78.3kg/hl. Lower specific weights are expected to reduce extraction rates for flour milling this season, meaning more wheat needs to be milled to achieve the same flour output.

- Protein: The average for group 1 samples is up slightly (0.1%) from last year at 12.7% but below the three-year average of 12.9%. When compared to their respective three-year averages, group 1 samples seem to have fared better than group 2 samples. High nitrogen fertiliser costs and difficulties accessing supplies for some, forced targeted applications.

- Moisture: At 15.0%, the GB average moisture content is above last year’s low level and is likely the highest since 2012.

View the full details for wheat here.

Barley

The 2023 Cereal Quality Survey confirms reports from during the harvest of lower specific weights for barley. The year-on-year declines for spring varieties are much larger than those for winter varieties.

At 62.6kg/hl the 2023 GB average specific weight for all barley samples is likely the lowest in the history of the survey, which began in 1977. The change in methodology in 2022 means the results are not directly comparable but this still gives an indication of the challenge to industry.

Screening levels are also poorer year-on-year, though winter varieties fared much worse than spring varieties. On average, 82.0% of winter varieties were retained by a 2.5mm sieve, 7.7 percentage points (pp) below the three-year average of 89.7%. For spring varieties, 94.5% were retained, 0.7pp below the three-year average.

For winter barley, nitrogen content averaged 1.70%, comparable to last year and marginally higher than the three-year average of 1.68%. The nitrogen content in spring barley samples averaged 1.62%. This is higher than in 2022 (1.50%) and the three-year average of 1.56%.

Across all barley samples, the average moisture content is 16.0%. This is sharply up from last year’s low level of 14.3% and slightly above 2021 (15.9%).

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.