A weak week for wheat, where next though? Grain market daily

Thursday, 26 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £184.80/t yesterday, down £1.20/t from Tuesday’s close. The Nov-24 contract also fell over the same period by £0.80/t, ending yesterday’s session at £201.30/t.

- Global wheat markets continue to feel the pressure with prices also sliding for both Chicago and Paris wheat futures. While rainfall in Argentina has alleviated wheat supply concerns and demand has also slowed in Europe.

- Nov-23 Paris rapeseed futures gained €6.00/t yesterday to close at €411.50/t, while over the same period the Nov-24 contract gained €10.00/t, closing at €447.00/t.

- Gains in Paris rapeseed have followed gains in Chicago soybean oil and Malaysian palm oil. Also, conflict in the Middle East increased nearby Brent crude oil futures yesterday by 2%, closing at $90.13/barrel.

- Announced this morning there is reports from Barva Invest Consultancy that Ukraine has suspended the new Black Sea grain corridor due to threat from Russian warplanes. It’s reported that Ukrainian officials were not available for comment (Refinitiv). Grain market’s this morning do not seem to have reacted to supportive towards this news with UK feed wheat futures (May-23) trading at £196.30/t this morning (11:00).

A weak week for wheat, where next though?

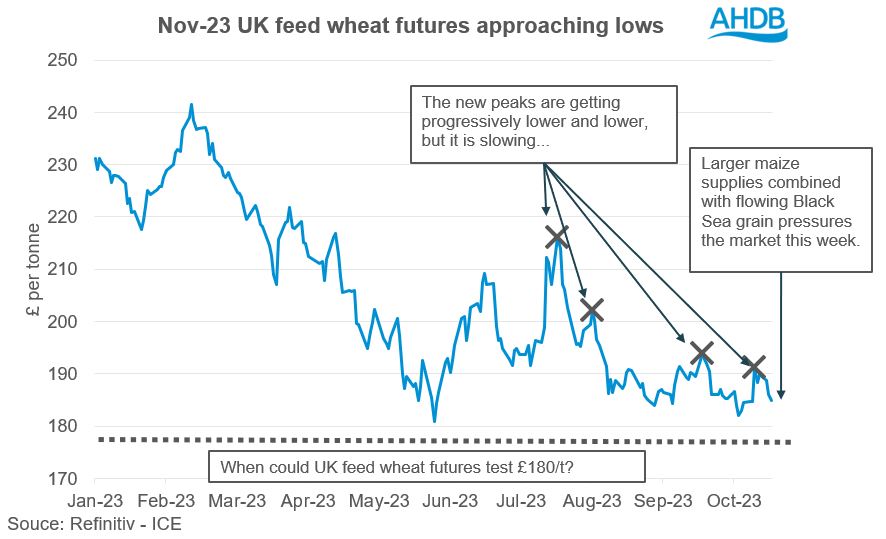

UK feed wheat futures (Nov-23) have been pressured so far this week, closing yesterday at £184.80/t. The contract has been pressured downwards from the recent peak set of £191.30/t last Wednesday (18 Oct). Over the longer-term UK wheat futures continued to be pressured but it appears the downward pressure is slowing.

Largely dictating the pressure on the domestic futures this week has been the pressure in Paris wheat futures.

Reasons for this is include a reduced export demand for European origin wheat with a lack of new tenders from major importers. Further, the recent rain in both Australia and Argentina has eased wheat production concerns in both these countries, which are predicted to account for 14% of global wheat exports in the 2023/24 marketing year.

Moreover, the limelight is still on very competitive Black Sea grain, which is currently supplying the global market. For context, Russia spot feed wheat (FOB - Novorossiysk) was quoted at $196/t (approx. £162/t) yesterday. This is a significant discount to EU Black Sea spot feed wheat (FOB - Constanta, Varna, Burgas), which was quoted at $227.5/t (£188/t) (UkrAgroConsult).

Further to that, Ukraine’s ‘new’ Black Sea corridor has been bolstering world supplies. The Ukrainian Agriculture Minister reports that over 700 Kt of grain has passed since the operation began in August.

What is the outlook going forward?

In recent AHDB market reports we have indicated marginally bearish longer-term outlooks for grains. This is because globally on paper, grain markets are well-supplied, especially maize markets. A near-record US maize crop is coming to market right now and South America is expected to plug the seasonal gap from the start of 2024.

The geo-politics in the Black Sea seem to have cooled at the moment, which is adding to the bearishness within markets. If that continues, markets will be relying on a weather event to keep grain markets supported.

To a large extent, the damage to Australia’s wheat crop is done, as harvest is imminent. For Argentina the crop is at more critical stages with the crop currently heading. The next major watchpoint will be the second Brazilian maize crop being successfully planted and harvested in the beginning of 2024. There is potential early signs of issues with Brazilian soyabean crop plantings (the second maize crop will follow this crop), but that is a critical watchpoint over the next two to four weeks.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.