Domestic wheat consumption on the rise? Grain market daily

Tuesday, 17 October 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £0.20/t yesterday, ending the session at £184.75/t. The Nov-24 contract closed at £198.85/t, up £1.35/t over the same period.

- European wheat markets ended yesterday relatively unchanged. While wheat markets felt some support towards the end of last week on strong global demand, a lack of further demand news stopped any further gains. Competitive Black Sea supplies also continue to cap any major gains in grain markets.

- Paris rapeseed futures (Nov-23) closed at €424.25/t yesterday, down €1.25/t from Friday’s close. The Nov-24 contract was down €1.25/t over the same period, closing the session at €451.75/t.

- Paris rapeseed futures moved in the opposite direction to US soyabeans yesterday, as the strengthening euro meant EU prices were less competitive. Yesterday €1 = $1.0538, up 0.1% from Friday.

Domestic wheat consumption on the rise?

The 2023/24 Early Balance Sheets for wheat and barley were published today, which provide a first look at supply and demand for the season ahead. For wheat, a yearly fall in availability, combined with a climb in domestic consumption, sees a much tighter balance than the 2022/23 season. For barley, declines in availability are more than offset by a fall in demand; this leads to expectations of a heavier barley balance this season compared to last.

Outlined below are the key demand drivers this season, as well as the main areas to watch as we progress through the marketing year.

Wheat

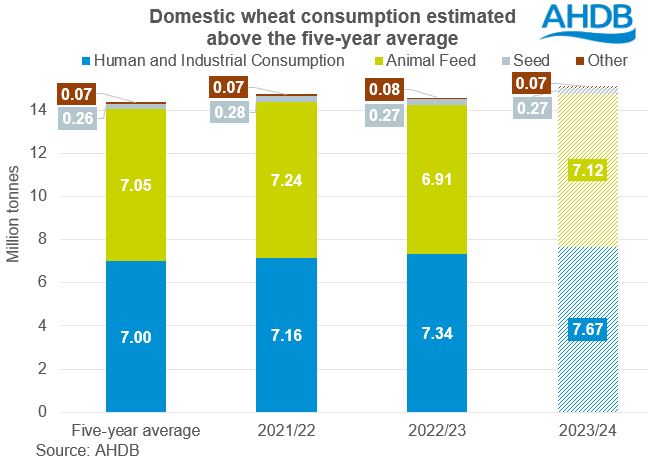

Total domestic consumption of wheat for the 2023/24 season is expected to be up 534 Kt on the year, at 15.124 Mt. This climb is due to year-on-year increases in both human and industrial consumption (up 5%), and animal feed consumption (up 3%).

Human and industrial consumption of wheat is expected to rise this season, largely due to increased demand from the bioethanol and starch sector. As we know, when looking at the UK flour miller’s data, the ‘other flour’ production category mostly represents output from these industries. This season to date (July–August), ‘other flour’ production is up 14.6% on the year, suggesting a strong start to the season.

It is expected that both bioethanol plants will remain operational in 2023/24. Vivergo Fuels parent company, Associated British Foods, reports reduced losses at the end of the last financial year. Our current estimates also assume the resolution to the renewable energy directive (RED II) requirements following the UK’s exit from the EU. The wheat S&D could evolve significantly through the season if we see any changes to the RED II status of domestically produced grain.

Wheat usage by UK flour millers is also expected to be up slightly on the year. The ‘cost-of-living crisis’ is impacting the use of flour in some premium products. However, reports of lower extraction rates this season bring estimated wheat demand up marginally from 2022/23. Reports from industry suggest the quality of this year’s wheat crop is variable but relatively functional. Despite imports not pricing competitively everywhere across the UK currently, a variable and smaller crop means UK flour millers are expected to use a similar proportion of imported wheat this season compared to last.

Wheat usage for animal feed is expected to increase by 210 Kt to 7.119 Mt. Total animal feed production by GB compounders and UK Integrated Poultry Units is expected to remain fairly static. However, the cereal inclusion and the proportion of wheat used in comparison to other cereals are both expected to rise due to wheat’s relative price. As it stands, although input costs are expected to fall for livestock and poultry producers, a significant rebound in feed production is unlikely; this will be something to watch over the next few months.

Barley

At 6.021 Mt, total domestic consumption of barley is estimated down 120 Kt on the year. Despite an anticipated rise (up 1%) in human and industrial consumption, a 3% decline in barley usage for animal feed outweighs these gains.

Human and industrial barley usage is estimated to reach 1.991 Mt this season, up 11 Kt on the year; if realised, this will be the highest since the late 1990s. Anecdotal reports suggest the cost-of-living crisis is expected to impact brewing demand, but demand for distilling will remain robust due to increased capacity coming online last season.

Usage of barley for animal feed is forecast to decline by 129 Kt on the year, to sit at 3.814 Mt. The reason for this is that wheat and maize are expected to price more competitively than barley this season, meaning barley inclusions in rations have been reduced.

Read the full set of 2023/24 wheat and barley supply and demand estimates.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.