Lower proteins persist as wheat harvest presses on: Grain market daily

Friday, 30 August 2024

Market commentary

- Global wheat futures prices gained again yesterday supported by worries about EU production and short covering by speculative traders. Nov-24 UK feed wheat futures gained £0.85/t yesterday to settle at £182.15/t.

- Yesterday the EU Commission cut its estimate of the 2024 EU-27 soft wheat (exc. Durum) crop from 120.8 Mt to 116.1 Mt. Barley production is now pegged at 51.3 Mt, down 1.4Mt from July, while maize output was reduced by 1.3 Mt to 61.7 Mt and now below 2023’s level. Rapeseed production was cut by 0.4 Mt to 18.0 Mt. These cuts follow reduced yields projections by the EU’s crop monitoring service earlier in the week.

- Nov-24 Paris rapeseed futures rose €8.50/t to €469.75/t, supported by stronger vegetable oil prices, stronger US soyabean futures and short covering. US soyabean weekly export sales came in stronger than expected.

Lower proteins persist as wheat harvest presses on

With the 2024 UK wheat harvest now into its closing stages, lower protein levels continue to be reported. AHDB’s third harvest progress report of 2024 shows that by 28 August 88% of wheat had been harvested across the UK. This is up from 37% a fortnight ago meaning more insight into the crop’s quality is available.

However, protein contents continue to be on the low side. It’s reported that so far UK Flour Millers Group 1 samples have generally averaged 11.5% to 12%, though some samples have exceeded 13%. This is likely linked to duller than usual conditions during the grain fill period, as well as difficulty timing nutrient applications during the spring and a need to target spend to crops’ potential in some cases.

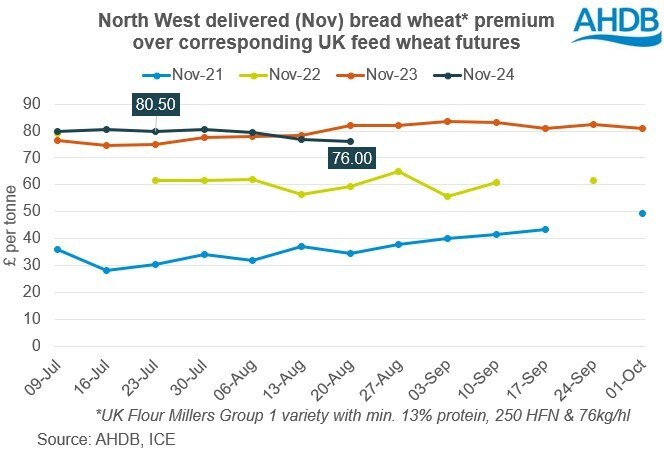

However, other measures of quality continuing to look positive, such as specific weights and Hagberg Falling Numbers (HFN). Anecdotally, the crop will be manageable and there are reports of higher volumes of imports of high protein wheat to blend with lower protein UK samples. As a result, the premiums for delivered full specification bread wheat over UK feed wheat futures, have softened slightly in recent weeks.

As of last Thursday (22 August), full specification bread wheat (Group 1 varieties with min. 13% protein, 250 HFN & 76kg/hl) to be delivered into the North West in November 2024 was reported at £257.50/t. This equated to £76.00/t above the Nov-24 UK feed wheat futures price on the same date. This is down from 25 July, when the reported price for bread wheat for the same delivery (North West, Nov-24) was £80.50/t above the Nov-24 futures contract.

But, with protein content a challenge in Europe too and the smaller UK wheat area for harvest 2024, the premiums remain historically strong. AHDB’s next delivered price survey is due out later today and will show prices and premiums for 29 August 2024.

Meanwhile, lower nitrogen contents are also being reported for barley. Insights on yields for wheat, alongside progress, yields and quality information for barley, oats and oilseed rape can be found in the full report here.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.