Looking ahead to 2021 wheat prices: Analyst Insight

Thursday, 11 June 2020

Market Commentary

- UK feed wheat futures (Nov-20) closed at £167.75/t yesterday, down £0.25/t from Tuesday’s close, potentially influenced by a decline in US maize futures.

- Sterling also edged higher yesterday, reaching its highest level against the US dollar since 11 March at £1 = $1.2786 (ECB).

- In contrast, US wheat futures closed slightly higher, supported by a weaker US dollar and traders reportedly re-positioned ahead of tonight’s monthly supply and demand report from the USDA. The report will be released at 5pm BST.

- One area to watch is dry weather in central Argentina, where planting of the 2020/21 wheat crop is approximately 40% complete. Farmers were expected to plant a record 7Mha but the Rosario Grains Exchange warned yesterday that the area will drop unless rain arrives soon.

Looking ahead to 2021 wheat prices

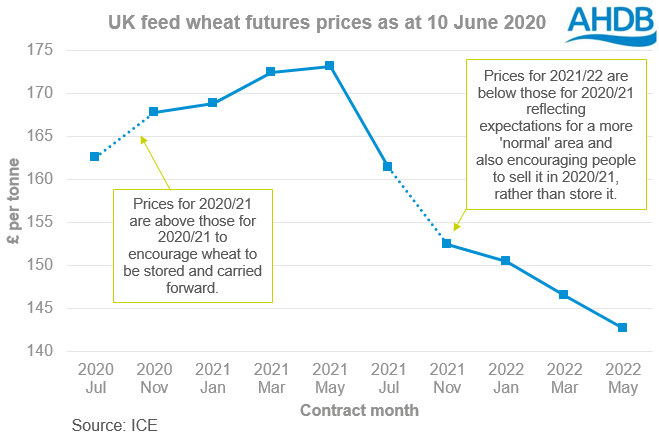

UK feed wheat futures for Nov-21 delivery have been trading for nearly ten months now and have closed in a range of £145.35/ to £158.80/t. Yesterday (10 June), the Nov-21 contract closed at £152.40/t, some £15.35/t below the Nov-20 contract.

A reflection on expected tight 2020/21 supplies

A small UK wheat crop is expected this year after the area planted was limited by the wet weather last autumn. Also, the dry weather during April and May was challenging for crops. While rain has arrived recently, there has been considerable variation in the amounts and it seems to have been too little too late for some crops.

While wheat demand is uncertain due to the impact of the coronavirus pandemic, the area is that low we’re still expecting demand to exceed production and that higher grain imports will be needed in 2020/21.

The price gap between Nov-20 and Nov-21 prices likely reflects a couple of things:

- Firstly, expectations that the market will need every bit of wheat in the UK to be available within next season, with only a minimum carried into 2021/22. A similar price pattern was seen ahead of the 2014 crop being planted; the 2013 crop was just 11.9Mt after wet weather limited autumn plantings.

- And secondly, expectations that the UK wheat area and production will recover for harvest 2021. When adverse weather in the autumn has limited winter wheat plantings for harvest in 2001 and 2013, the total wheat area and production rebounded in the following years.

The opposite has been true for the approaching season, with Nov-20 prices above those for the 2019 crop. This price relationship reflected the ample supplies in 2019/20 after the large crop and a need to carry wheat forward into 2020/21 to help offset the small crop. This price incentive (positive carry) worked and potentially contributes to the UK highest wheat stocks in recent records, estimated at 3.4Mt.

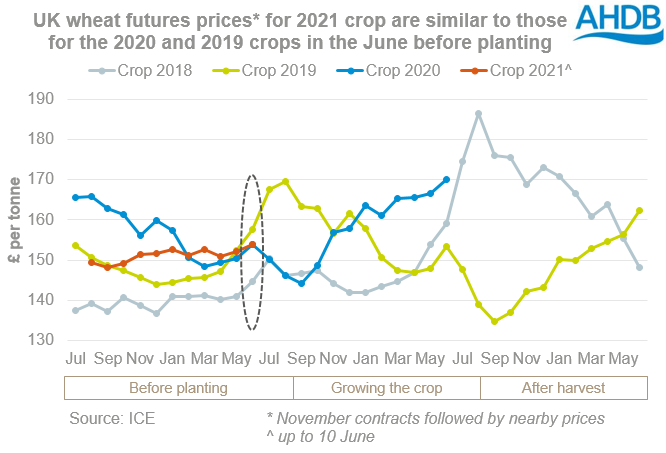

Similar incentive to plant as last year

Prices for 2021 are very similar to where the Nov-20 prices were in the June before planting started, before the wet weather set in limiting planting and pushing up prices. They're also close to where Nov-19 price were 14 months before harvest and the need to export a large crop before end-October pressured prices.

While past prices are no indicator of where prices might go in the future, it potentially offers a similar incentive to plant wheat as in the past couple of years at a price level alone.

Full farm specific margin calculations, rotational considerations, input costs and more are critical to planting decisions. AHDB has a whole host of tools that can help and you can find your local Knowledge Exchange Manager here. This year, local demand levels for crops and varieties are also particularly important given the uncertainty over demand triggered by the coronavirus pandemic.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.