Large closing stocks weigh on UK wheat supply & demand: Grain Market Daily

Friday, 29 May 2020

Yesterday was the release of the latest 2019/20 UK cereal supply and demand estimates. This release covers the first forecast for exports and closing stocks for the season, to find out more check out the supply & demand page on the website.

Market Commentary

- UK new crop futures (Nov-20) closed yesterday at £173.00, a rise of £1.50 on the day and up £3.55 from Tuesday’s close. This support has come from a weakening sterling and dry weather across the UK and northern Europe.

- The European Commission has cut 4.3 million tonnes from its wheat production estimate, from 125.8Mt to 121.5Mt. Last year the EU-27 harvested 130.8Mt.

- Paris Aug-20 rapeseed futures closed down €5.25 at €369.25, its lowest level since mid-May.

- US ethanol stocks are down 0.45k barrels from the previous week to 23.2k barrels. This is the lowest stocks have been since 10 January and could indicate that maize demand is starting to recover.

Large closing stocks weigh on UK wheat supply & demand

Higher UK wheat supplies due to a large production year and relatively stable demand, combined with our export campaign slowing considerably post October have resulted in a large increase in closing stocks. End of season stocks are currently forecast at 3.4Mt resulting in potentially the largest end of season stocks on records dating back to 1999/00.

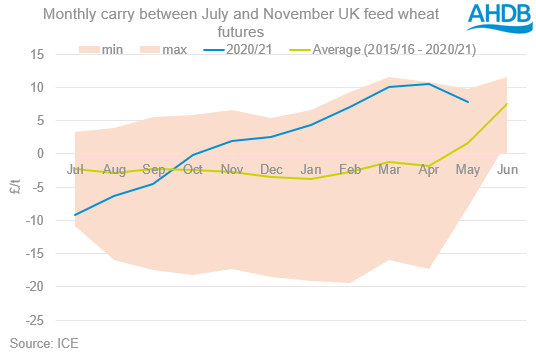

Another factor contributing to this has been the carry in the market from old crop to new crop incentivising farmers to store their wheat into next season. Nov-20 wheat futures has been at a premium to the July-20 contract since October 2019 and this spread has steadily widened throughout the season. Anthony discussed earlier in the year the economic viability of growers holding wheat into the new season. This carry has been caused by factors affecting both old and new crop.

Due to a large domestic crop in the 2019/20 season substantial volumes needed to be exported. Therefore, UK wheat had to stay price competitive into the EU and further afield. The season started off with an fast-paced export campaign that unfortunately slowed up post the previous Brexit deadline at the end of October as we discussed here.

Support to the Nov-20 contract has been provided by weather concerns, both domestically and globally. Here in the UK, we had an exceptionally wet autumn and winter which seriously hampered winter plantings and lead to a considerable reduction in winter wheat area drilled. This has been followed by a very dry couple of months. May is looking set to be the driest on record, likely reducing yield potential of the wheat area planted. There is more details on crop conditions in May here.

Another factor that is expected to push up ending stocks is reduced demand due to the coronavirus pandemic and subsequent lockdown, limiting demand into food service. The balance sheet estimates are based on lowered demand for food service for the remainder of the 19/20 season.

This large carryout figure could pressure prices if we were looking at large production next year, such as 2019/20. However, facing the tight supply we are expecting, it is less of a concern.

Barley

Barley also saw a large production year, slightly offset by increased exports and a slight increase in domestic consumption, however barley ending stocks are expected to reach a four year high. Human and Industrial demand for barley is likely to remain subdued for the remainder of the season and quite possibly into the start of the 2020/21 crop year. This is due the temporary closure of pubs and restaurants across the UK and Europe.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.