Analyst Insight: Minimal exports pose large stocks risks

Thursday, 16 January 2020

Market Commentary

- Global grain and oilseed markets have fallen following the signing of the Phase one US-China trade deal. A pledge for China to purchase US goods based on ‘Market conditions’ rather than commit to volumes led to falls in Chicago maize and soyabean futures, with Chicago wheat having recorded losses today.

- UK feed wheat futures (May-20) closed at £157.45/t yesterday, falling £0.25/t. May-20 Paris rapeseed lost €6.75/t to close at €405.75/t.

Minimal exports pose large stocks risks

The 2019/20 season began with the need to export a large volume of wheat due to the 16.2Mt harvest. As such, domestic prices were at a competitive level into EU and indeed non-EU origins. The pace of exports until October was on track to clear this exportable surplus.

However, this fast export pace slowed dramatically into November. Political uncertainty around potential trade disruptions reduced the appetite from buyers and sellers for UK wheat exports post the previous October Brexit deadline.

At the same time, the wet autumn created difficulty in planting winter wheat for 2020/21. The prospect for a deficit in 2020/21 pushed up new crop prices and also pulled up old crop values.

So while the political uncertainty regarding trading relationships for the remainder of the 2019/20 has subsided, which would have enabled a resumption in exports, current domestic wheat prices are now uncompetitive in the global export market place.

At just 742Kt of wheat exported so far this season, there remains over 2Mt of wheat available for free stock or export for the remainder of the season 2019/20.

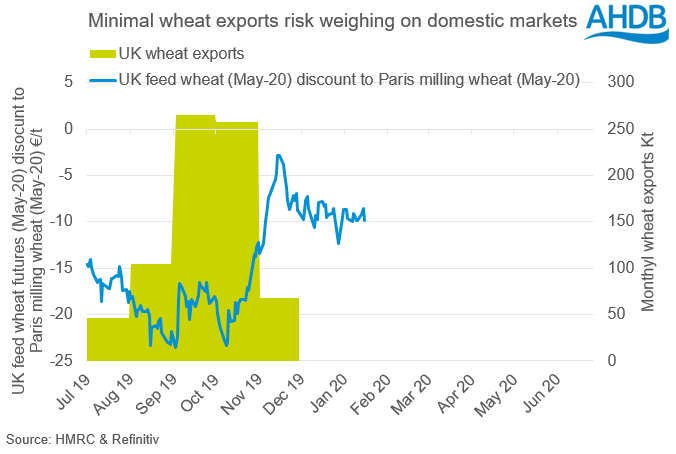

Taking the relationship between May-20 UK feed wheat futures and May-20 Paris milling wheat futures, in euro terms (see graph below), the upward move of old crop domestic prices can clearly be seen, correlating with a fall in export volumes. A continued lack of competitiveness of UK feed wheat will continue to dent the volumes of UK wheat exports and reduce the incentive to book in new trade for the remainder of the season.

This lack of export volumes and current lack of competitiveness is building up risks for both 2019/20 and 2020/21 domestic prices.

The degree of support that domestic prices have gained has already begun to be eroded as the volume of remaining old crop stocks weighs on the market.

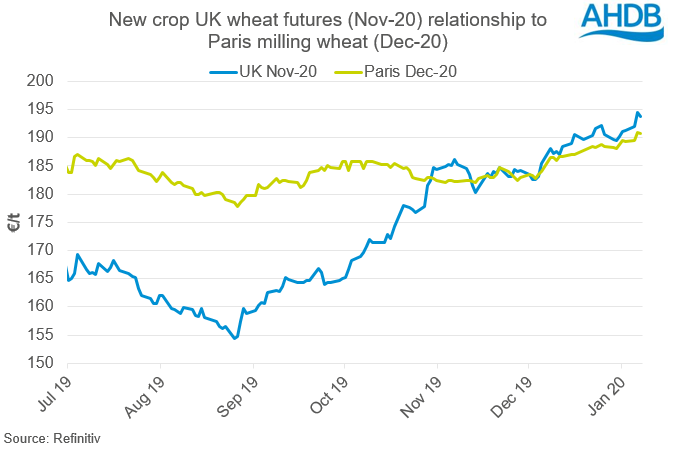

Yet looking toward the 2020/21 season, a smaller area has led to an expectation for a domestic deficit and import requirement. As such, the Nov-20 UK feed wheat futures contract has already moved up to price at a historical import levels relative to Paris milling wheat futures (Dec-20).

A continued minimal old crop export campaign will add to the volume of stock carried over into next season, easing the potential deficit.

With total domestic consumption at 16Mt, there is the potential for the supply and demand outlook for 2020/21 to be closer to balance than is currently being priced in.

With an operating stock requirement of 1.55Mt, and minimum imports of 1Mt for higher specification bread wheat, the remaining domestic demand could potentially be met through a combination of a 12Mt crop (1.6Mha and 7.4t/ha) and 1.6Mt of remaining old crop exportable surplus.

Should the overall domestic wheat balance for 2020/21 move away from the degree of deficit that is currently expected, then the pricing relationship between new crop November-20 UK futures to Dec-20 Paris milling wheat futures could well fall away.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.