Lamb market update: What is happening with prices?

Wednesday, 24 July 2024

The GB SQQ deadweight lamb price has been easing over recent weeks as we explore the key drivers.

Key points

- GB deadweight SQQ grew 1.6p in the week ending 20 July

- New season lambs have been slower to come forward, impacting on throughput numbers

- Imports have seen growth to meet domestic demand but are expected to cool off in coming months

- Exports have been impacted by our domestic price and smaller production capability

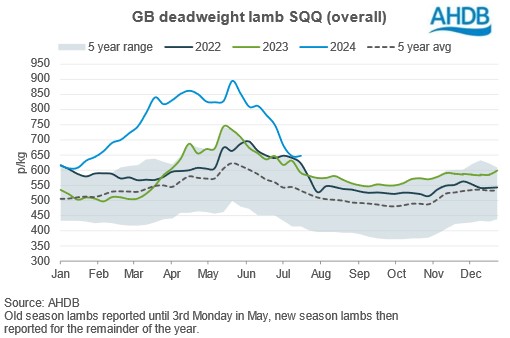

The GB deadweight SQQ lamb price sat at 647p/kg for the week ending 20 July 2024, which represents an increase of 1.6p from the previous week. This week represents some stability coming back into the market following big peaks and troughs so far this year. In recent weeks, the SQQ price has fallen by nearly £2.50/kg from the peak of 893p/kg at the week ending 25 May. This peak was fuelled by a shortage of lambs coming forward, as AHDB GB estimated kill sat 8% lower to the week ending 25 May compared to 2023. In the year to date, GB estimated kill remains 9.4% behind the same time in 2023. For the week ending 20 July, estimated GB kill sat at 181,000 head, a fall of 13,000 head from the previous week. Questions remain on when we will see the full extent of the new season crop come forward and how much the wet weather and disease factors earlier in the season have slowed down or reduced the size of the crop.

Recent weekly price declines have ranged between 31p/kg up to 68p/kg, but prices remain higher than seen in previous years, with the week ending 20 July sitting 55p higher than 2023. Given this elevated starting point, and some stability in the market, we are expecting the SQQ lamb price to stay buoyant in the coming weeks, relative to previous years. However, strength in these prices may be dictated by the quality of lambs coming forward, with industry insight suggesting that higher values are not being achieved if lambs are under finished.

GB deadweight lamb SQQ price

Source: AHDB

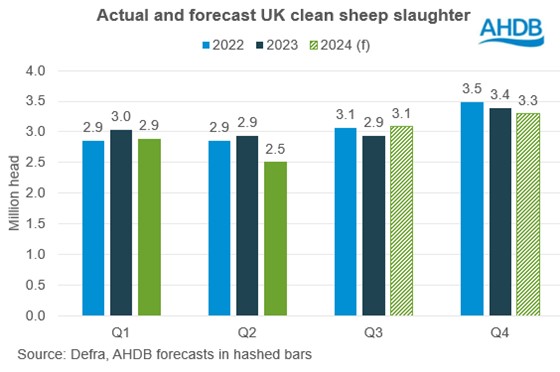

In our recently released lamb market outlook, we predict that new season lamb numbers will grow throughout the second half of the year, with numbers delayed pushing kill later into the 3rd quarter.

Actual and forecast UK clean sheep slaughter

Source: Defra, AHDB forecast in hashed bars

From an international side, we have seen imports from New Zealand increase so far this year compared to 2023, when New Zealand production was hit by extreme weather. Imports from New Zealand up to May have totalled 26,800 tonnes, up 7,700 tonnes from last year but remain behind levels seen in 2022. Moving forward, imports from New Zealand tend to slow seasonally as their own production falls, which could benefit UK prices as we see fewer international supplies on the market.

However, UK exports are being hit by our lower production, as we export in the region of a third of the lamb we produce annually. Sheep meat exports volumes are down 8% so far this year to May compared to 2023, with reports suggesting this was partially due to an increase in the price of UK sheep meat during March-April compared to other markets, making domestic product less competitive.

Looking into domestic demand, foodservice purchases look strong, up nearly 5% year on year in the 52 weeks ending 9 June, due to positive takeaway volumes through kebabs. Retail demand in the past 12 weeks ending 07 July saw total growth of 1%, with some strong performances in areas such as steaks, witnessing a 5% increase in volumes year on year. The promise of warmer weather may have driven more consumer interest in recent weeks.

Overall, the market appears to show signs of stabilisation, as we see some lambs coming forward but not as many as seen in previous years, with steady domestic demand, and the potential for fewer imports.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.