Lamb market update: UK production declines make way for growing imports

Thursday, 17 October 2024

Key points:

- UK sheep meat production has fallen by nearly 8% so far this year

- Clean and adult sheep kill has declined considerably compared to 2023

- Imports have increased in the months to August, as Australian volumes start to creep up

- Exports to August have been hampered by our lower domestic production

Production

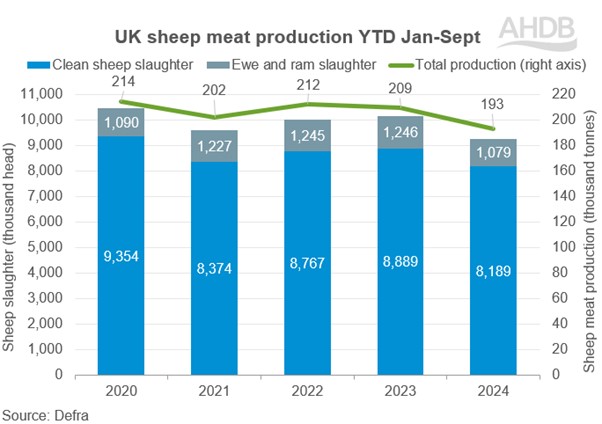

UK sheep meat production has fallen considerably from 2023, currently sitting 7.8% lower January-September. Production has totalled 193,000 tonnes so far this year, with volumes for September at 21,900 tonnes. A significant decline in both adult and clean sheep kill has contributed to this decline in overall production, with minor shifts in carcase weight in the year so far.

Clean sheep kill has totalled 8.19m head so far in 2024, a fall of nearly 700,000 head (7.9%) from the same period in 2023. September kill sat at 939,000 head, a slight increase of 2,600 head from August, but 61,500 head behind 2023. So far this year we have not seen a month exceed 1m head slaughtered, highlighting the tightness of supply compared to prior years.

UK sheep meat production YTD Jan-Sept

Source: Defra

Trade

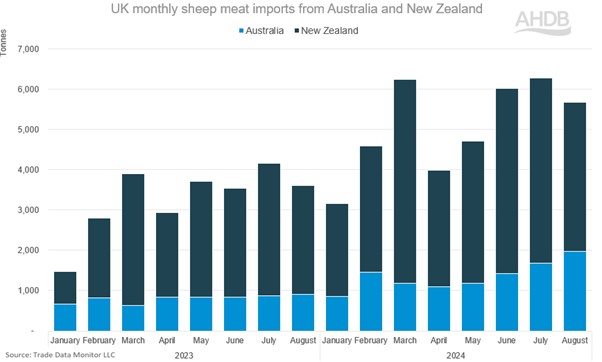

In the year to date to August, imports of fresh and frozen sheep meat have totalled 47,200 tonnes, growth of 14,200 tonnes from the same time in 2023. Monthly imports have been considerably higher than last year, between 1,000-2,600 tonnes higher per month. Volumes imported in August were 6,300 tonnes, a fall of 900 tonnes from July but nearly 2,000 tonnes higher than 2023. These rises in volumes are a combination of our lower production this year resulting in more imports to meet demand, and comparing to 2023 where one factor in lower imports was limited production in New Zealand (our largest supplier of sheep).

Looking into volumes imported from Australia and NZ, we imported 3,700 tonnes of fresh and frozen product from NZ and just under 2,000 tonnes from Australia in August. This represented a fall of 900 tonnes from New Zealand compared to the previous month, but growth of 1,000 tonnes from 2023. Conversely, Australian volumes have grown by around 300 tonnes from July, and over doubled compared to August 2023. Both countries were suffering from a downturn in slaughter levels in August as their old season crop tails off and the new season crop is slow to come forward.

UK monthly sheep meat imports from Australia and New Zealand

Source: HMRC via Trade Data Monitor

UK exports have reduced so far this year as our domestic production has fallen, limiting volumes available for export, sitting 7% lower than 2023. Volumes exported in August sat at 6,200 tonnes, growth of 940 tonnes from July, but a fall of 240 tonnes from the same time in 2023. Our largest export continues to be lamb carcasses into the EU for further processing, sitting at 38,400 tonnes for the year so far to August. Beyond the EU, other notable countries include Ghana, Kuwait, and Canada however these volumes sit between 300-700 tonnes exported so far this year.

UK sheep meat exports by destination (YTD Jan-Aug)

Source: HMRC via Trade Data Monitor

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.