Lamb market update: store and finished prices remain firm

Friday, 6 October 2023

Key points:

- Liveweight and deadweight SQQ still above last year’s prices

- Store prices remain firm, with recent weeks supply below year-ago levels

- Forage and fodder availability one to watch moving forward

Finished prices overview

The GB liveweight new season lamb SQQ has fallen since our last prices update a month ago. The measure averaged 251.1p/kg for September, down just over 8p from August, but remained elevated compared to last year. The measure ended the month (week ending 30 September) on 250.8p, up 23p from the same period in 2022. The average weekly throughputs in GB auction markets for September sat at 104,500 head, growth from August figures of just over 2,000 head per week. Cull ewe prices fell by £8.30 per head to £74.70 for the month of September but remain slightly elevated on last year.

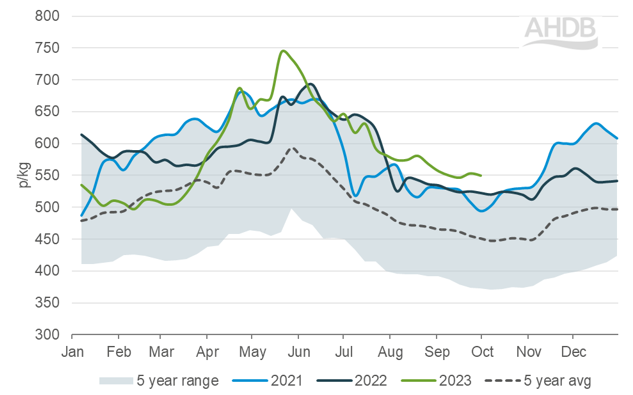

The GB deadweight SQQ ended the month of September as it began, averaging 549.7p/kg, with a fall of 3.3p in the second week, before growing to 553.1p in the third week. Prices averaged just under 550p/kg for the month, growth of over 25p from last year, but falling 20p from August. This continues the trend of monthly declines from May onwards, as more lambs have come forward into the new season. Average weekly kill for September from AHDB’s estimates sat at just under 230,000 head, up 2.5% from the same period in 2022.

GB deadweight lamb SQQ

Source: AHDB, LAA, IAAS

Store prices

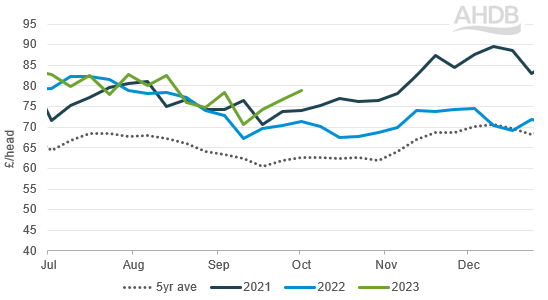

GB store sheep prices have steadily grown throughout September, to average £78.92 per head for the week ending 30 September. There was growth of £2–4 per week throughout the month, compared to last year where prices stood at around £70/head. There is variation among auction markets across GB, with some reports suggesting that buyers are keen on trading store lambs. A wet summer has reduced dry matter intakes, making it harder to finish lambs, with fewer stores coming forward. This has supported the store trade, with demand persisting despite higher prices. Margins will of course be under scrutiny throughout the store buying period.

GB new season store lamb prices

Source: AHDB/LAA/IAAS

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.