Japanese pig meat imports remain subdued

Thursday, 5 November 2020

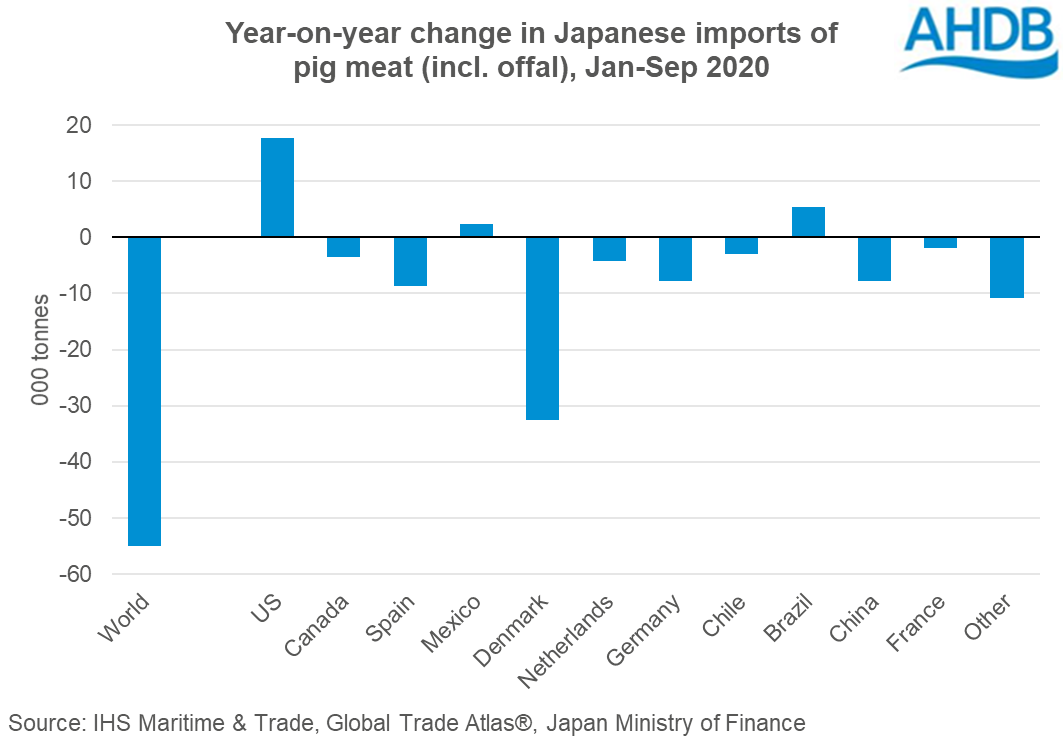

Japanese imports of pig meat (incl. offal) between January and September totalled 862,600 tonnes, down 6% on the same period in 2019.

Despite incoming shipments of US pig meat increasing 6% year-on-year during the nine-month period, lower volumes from elsewhere, particularly Denmark, outweighed this. Receipts from Denmark fell 35% year-on-year, totalling 59,700 tonnes for the period. There were also notable decreases in shipments from Spain (-9%), Germany (-26%) and China (-38%), among others.

At a product level, the large majority of Japan’s pig meat imports are of fresh and frozen pork, followed by processed pig meat. According to Japanese trade figures, typically more pork arrives into the country frozen, mostly from the EU, while a smaller (but still substantial) volume of fresh/chilled pork comes mainly from the US and Canada.

Industry reports suggest that frozen pork is more likely to go into Japanese foodservice, while fresh/chilled pork is more likely to be sold via retail. COVID-19 disruption of the Japanese foodservice sector has reportedly therefore shifted trade away from frozen pork to fresh/chilled, potentially explaining growth in US shipments and losses from European suppliers. Indeed, between January-September, Japanese imports of frozen pork fell 12% year-on-year, while fresh/chilled volumes grew 2%.

According to the USDA, Japan’s pork production in 2020 is expected to grow slightly year-on-year, boosted by herd expansion, and strong wholesale prices. Reports suggest that prices have been bolstered by rising retail demand, with consumers cooking more at home due to the pandemic. Market analysts Rabobank expect that Japanese pork imports will remain subdued into quarter four, as while there has been growth in retail sales, this has not been enough to outweigh foodservice losses.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.