January 2024 dairy market review

Tuesday, 13 February 2024

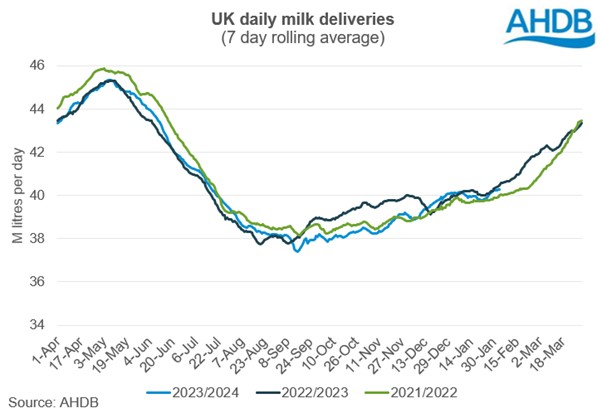

Milk production

GB milk deliveries fell back again in January by 7.6 million litres, compared to the previous year, or -0.7%. The decline deepened from December’s -0.3% but the rate of decline remains behind the c. 3% declines seen in the Autumn. Production for the milk season to date (April to January) totals 10,296 million litres, slightly behind (-0.5%) the same point in 2023. This is currently running ahead of the latest forecast revision, which will be revised in March ahead of the flush.

You can read more about expectations and drivers for the milk year ahead in the Dairy market outlook.

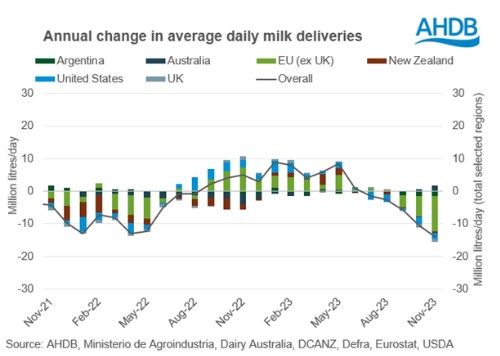

Global milk deliveries in the latest period (November) averaged 809.3 million litres per day in November, a decline of 13.9 million litres per day, or -1.7%), across the selected regions, compared to the same period last year. All regions except Australia recorded year on year volume decline.

Milk deliveries in the EU averaged 351.7 million litres per day in November, a decline of 10.9 million litres per day (3.0%) compared to the same point last year.

The decrease in EU total milk deliveries was driven by year-on-year production declines in France (89.9 million litres), Germany (73.8 million litres) and Ireland (96.1 million litres). Poor weather impacted production volumes across the continent, particularly in Ireland where a large proportion of the cows are on grass-based systems.

According to latest forecast estimates, global milk production across the key producing regions is expected to grow modestly by 0.25% in 2024. This is slightly higher than the 0.05% increase recorded in 2023. Although production is likely to increase, there is expected to be variability across key regions with growth expected in USA, EU and Australia, but decline in UK, Argentina and New Zealand.

Wholesale markets

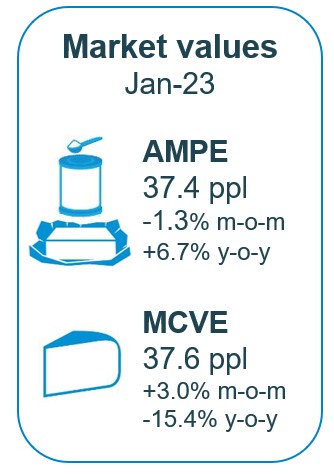

Overall price movements on UK wholesale markets recorded some uncertainty in January, with the steady growth we had been seeing through the Autumn grinding to a halt. Mild cheddar and butter continued to record some small price gains of £90/t and £10/t respectively but SMP and bulk cream both saw some modest drop-offs. The tone has returned to one of “wait and see” ahead of the Spring flush with trade fairly thin.

By contrast, however, the GDT surged ahead with some significant gains of 4% overall and 9% for butter indicating some supply and demand imbalances.

As of January, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) moved in a slightly positive direction to 37.6ppl. AMPE declined by -1%, MCVE rose by 3%. Both indicators in the UK remain much lower than a year earlier, with AMPE and MCVE down by 7% and 15% respectively and far behind the 2022 peak.

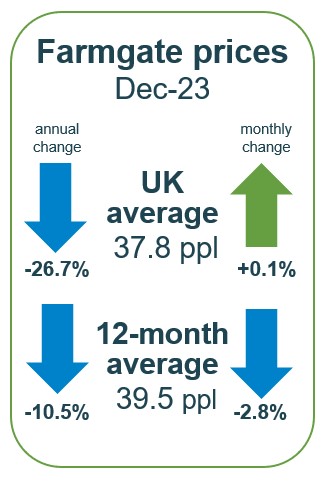

Farmgate milk prices

The latest published farmgate price was for December with a UK average of 37.8ppl. Latest announced farmgate prices for February were relatively positive, with most processors announcing increases or no change to their pricing. On retail aligned contracts, many suppliers will see an increase in price. Tesco and Sainsbury’s saw increases of 0.69ppl and 0.04ppl respectively continuing the upward momentum this month. Co-op Dairy Group announced an increase of 0.24 ppl. Waitrose was the only retailer to announce hold on to their prices in February.

On non-aligned liquid contracts, all members of the AHDB league table continued to hold their prices.

Cheese and manufacturing contracts saw a mixture of holds and increases with Arla Direct leading the pack with a 2.52ppl uplift.

Input costs

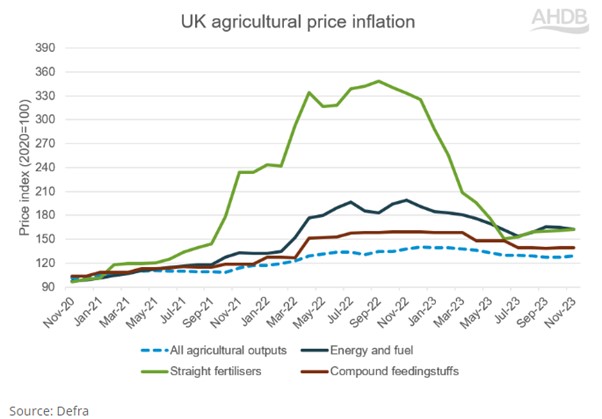

All agricultural inputs fell by 10% year-on-year but all costs remain significantly ahead of pre-Covid levels, impacting on farm margins given the value of outputs has also declined. The Bank of England’s Bank Rate remains unchanged since July, sitting at 5.25%, its highest level for 15 years.

Compound feed costs have now stabilised, fertiliser prices are down by 50% since the peak in September 2022 and energy costs have fallen by 17%.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.